3Q20 Earnings Call Presentation

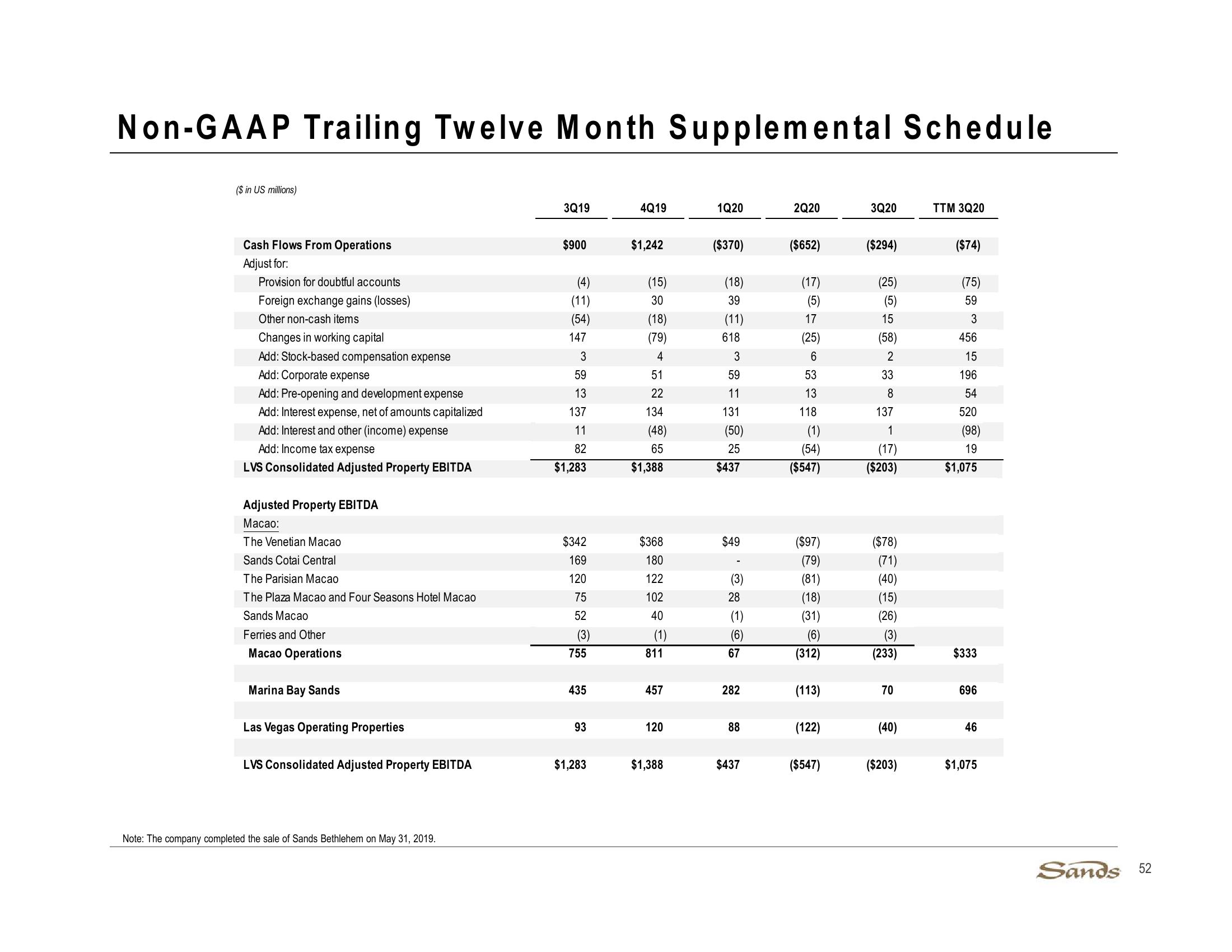

Non-GAAP Trailing Twelve Month Supplemental Schedule

($ in US millions)

3Q19

4Q19

1Q20

2Q20

3Q20

TTM 3Q20

Cash Flows From Operations

$900

$1,242

($370)

($652)

($294)

($74)

Adjust for:

Provision for doubtful accounts

(4)

Foreign exchange gains (losses)

(11)

Other non-cash items

(54)

Changes in working capital

147

Add: Stock-based compensation expense

3

Add: Corporate expense

59

Add: Pre-opening and development expense

13

Add: Interest expense, net of amounts capitalized

137

134

Add: Interest and other (income) expense

Add: Income tax expense

11

82

222222

(15)

(18)

39

(18)

(11)

(79)

618

(25)

3

59

11

131

118

(48)

(50)

ཞྲི་ཆེ༠ ༠8བབྱེ

(17)

(25)

(75)

(5)

(5)

59

15

3

(58)

456

2

15

33

196

8

54

137

520

(1)

1

(98)

25

(54)

(17)

19

LVS Consolidated Adjusted Property EBITDA

$1,283

$1,388

$437

($547)

($203)

$1,075

Adjusted Property EBITDA

Macao:

The Venetian Macao

$342

Sands Cotai Central

169

The Parisian Macao

120

The Plaza Macao and Four Seasons Hotel Macao

75

Sands Macao

52

Ferries and Other

(3)

Macao Operations

755

Marina Bay Sands

($97)

($78)

(79)

(71)

(81)

(40)

(18)

(15)

(31)

(26)

(6)

(312)

(233)

$333

435

457

282

(113)

70

696

Las Vegas Operating Properties

93

120

88

(122)

(40)

46

LVS Consolidated Adjusted Property EBITDA

$1,283

$1,388

$437

($547)

($203)

$1,075

$368

$49

180

122

102

40

(1)

811

ཐགྱེཌཱུ8ཝེ, ཙྪི

Note: The company completed the sale of Sands Bethlehem on May 31, 2019.

Sands 52View entire presentation