HSBC Results Presentation Deck

Mainland China drawn risk exposure

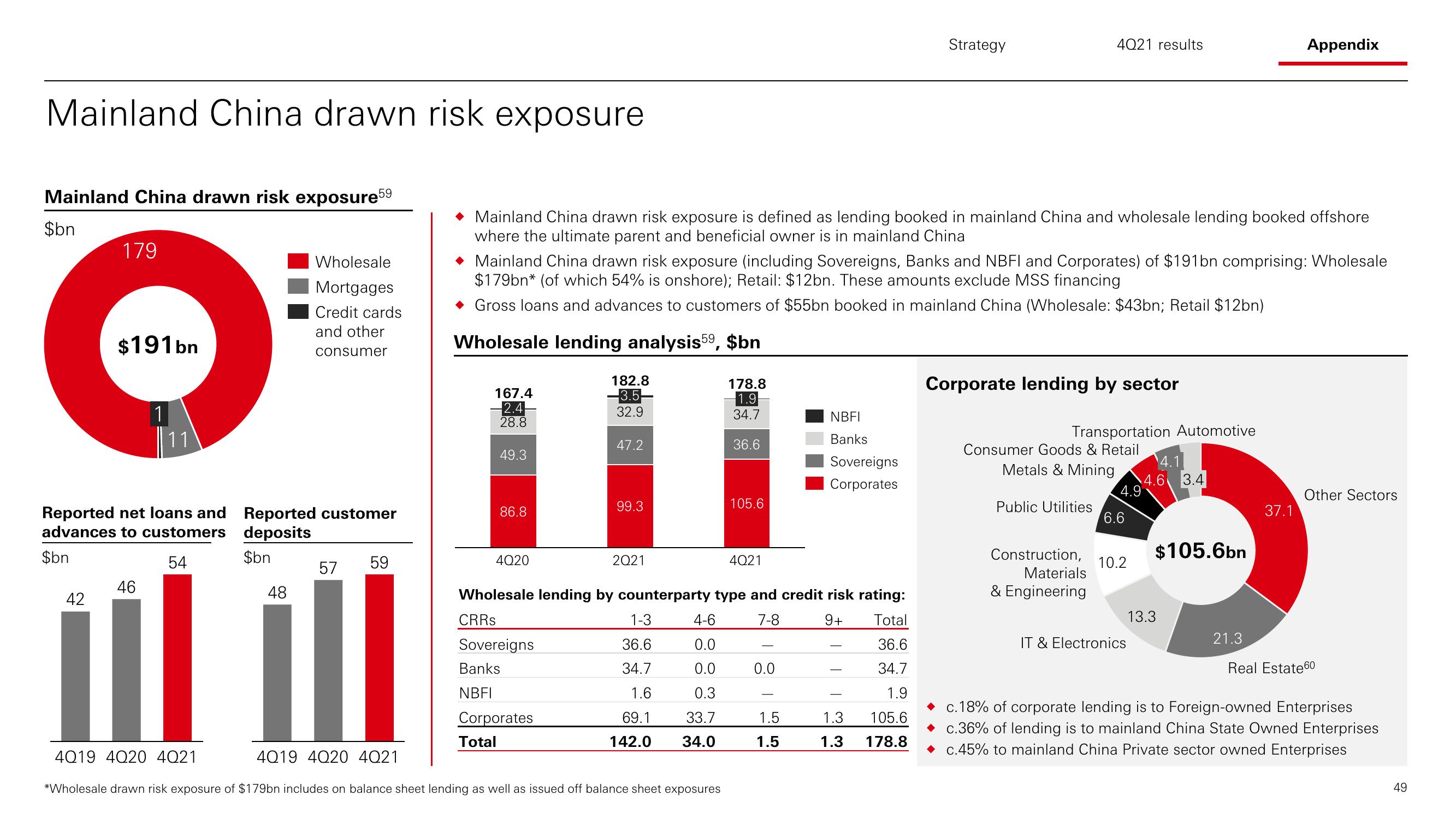

Mainland China drawn risk exposure5⁹

$bn

179

O

$191bn

1

11

Reported net loans and

advances to customers

$bn

54

42

46

Wholesale

Mortgages

Credit cards

and other

consumer

Reported customer

deposits

$bn

48

57

59

167.4

-2.4-

28.8

Mainland China drawn risk exposure is defined as lending booked in mainland China and wholesale lending booked offshore

where the ultimate parent and beneficial owner is in mainland China

49.3

Mainland China drawn risk exposure (including Sovereigns, Banks and NBFI and Corporates) of $191bn comprising: Wholesale

$179bn* (of which 54% is onshore); Retail: $12bn. These amounts exclude MSS financing

Gross loans and advances to customers of $55bn booked in mainland China (Wholesale: $43bn; Retail $12bn)

Wholesale lending analysis 59, $bn

86.8

4020

182.8

-3.5-

32.9

Sovereigns

Banks

NBFI

Corporates

Total

47.2

99.3

2Q21

1-3

36.6

34.7

1.6

69.1

142.0

4-6

0.0

0.0

0.3

33.7

34.0

178.8

1.9

34.7

36.6

Wholesale lending by counterparty type and credit risk rating:

CRRs

7-8

9+

Total

36.6

34.7

1.9

1.3 105.6

1.3 178.8

11

4019 4020 4Q21

4019 4020 4Q21

*Wholesale drawn risk exposure of $179bn includes on balance sheet lending as well as issued off balance sheet exposures

105.6

4Q21

-

0.0

Strategy

NBFI

Banks

Sovereigns

Corporates

1.5

1.5

4021 results

Corporate lending by sector

Transportation Automotive

Consumer Goods & Retail

Metals & Mining

Public Utilities

Construction,

Materials

& Engineering

4.1

4.6 3.4

4.9

6.6

10.2

IT & Electronics

$105.6bn

13.3

Appendix

21.3

37.1

Other Sectors

Real Estate 60

c.18% of corporate lending is to Foreign-owned Enterprises

c.36% of lending is to mainland China State Owned Enterprises

c.45% to mainland China Private sector owned Enterprises

49View entire presentation