OppFi Results Presentation Deck

28

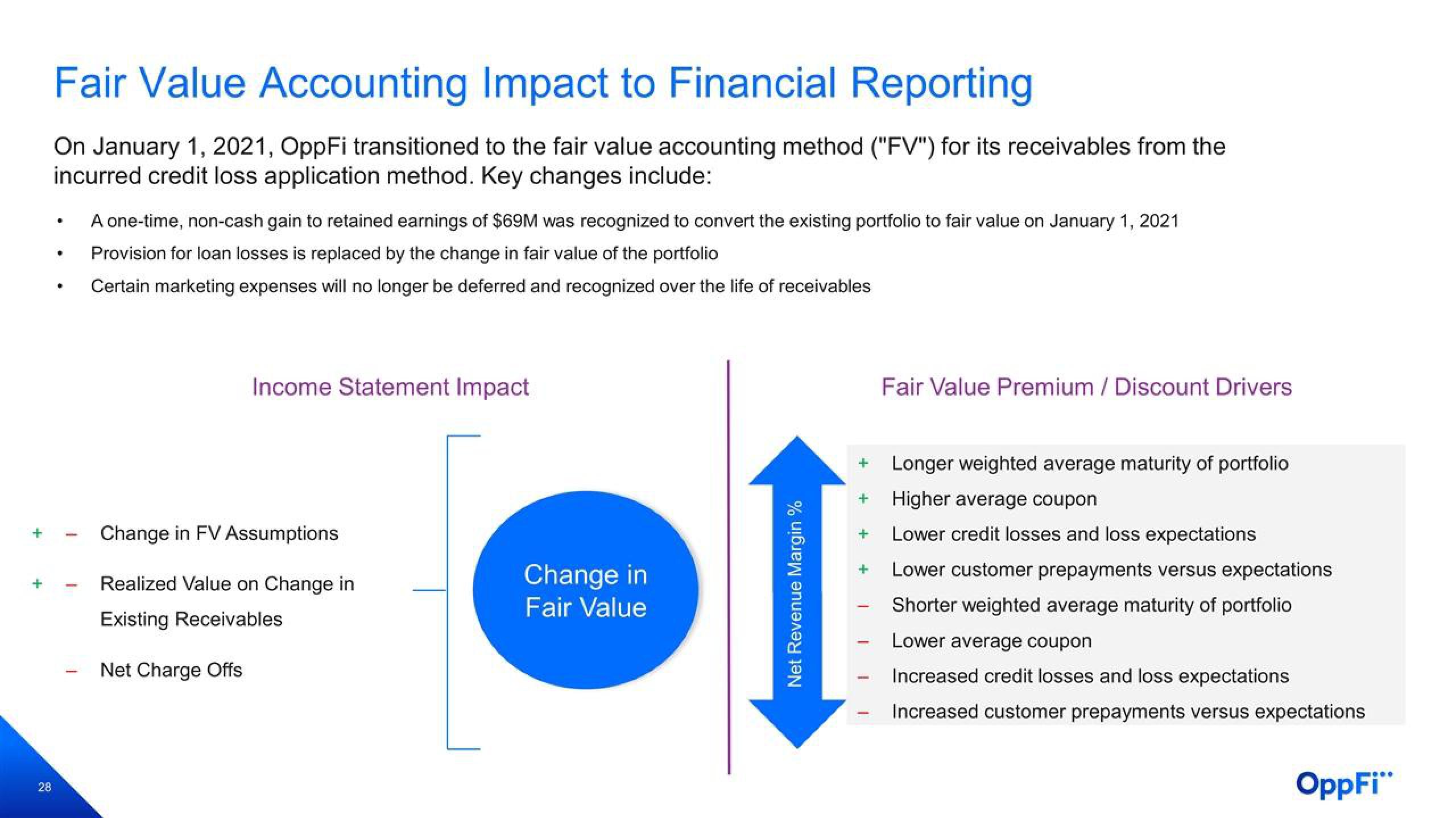

Fair Value Accounting Impact to Financial Reporting

On January 1, 2021, OppFi transitioned to the fair value accounting method ("FV") for its receivables from the

incurred credit loss application method. Key changes include:

4

•

.

A one-time, non-cash gain to retained earnings of $69M was recognized to convert the existing portfolio to fair value on January 1, 2021

Provision for loan losses is replaced by the change in fair value of the portfolio

Certain marketing expenses will no longer be deferred and recognized over the life of receivables

Income Statement Impact

Change in FV Assumptions

Realized Value on Change in

Existing Receivables

Net Charge Offs

Change in

Fair Value

Net Revenue Margin %

Fair Value Premium / Discount Drivers

Longer weighted average maturity of portfolio

Higher average coupon

Lower credit losses and loss expectations

Lower customer prepayments versus expectations

Shorter weighted average maturity of portfolio

Lower average coupon

Increased credit losses and loss expectations

Increased customer prepayments versus expectations

OppFi"View entire presentation