Evercore Investment Banking Pitch Book

Executive Summary

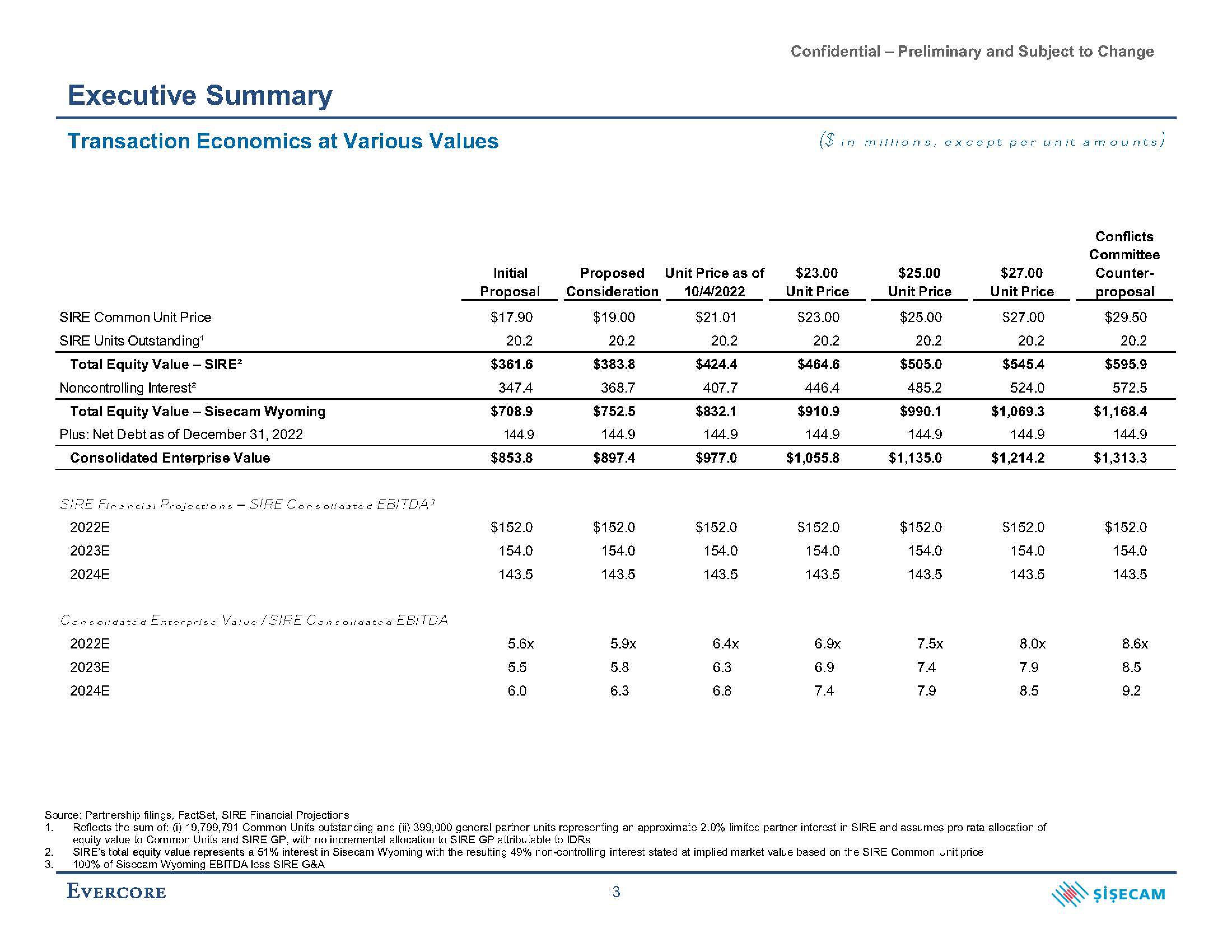

Transaction Economics at Various Values

SIRE Common Unit Price

SIRE Units Outstanding¹

Total Equity Value - SIRE²

Noncontrolling Interest²

Total Equity Value - Sisecam Wyoming

Plus: Net Debt as of December 31, 2022

Consolidated Enterprise Value

SIRE Financial Projections - SIRE Consolidated EBITDA³

2022E

2023E

2024E

Consolidated Enterprise Value /SIRE Consolidated EBITDA

2022E

2023E

2024E

Initial

Proposal

$17.90

20.2

$361.6

347.4

$708.9

144.9

$853.8

$152.0

154.0

143.5

5.6x

5.5

6.0

Proposed Unit Price as of

Consideration 10/4/2022

$19.00

$21.01

20.2

20.2

$383.8

$424.4

368.7

407.7

$752.5

$832.1

144.9

144.9

$897.4

$977.0

$152.0

154.0

143.5

5.9x

5.8

6.3

$152.0

154.0

143.5

3

6.4x

6.3

6.8

Confidential - Preliminary and Subject to Change

($ in millions, except per unit amounts,

$23.00

Unit Price

$23.00

20.2

$464.6

446.4

$910.9

144.9

$1,055.8

$152.0

154.0

143.5

6.9x

6.9

7.4

$25.00

Unit Price

$25.00

20.2

$505.0

485.2

$990.1

144.9

$1,135.0

$152.0

154.0

143.5

7.5x

7.4

7.9

$27.00

Unit Price

$27.00

20.2

$545.4

524.0

$1,069.3

144.9

$1,214.2

$152.0

154.0

143.5

8.0x

7.9

8.5

Source: Partnership filings, FactSet, SIRE Financial Projections

1.

Reflects the sum of: (i) 19,799,791 Common Units outstanding and (ii) 399,000 general partner units representing an approximate 2.0% limited partner interest in SIRE and assumes pro rata allocation of

equity value to Common Units and SIRE GP, with no incremental allocation to SIRE GP attributable to IDRs

2. SIRE's total equity value represents a 51% interest in Sisecam Wyoming with the resulting 49% non-controlling interest stated at implied market value based on the SIRE Common Unit price

100% of Sisecam Wyoming EBITDA less SIRE G&A

3.

EVERCORE

Conflicts

Committee

Counter-

proposal

$29.50

20.2

$595.9

572.5

$1,168.4

144.9

$1,313.3

$152.0

154.0

143.5

8.6x

8.5

9.2

ŞİŞECAMView entire presentation