Vaxcyte Corporate Presentation

Pneumococcal Vaccine Market is Highly Attractive

VAX-24 has the Potential to Become the Most Broad-Spectrum PCV

Pneumococcal Vaccine Market Dynamics

•

•

Spectrum of coverage drives adoption

Highly attractive margins:

-

Prevnar 13 & Pneumovax 23 are premium priced in the US

Durable revenue stream:

-

Prevnar 13 & Pneumovax have generated >$100B in revenues

PCVs are best-in-class:

Well-understood T-cell dependent MOA tied to co-presentation

of disease-specific polysaccharide antigens with mapped T-cell

epitopes on protein carrier

Well-defined clinical development path: Non-inferiority to SOC

using validated surrogate immune endpoints now adequate for

full approval for follow-on PCVS

Potential for rapid adoption: Governing body - ACIP

recommendation drives uptake

-

Prevnar 13 vs Prevnar 7

-

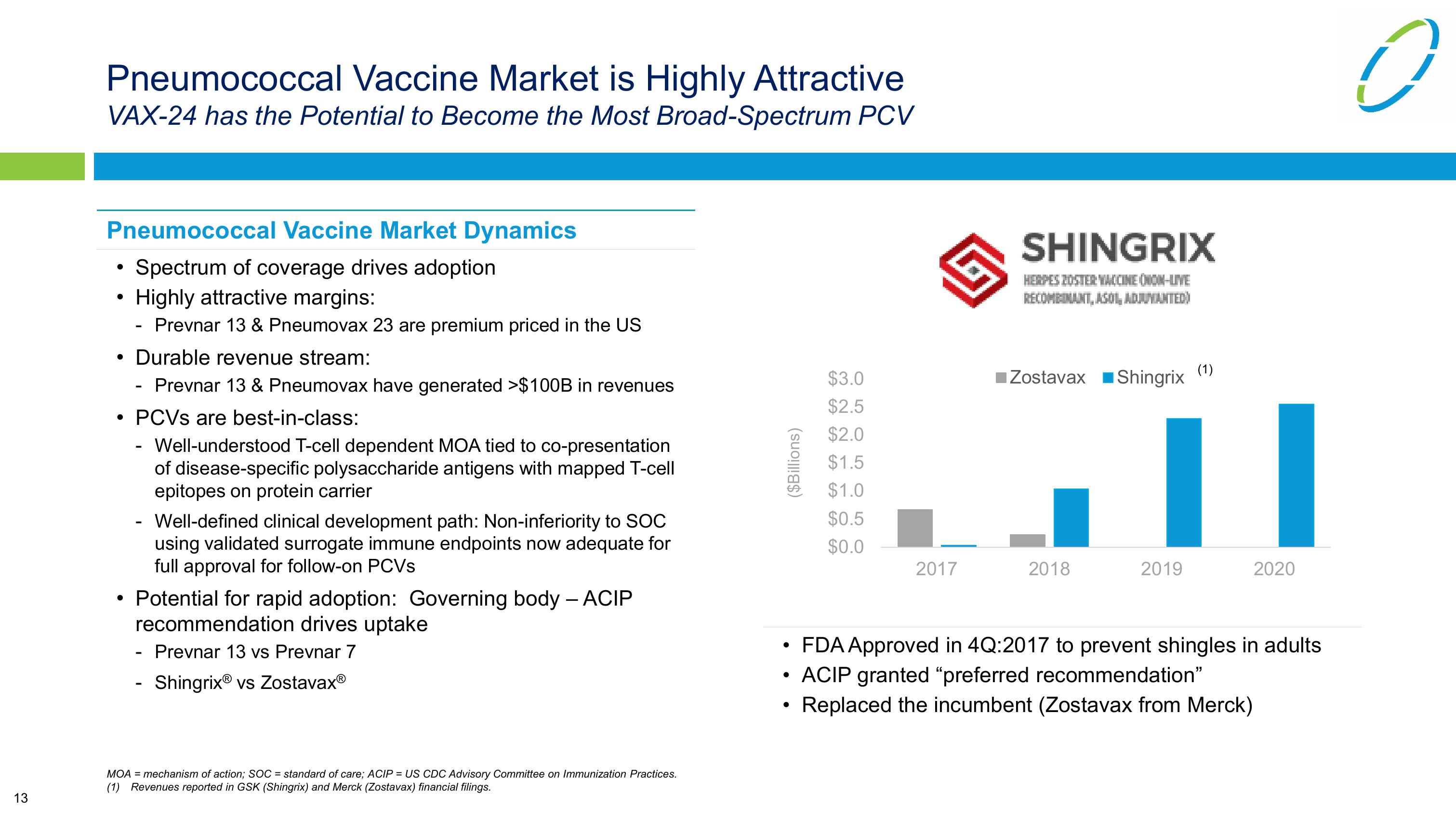

ShingrixⓇ vs ZostavaxⓇ

MOA = mechanism of action; SOC = standard of care; ACIP = US CDC Advisory Committee on Immunization Practices.

(1) Revenues reported in GSK (Shingrix) and Merck (Zostavax) financial filings.

13

($Billions)

SHINGRIX

HERPES ZOSTER VACCINE NON-LIVE

RECOMBINANT, ASOI, ADJUVANTED)

$3.0

■Zostavax Shingrix

(1)

$2.5

$2.0

$1.5

$1.0

$0.5

$0.0

2017

2018

2019

2020

•

FDA Approved in 4Q:2017 to prevent shingles in adults

• ACIP granted “preferred recommendation"

•

Replaced the incumbent (Zostavax from Merck)

оView entire presentation