J.P. Morgan 2016 Auto Conference

Adient Financial Overview

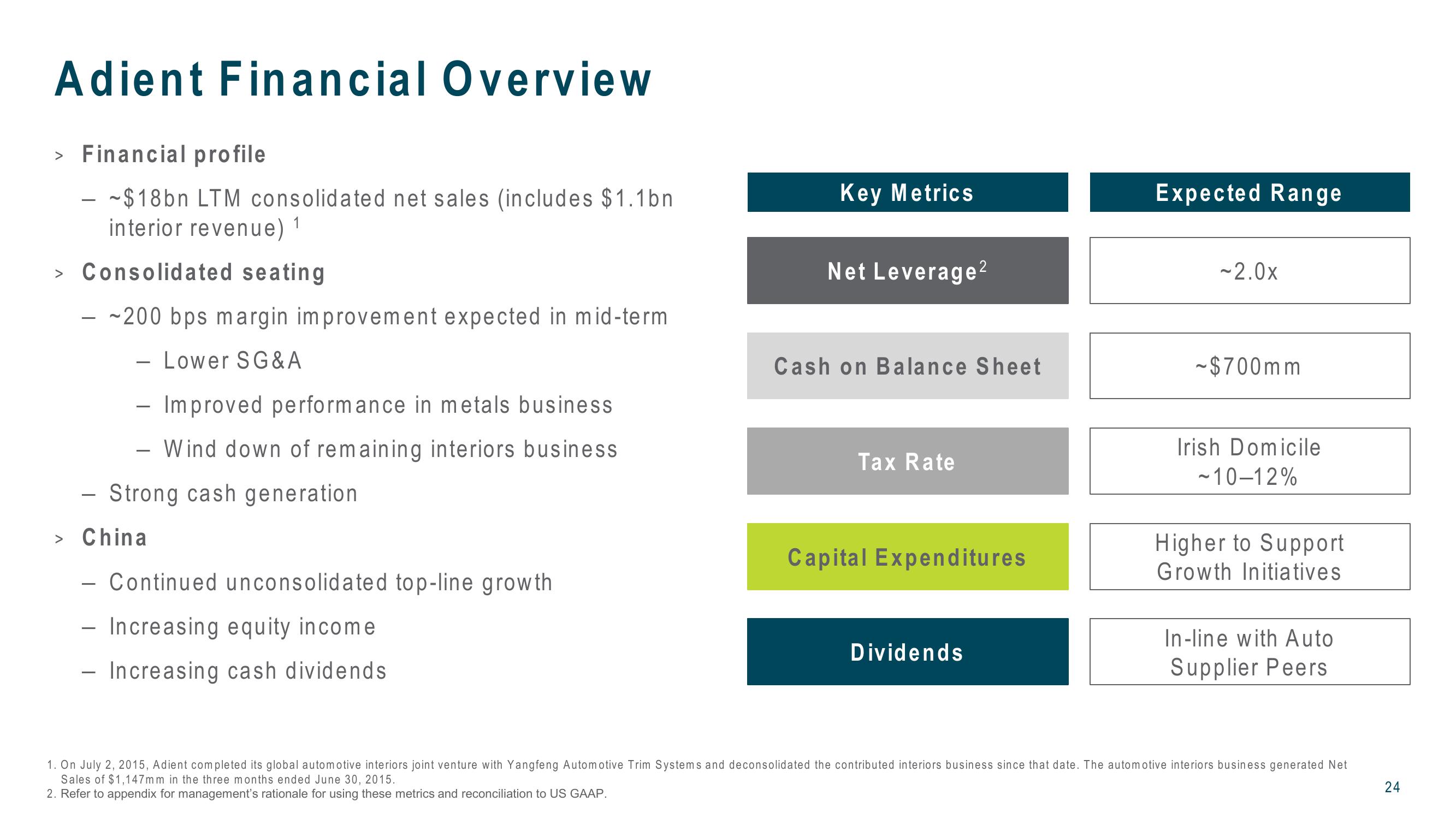

> Financial profile

- $18bn LTM consolidated net sales (includes $1.1bn

interior revenue)

> Consolidated seating

- ~200 bps margin improvement expected in mid-term

- Lower SG&A

- Improved performance in metals business.

Wind down of remaining interiors business

Key Metrics

Net Leverage 2

Cash on Balance Sheet

Tax Rate

Expected Range

~2.0x

~$700mm

-

Strong cash generation

> China

- Continued unconsolidated top-line growth

—

Increasing equity income

1

Increasing cash dividends

Capital Expenditures

Irish Domicile

-10-12%

Higher to Support

Growth Initiatives

In-line with Auto

Dividends

Supplier Peers

1. On July 2, 2015, Adient completed its global automotive interiors joint venture with Yangfeng Automotive Trim Systems and deconsolidated the contributed interiors business since that date. The automotive interiors business generated Net

Sales of $1,147mm in the three months ended June 30, 2015.

2. Refer to appendix for management's rationale for using these metrics and reconciliation to US GAAP.

24View entire presentation