Crocs Investor Presentation Deck

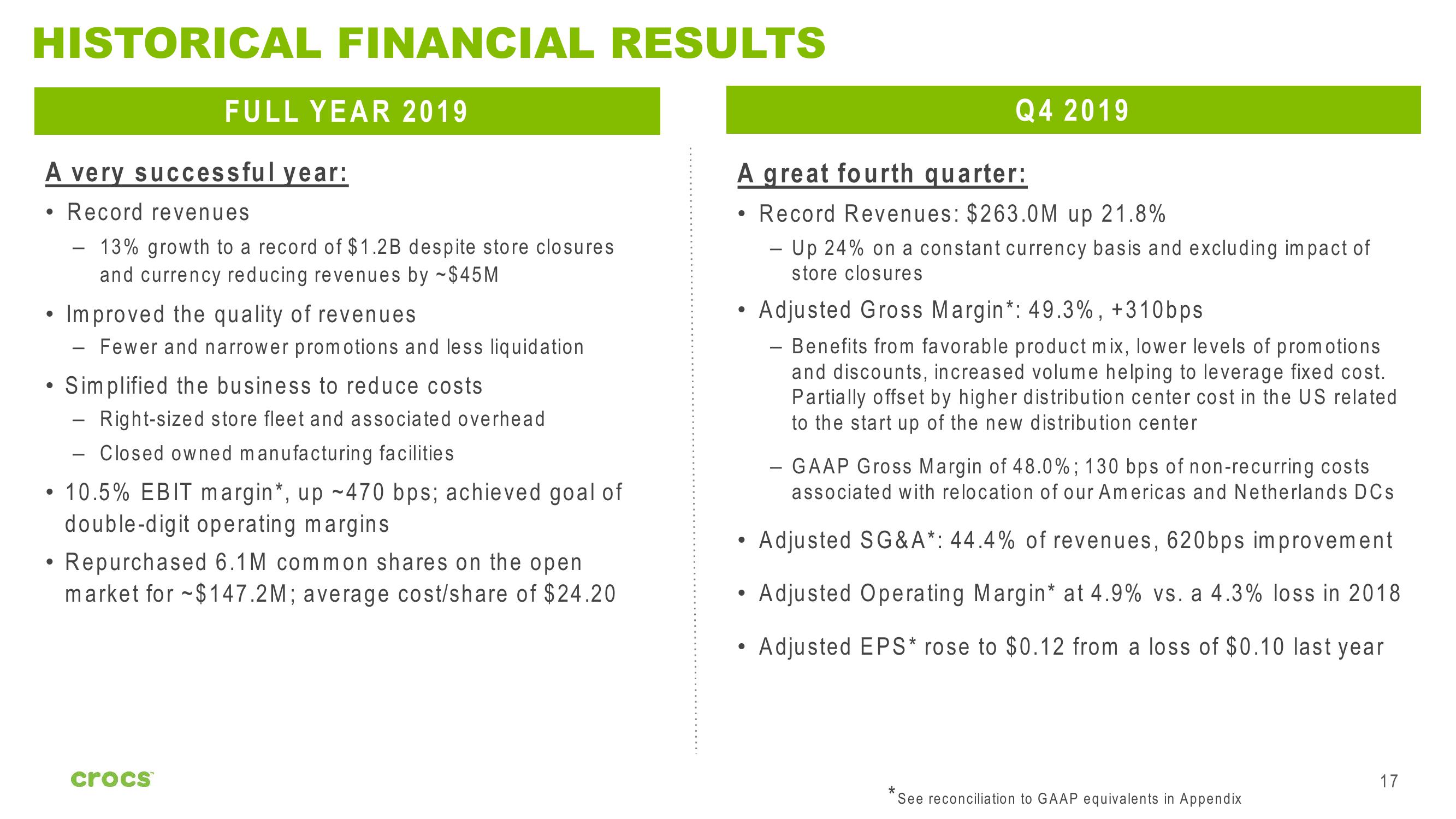

HISTORICAL FINANCIAL RESULTS

A very successful year:

Record revenues

- 13% growth to a record of $1.2B despite store closures

and currency reducing revenues by ~$45M

●

●

●

●

FULL YEAR 2019

Improved the quality of revenues

- Fewer and narrower promotions and less liquidation

Simplified the business to reduce costs

- Right-sized store fleet and associated overhead

- Closed owned manufacturing facilities

• 10.5% EBIT margin*, up ~470 bps; achieved goal of

double-digit operating margins

Repurchased 6.1M common shares on the open

market for $147.2M; average cost/share of $24.20

crocs™

P

A great fourth quarter:

Record Revenues: $263.0M up 21.8%

- Up 24% on a constant currency basis and excluding impact of

store closures

●

●

Q4 2019

●

Adjusted Gross Margin*: 49.3%, +310bps

- Benefits from favorable product mix, lower levels of promotions

and discounts, increased volume helping to leverage fixed cost.

Partially offset by higher distribution center cost in the US related

to the start up of the new distribution center

- GAAP Gross Margin of 48.0%; 130 bps of non-recurring costs

associated with relocation of our Americas and Netherlands DCs

Adjusted SG&A*: 44.4% of revenues, 620bps improvement

Adjusted Operating Margin* at 4.9% vs. a 4.3% loss in 2018.

Adjusted EPS* rose to $0.12 from a loss of $0.10 last year

* See reconciliation to GAAP equivalents in Appendix

17View entire presentation