Selina SPAC

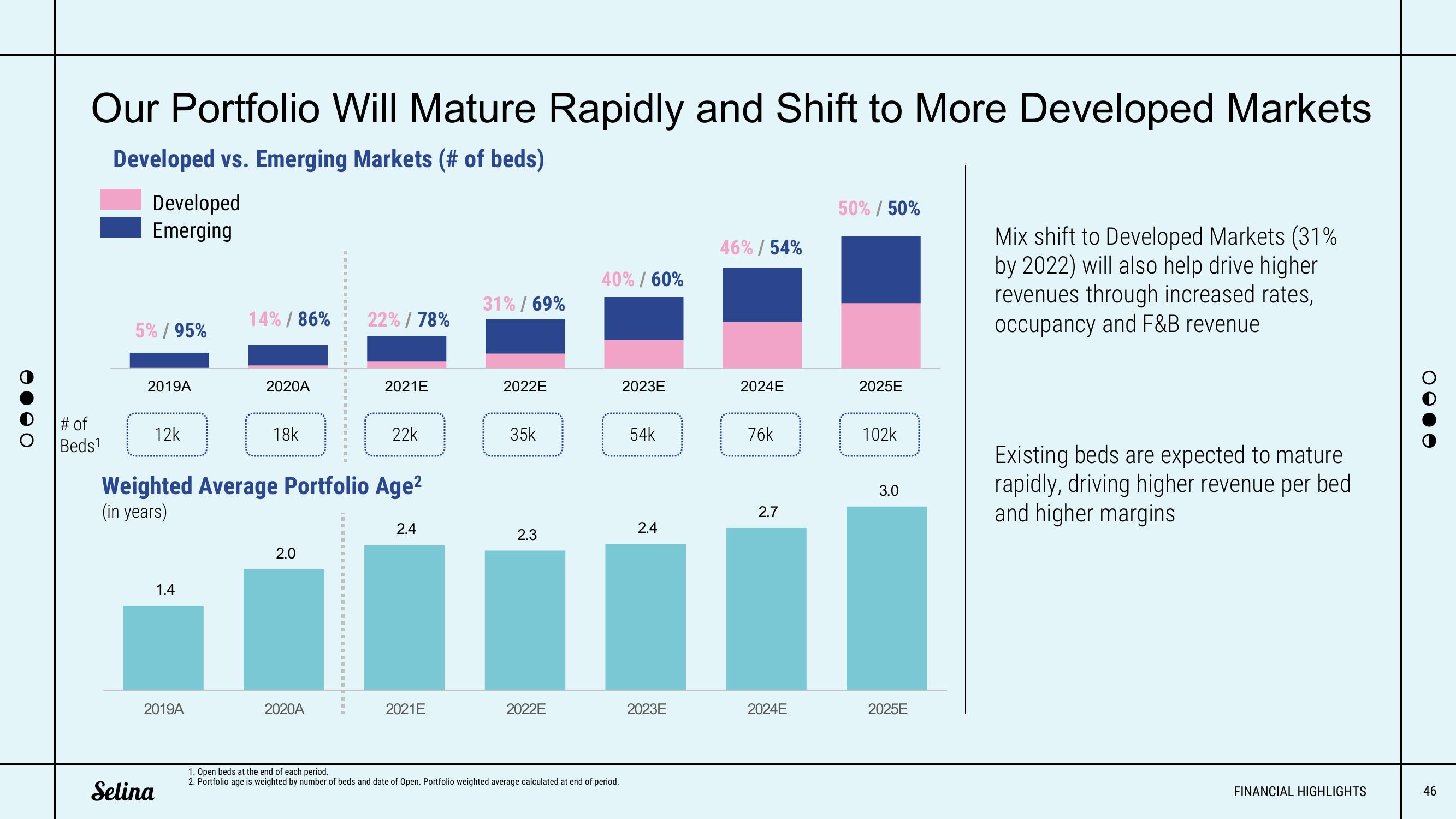

Our Portfolio Will Mature Rapidly and Shift to More Developed Markets

Developed vs. Emerging Markets (# of beds)

# of

Beds¹

Developed

Emerging

5% / 95%

2019A

12k

Selina

1.4

2019A

14% / 86%

2020A

18k

2.0

m

2020A

=

m

Weighted Average Portfolio Age²

(in years)

E

22% / 78%

2021E

22k

2.4

2021E

31% / 69%

2022E

35k

2.3

2022E

40% / 60%

1. Open beds at the end of each period.

2. Portfolio age is weighted by number of beds and date of Open. Portfolio weighted average calculated at end of period.

2023E

54k

2.4

2023E

46% / 54%

2024E

76k

2.7

2024E

50% / 50%

2025E

102k

3.0

2025E

Mix shift to Developed Markets (31%

by 2022) will also help drive higher

revenues through increased rates,

occupancy and F&B revenue

Existing beds are expected to mature

rapidly, driving higher revenue per bed

and higher margins

FINANCIAL HIGHLIGHTS

46View entire presentation