PowerSchool Results Presentation Deck

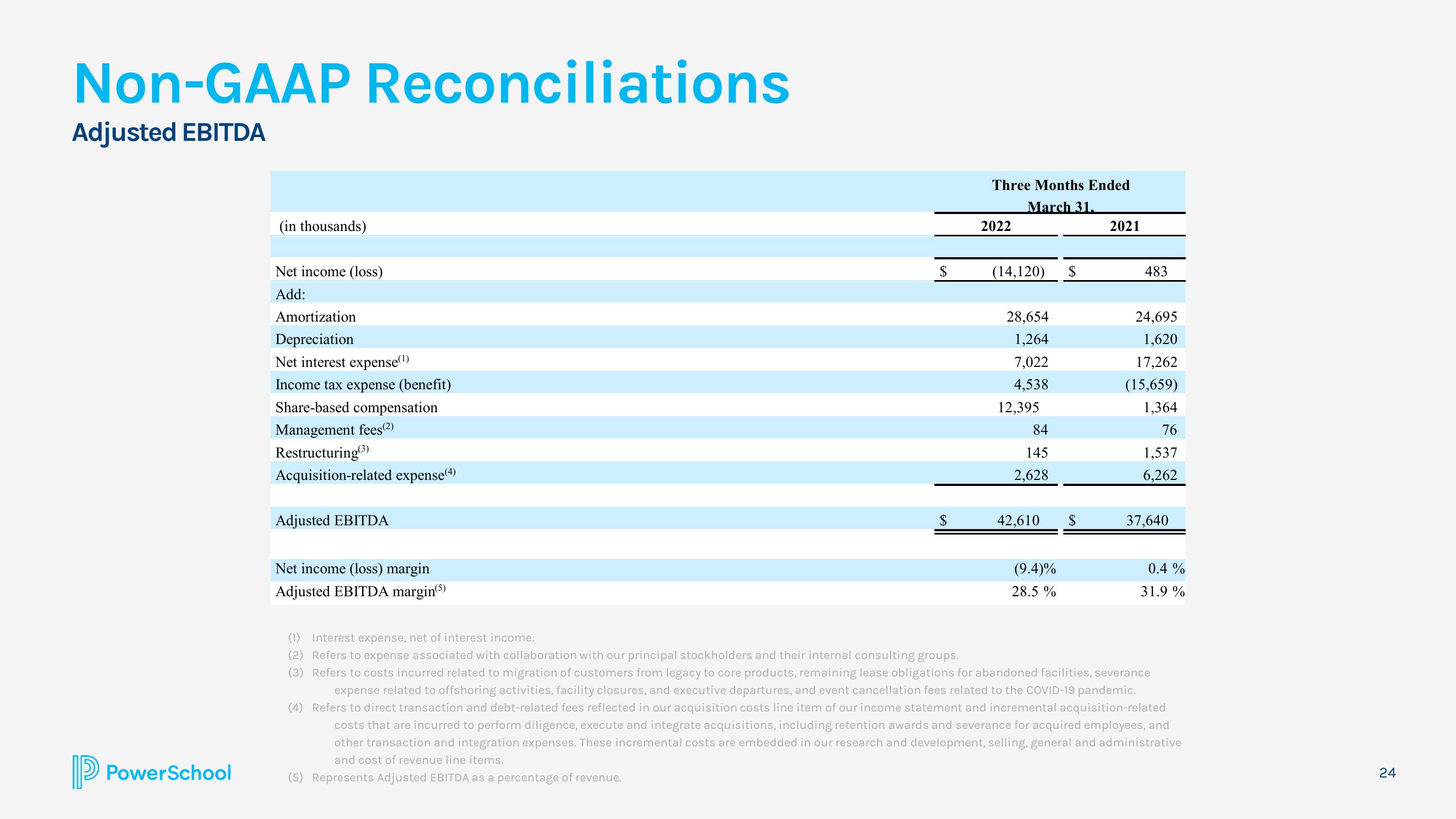

Non-GAAP Reconciliations

Adjusted EBITDA

PowerSchool

(in thousands)

Net income (loss)

Add:

Amortization

Depreciation

Net interest expense(¹)

Income tax expense (benefit)

Share-based compensation

Management fees(2)

Restructuring (3)

Acquisition-related expense(4)

Adjusted EBITDA

Net income (loss) margin

Adjusted EBITDA margin(5)

$

$

Three Months Ended

March 31.

2022

(14,120)

28,654

1,264

7,022

4,538

12,395

84

145

2,628

42,610

(9.4)%

28.5%

$

$

2021

483

24,695

1,620

17,262

(15,659)

1,364

76

1,537

6,262

37,640

0.4%

31.9 %

(1) Interest expense, net of interest income.

(2) Refers to expense associated with collaboration with our principal stockholders and their internal consulting groups.

(3) Refers to costs incurred related to migration of customers from legacy to core products, remaining lease obligations for abandoned facilities, severance

expense related to offshoring activities, facility closures, and executive departures, and event cancellation fees related to the COVID-19 pandemic.

(4) Refers to direct transaction and debt-related fees reflected in our acquisition costs line item of our income statement and incremental acquisition-related

costs that are incurred to perform diligence, execute and integrate acquisitions, including retention awards and severance for acquired employees, and

other transaction and integration expenses. These incremental costs are embedded in our research and development, selling, general and administrative

and cost of revenue line items.

(5) Represents Adjusted EBITDA as a percentage of revenue.

24View entire presentation