Trian Partners Activist Presentation Deck

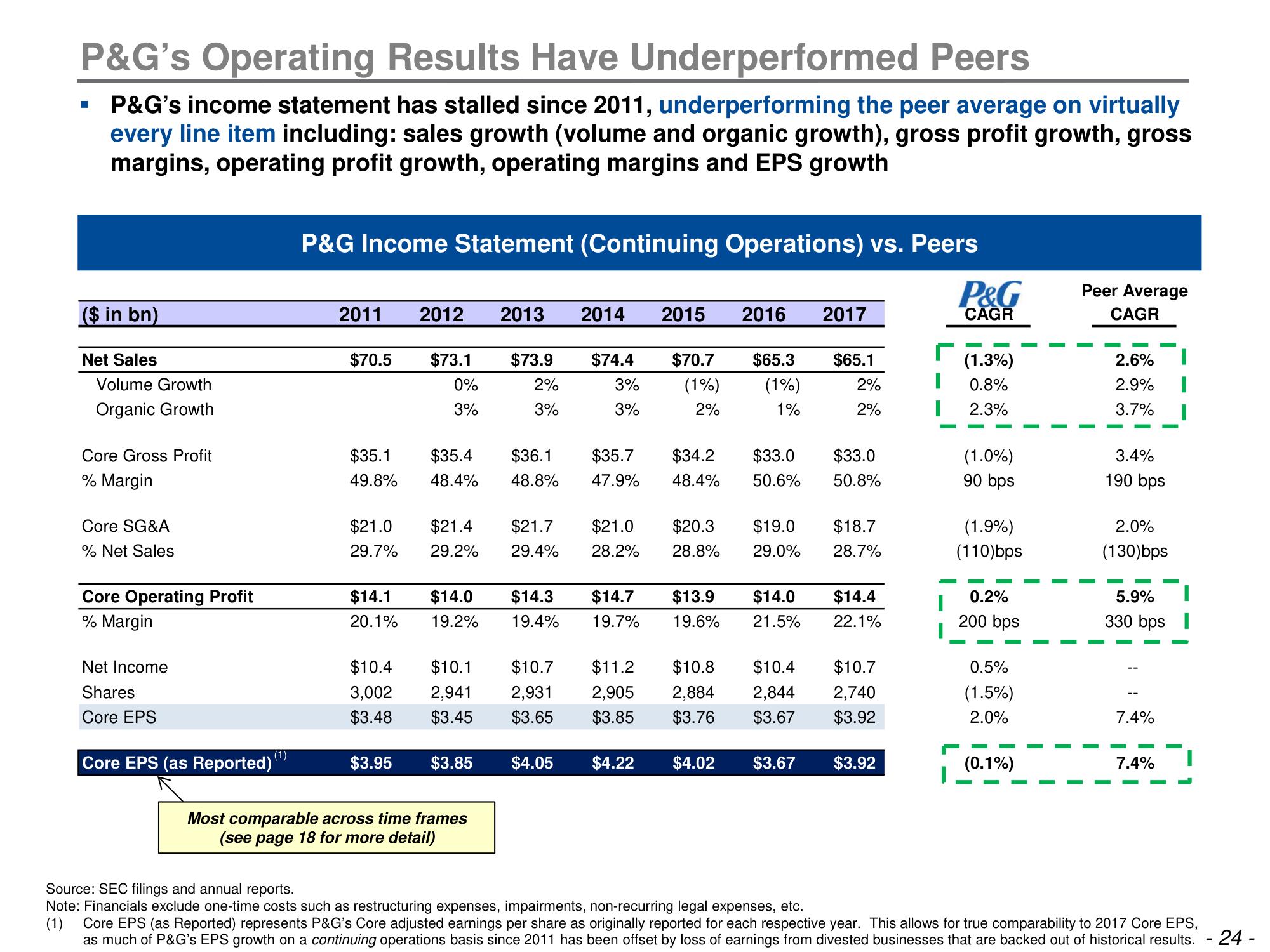

P&G's Operating Results Have Underperformed Peers

P&G's income statement has stalled since 2011, underperforming the peer average on virtually

every line item including: sales growth (volume and organic growth), gross profit growth, gross

margins, operating profit growth, operating margins and EPS growth

■

($ in bn)

Net Sales

Volume Growth

Organic Growth

Core Gross Profit

% Margin

Core SG&A

% Net Sales

Core Operating Profit

% Margin

Net Income

Shares

Core EPS

Core EPS (as Reported)

(1)

P&G Income Statement (Continuing Operations) vs. Peers

P&G

CAGR

2011 2012 2013 2014

$70.5 $73.1

0%

3%

$35.1

49.8%

$21.0

29.7%

$14.1

20.1%

$35.4

48.4%

$3.95

$21.4

29.2%

$73.9

2%

3%

$3.85

Most comparable across time frames

(see page 18 for more detail)

$74.4

3%

3%

$36.1 $35.7

48.8% 47.9%

$21.7 $21.0

29.4% 28.2%

2015 2016 2017

$70.7 $65.3 $65.1

(1%) (1%)

2%

1%

$14.0 $14.3 $14.7 $13.9

19.2% 19.4% 19.7%

19.6%

$4.05

$34.2 $33.0

48.4% 50.6%

2%

2%

$10.4 $10.1 $10.7 $11.2 $10.8 $10.4 $10.7

3,002 2,941 2,931 2,905 2,884 2,844 2,740

$3.48 $3.45 $3.65 $3.85 $3.76 $3.67 $3.92

$33.0

50.8%

$20.3 $19.0 $18.7

28.8% 29.0% 28.7%

$14.0 $14.4

21.5% 22.1%

$4.22 $4.02 $3.67 $3.92

I

(1.3%)

0.8%

2.3%

(1.0%)

90 bps

(1.9%)

(110)bps

0.2%

200 bps

0.5%

(1.5%)

2.0%

(0.1%)

Peer Average

CAGR

2.6%

2.9%

3.7%

3.4%

190 bps

2.0%

(130)bps

5.9%

330 bpsI

7.4%

7.4%

Source: SEC filings and annual reports.

Note: Financials exclude one-time costs such as restructuring expenses, impairments, non-recurring legal expenses, etc.

(1) Core EPS (as Reported) represents P&G's Core adjusted earnings per share as originally reported for each respective year. This allows for true comparability to 2017 Core EPS,

as much of P&G's EPS growth on a continuing operations basis since 2011 has been offset by loss of earnings from divested businesses that are backed out of historical results.

- 24 -View entire presentation