Bank of America Investment Banking Pitch Book

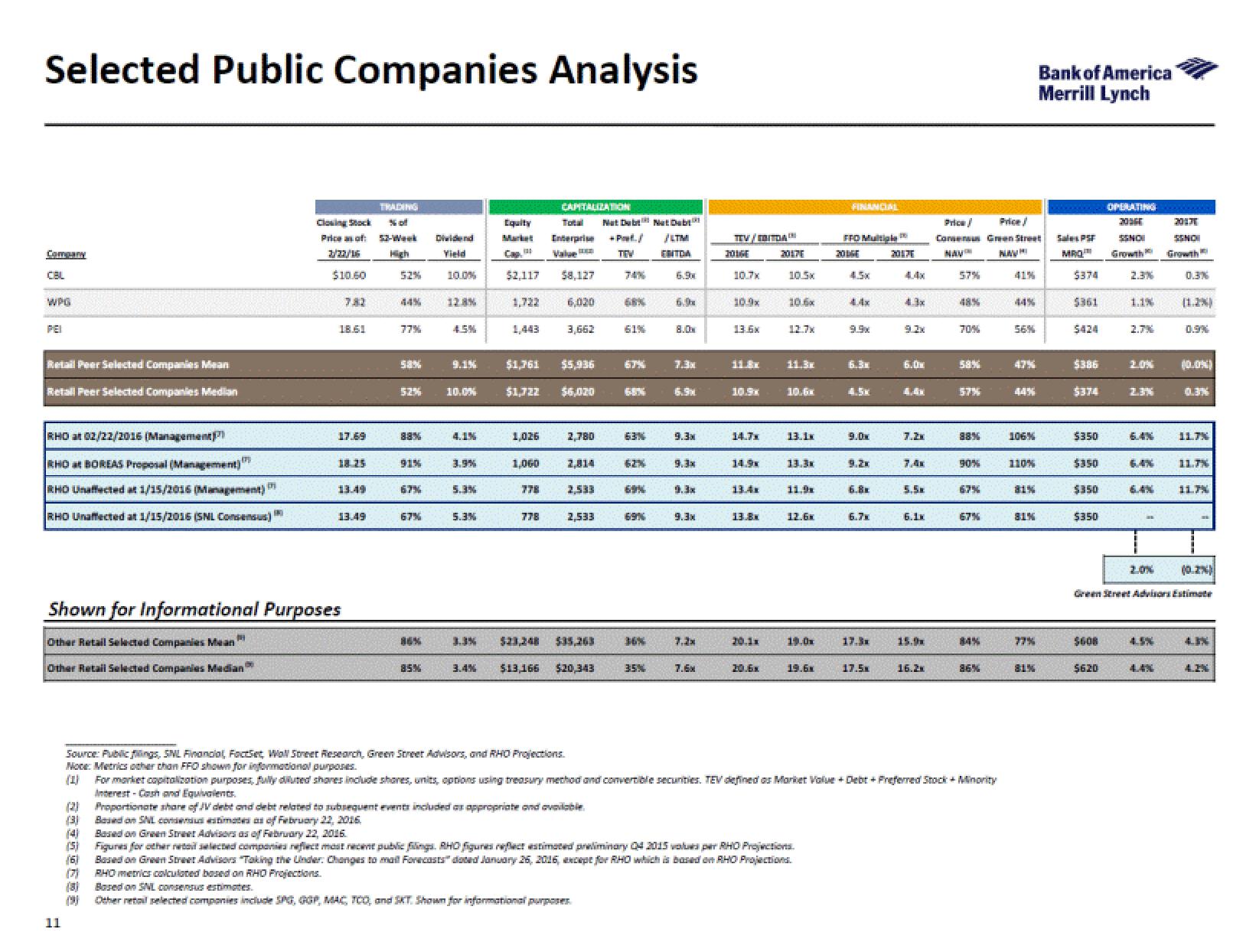

Selected Public Companies Analysis

Company

CBL

WPG

Retail Peer Selected Companies Mean

Retall Peer Selected Companies Median

RHD at 02/22/2016 (Management)

KHO at BOREAS Proposal (Management)

RHO Unaffected at 1/15/2016 (Management)

RHO Unaffected at 1/15/2016 (SNL Consensus)

11

Clowing Stock

Price of:

2/22/16

$10.60

3335002E

18.61

A

17.69

Shown for Informational Purposes

PH

Other Retail Selected Companies Mean

Other Retail Selected Companies Madian

18.25

13.49

TRADING

High

52%

44%

77%

53%

52%

88%

91%

67%

67%

85%

Dividend

Yield

10.0%

4.5%

9.1%

10.0%

19

3.9%

5.3%

5.3%

3.3%

3.4%

Equity

$2,117

1,443

1,026

1,060

778

CAPITALIZATION

Total Mat Dub

778

Enterprise

Value

$1,761

$5,936

$1,722 $6,020

58.127

6,020

3,662

2,780

2,814

Source: Public fings, SNL Financial, FactSet Wall Street Research, Green Street Advisors, and RHO Projections.

Note: Metrics other than FFO shown for informational purposes.

(1)

2,533

$23,248 $35,263

$13,166 $20,343

NatDab

+Prt./ /LTM

TIPW ERITOA

68%

(9) Other retail selected companies include SPG, GGP, MAC, TOO, and SKT. Shown for informational purposes.

61%

63%

67%

35%

6.9

8.0

7.3x

9.3x

9.3x

9.3x

7.3x

7.6x

TEV/DA

JOUGE

10.7x

10.9x

13.6x

11.8x

10.9x

14.7x

14.9

13.8x

20.1x

20.6x

20120

1Ox

10.6x

12.7x

11.3x

10.6x

13.1x

13.3M

11.9

12.6M

19.0x

19.6

(4) Based on Green Street Advisors as of February 22, 2016.

(5) Figures for other to selected companies reflect most recent public filings. RHO figures reflect estimated preliminary 04 2015 values per RHO Projections.

161 Based on Gream Street Advisors "Taking the Under: Changes to mail Forecasts dated January 26, 2016, except for RHO which is based on RHO Projections.

RHO metrics calculated based on RHO Projections.

Based on SNL consensus estimates.

FINANCIAL

FFO Multiple

2016

4.5x

4.4x

9.9x

6.3x

4.5K

9.0x

9.2x

6.8x

6.7x

17.3x

15

20171

6.0x

1.4.

7.2x

5.5x

6.1x

15.9

16.2x

Price/

Price/

Consensus Green Street

NAV

NAVI

57%

70%

58%

57%

90%

For market capitalization purposes, fully diluted shores include shares, units, oppions using treasury method and convertible securities. TEV defined as Market Value + Debt+ Preferred Stock + Minority

Interest-Cash and Equivalents

Proportionate share of JV debt and debt related to subsequent events included as appropriate and available

(3) Based on SNL consensus estimates as of February 22, 2016.

67%

84%

86%

44%

56%

106/%

110%

81%

SIN

77%

Bank of America

Merrill Lynch

81%

Sales PSF

MRO

$374

$361

$424

$386

$374

$350

$350

$350

$350

$608

OPERATING

$620

SSNOI

Growth

2.3%

1.1%

2.7%

2.0%

2.3%

6.4%

SINO

Growth

0.3%

0.9%

(0.0%)

11.7%

11.7%

Green Street Advisors Estimate

11.7%

LINView entire presentation