Experian Investor Presentation Deck

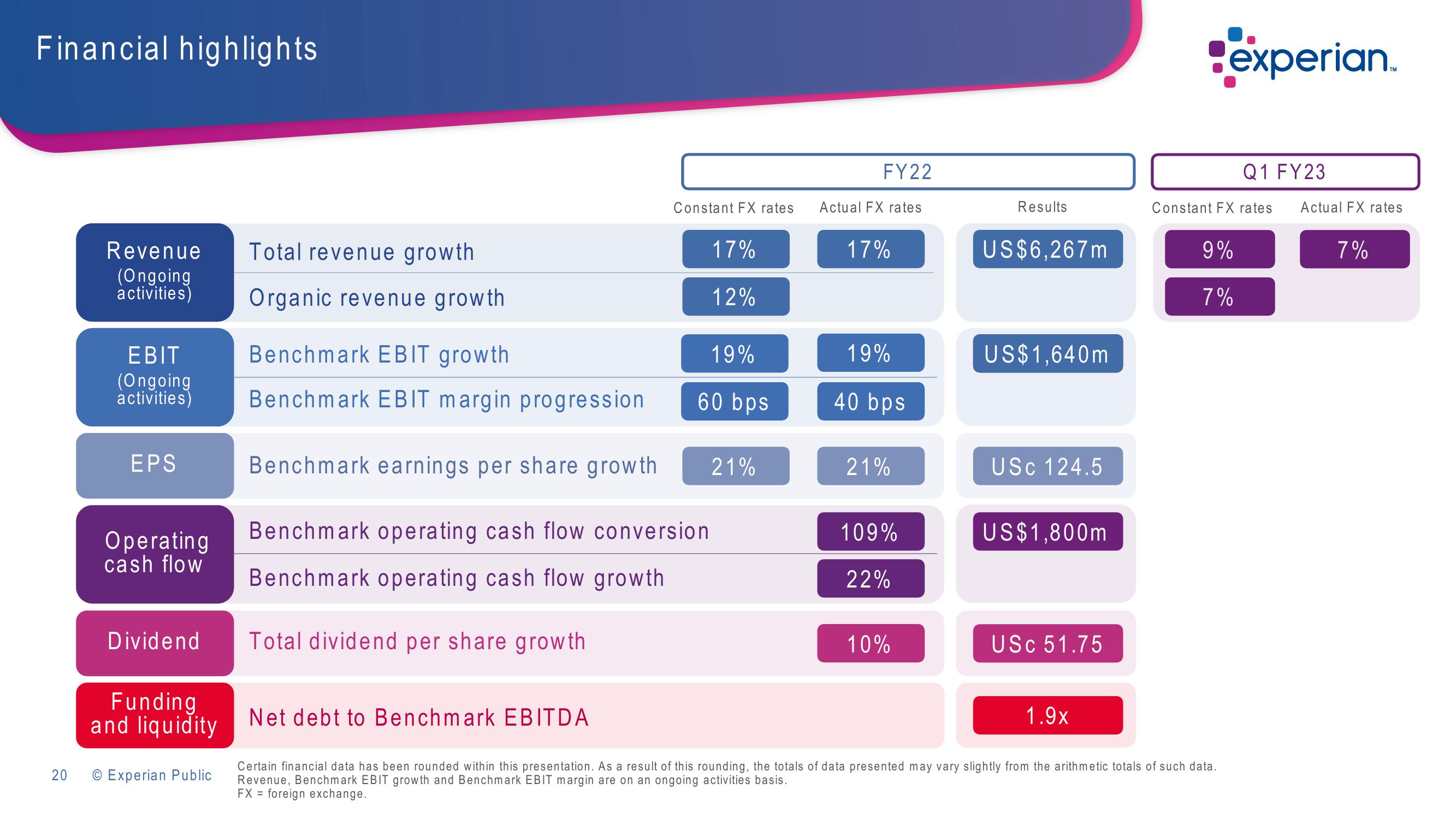

Financial highlights

20

Revenue Total revenue growth

(Ongoing

activities)

Organic revenue growth

EBIT

(Ongoing

activities)

EPS

Operating

cash flow

Dividend

Funding

and liquidity

Experian Public

Benchmark EBIT growth

Benchmark EBIT margin progression

FY22

Constant FX rates Actual FX rates

17%

12%

Net debt to Benchmark EBITDA

19%

60 bps

Benchmark earnings per share growth 21%

Benchmark operating cash flow conversion

Benchmark operating cash flow growth

Total dividend per share growth

17%

19%

40 bps

21%

109%

22%

10%

Results

US$6,267m

US$ 1,640m

USC 124.5

US$1,800m

USC 51.75

1.9x

I

Certain financial data has been rounded within this presentation. As a result of this rounding, the totals of data presented may vary slightly from the arithmetic totals of such data.

Revenue, Benchmark EBIT growth and Benchmark EBIT margin are on an ongoing activities basis.

FX foreign exchange.

experian.

Q1 FY23

Constant FX rates Actual FX rates

9%

7%

7%View entire presentation