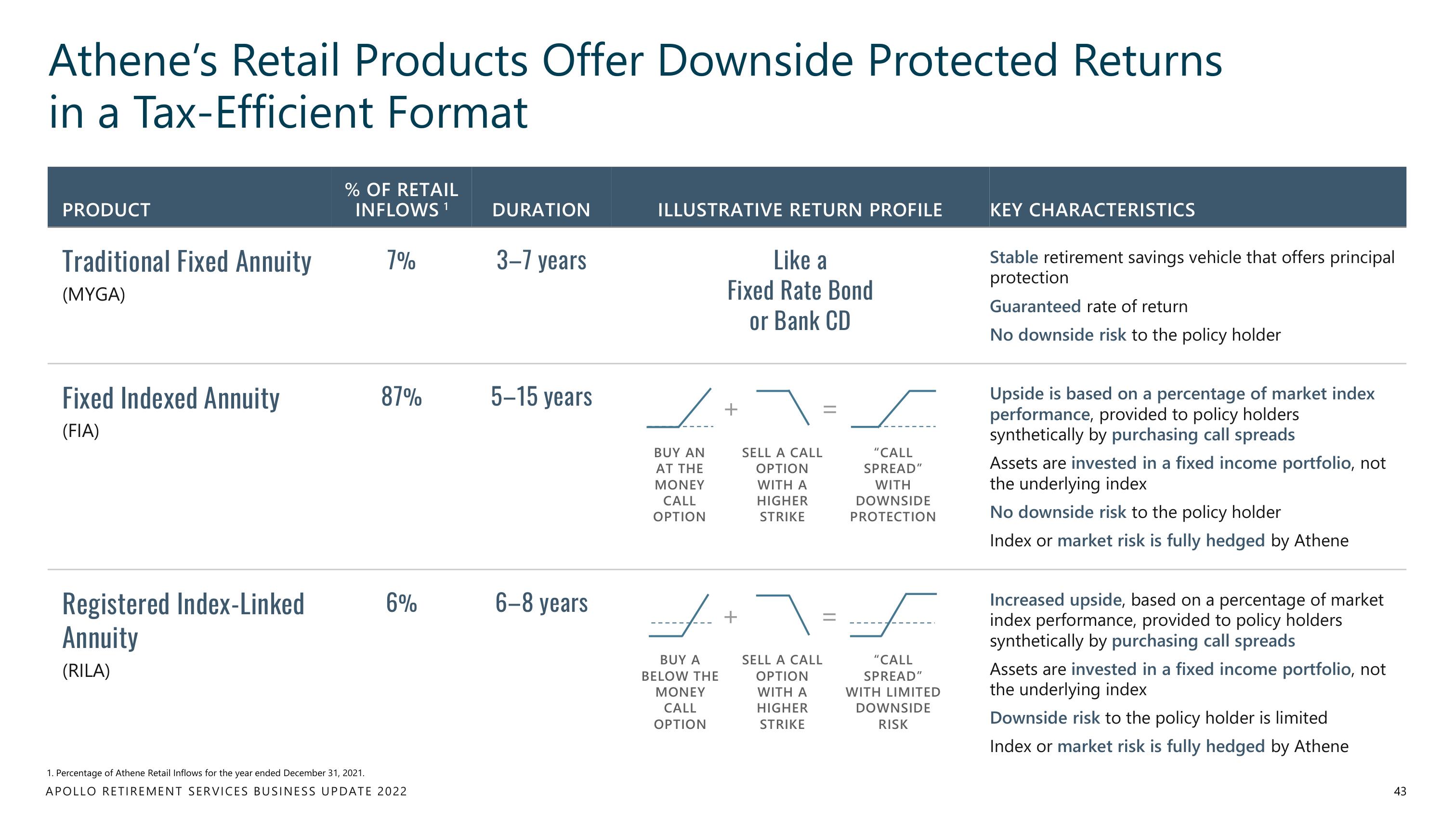

Apollo Global Management Investor Day Presentation Deck

Athene's Retail Products Offer Downside Protected Returns

in a Tax-Efficient Format

PRODUCT

Traditional Fixed Annuity

(MYGA)

Fixed Indexed Annuity

(FIA)

Registered Index-Linked

Annuity

(RILA)

% OF RETAIL

INFLOWS ¹ 1

7%

87%

6%

1. Percentage of Athene Retail Inflows for the year ended December 31, 2021.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

DURATION

3-7 years

5-15 years

6-8 years

ILLUSTRATIVE RETURN PROFILE

BUY AN

AT THE

MONEY

CALL

OPTION

f

BUY A

BELOW THE

MONEY

CALL

OPTION

Like a

Fixed Rate Bond

or Bank CD

+

+

SELL A CALL

OPTION

WITH A

HIGHER

STRIKE

=

SELL A CALL

OPTION

WITH A

HIGHER

STRIKE

ر

"CALL

SPREAD"

WITH

DOWNSIDE

PROTECTION

"CALL

SPREAD"

WITH LIMITED

DOWNSIDE

RISK

KEY CHARACTERISTICS

Stable retirement savings vehicle that offers principal

protection

Guaranteed rate of return

No downside risk to the policy holder

Upside is based on a percentage of market index

performance, provided to policy holders

synthetically by purchasing call spreads

Assets are invested in a fixed income portfolio, not

the underlying index

No downside risk to the policy holder

Index or market risk is fully hedged by Athene

Increased upside, based on a percentage of market

index performance, provided to policy holders

synthetically by purchasing call spreads

Assets are invested in a fixed income portfolio, not

the underlying index

Downside risk to the policy holder is limited

Index or market risk is fully hedged by Athene

43View entire presentation