Sezzle Results Presentation Deck

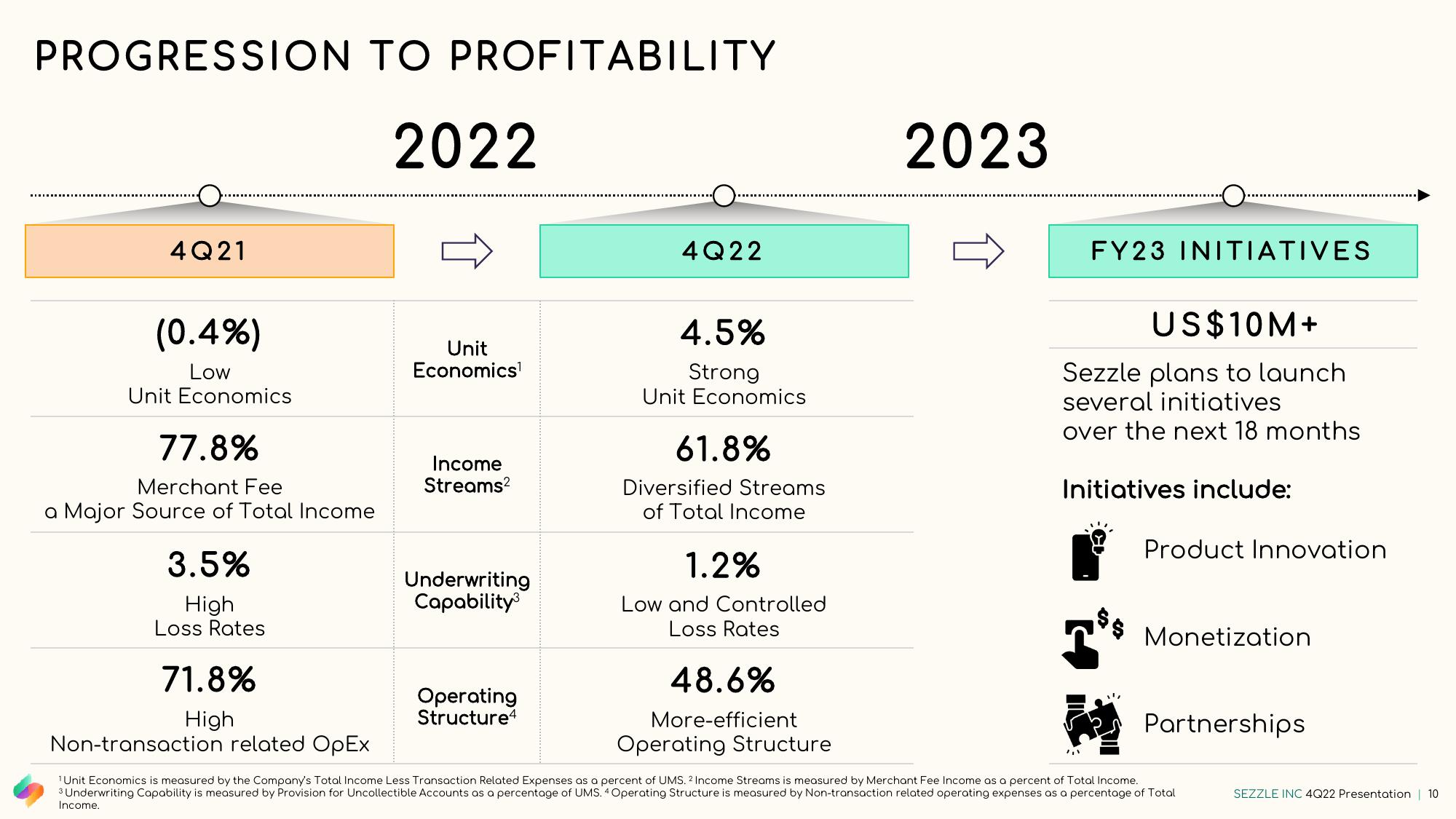

PROGRESSION TO PROFITABILITY

4Q21

(0.4%)

Low

Unit Economics

77.8%

Merchant Fee

a Major Source of Total Income

3.5%

High

Loss Rates

71.8%

High

2022

Unit

Economics¹

Income

Streams²

Underwriting

Capability³

Operating

Structure4

4Q22

4.5%

Strong

Unit Economics

61.8%

Diversified Streams

of Total Income

1.2%

Low and Controlled

Loss Rates

48.6%

More-efficient

2023

FY23 INITIATIVES

US$10M+

Sezzle plans to launch

several initiatives

over the next 18 months

Initiatives include:

ZIN

$$

Product Innovation

Monetization

Partnerships

Non-transaction related OpEx

Operating Structure

¹ Unit Economics is measured by the Company's Total Income Less Transaction Related Expenses as a percent of UMS. 2 Income Streams is measured by Merchant Fee Income as a percent of Total Income.

3 Underwriting Capability is measured by Provision for Uncollectible Accounts as a percentage of UMS. 4 Operating Structure is measured by Non-transaction related operating expenses as a percentage of Total

Income.

SEZZLE INC 4Q22 Presentation | 10View entire presentation