Babylon SPAC Presentation Deck

Understanding Babylon's Pipeline

4)

5)

6)

7)

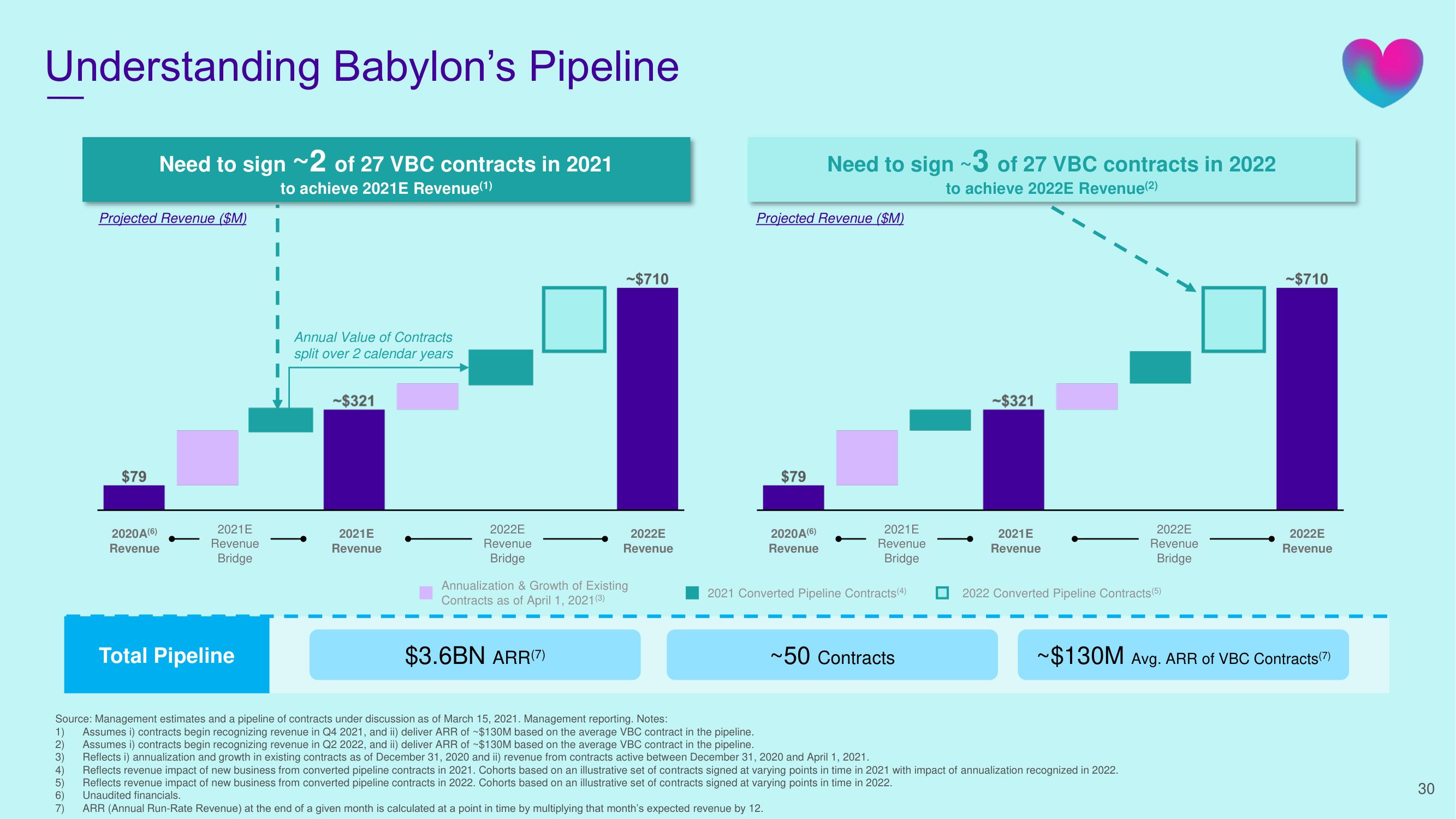

Need to sign ~2 of 27 VBC contracts in 2021

to achieve 2021E Revenue(¹)

Projected Revenue ($M)

$79

2020A(6)

Revenue

2021E

Revenue

Bridge

Total Pipeline

Annual Value of Contracts

split over 2 calendar years

-$321

2021E

Revenue

2022E

Revenue

Bridge

-$710

$3.6BN ARR(7)

2022E

Revenue

Annualization & Growth of Existing

Contracts as of April 1, 2021(3)

Projected Revenue ($M)

$79

Need to sign ~3 of 27 VBC contracts in 2022

to achieve 2022E Revenue(²)

2021E

Revenue

Bridge

2021 Converted Pipeline Contracts (4)

2020A(6)

Revenue

~50 Contracts

-$321

2021E

Revenue

2022E

Revenue

Bridge

2022 Converted Pipeline Contracts (5)

Source: Management estimates and a pipeline of contracts under discussion as of March 15, 2021. Management reporting. Notes:

1) Assumes i) contracts begin recognizing revenue in Q4 2021, and ii) deliver ARR of ~$130M based on the average VBC contract in the pipeline.

2)

Assumes i) contracts begin recognizing revenue in Q2 2022, and ii) deliver ARR of ~$130M based on the average VBC contract in the pipeline.

3)

Reflects i) annualization and growth in existing contracts as of December 31, 2020 and ii) revenue from contracts active between December 31, 2020 and April 1, 2021.

Reflects revenue impact of new business from converted pipeline contracts in 2021. Cohorts based on an illustrative set of contracts signed at varying points in time in 2021 with impact of annualization recognized in 2022.

Reflects revenue impact of new business from converted pipeline contracts in 2022. Cohorts based on an illustrative set of contracts signed at varying points in time in 2022.

Unaudited financials.

ARR (Annual Run-Rate Revenue) at the end of a given month is calculated at a point in time by multiplying that month's expected revenue by 12.

-$710

2022E

Revenue

~$130M Avg. ARR of VBC Contracts (7)

30View entire presentation