J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

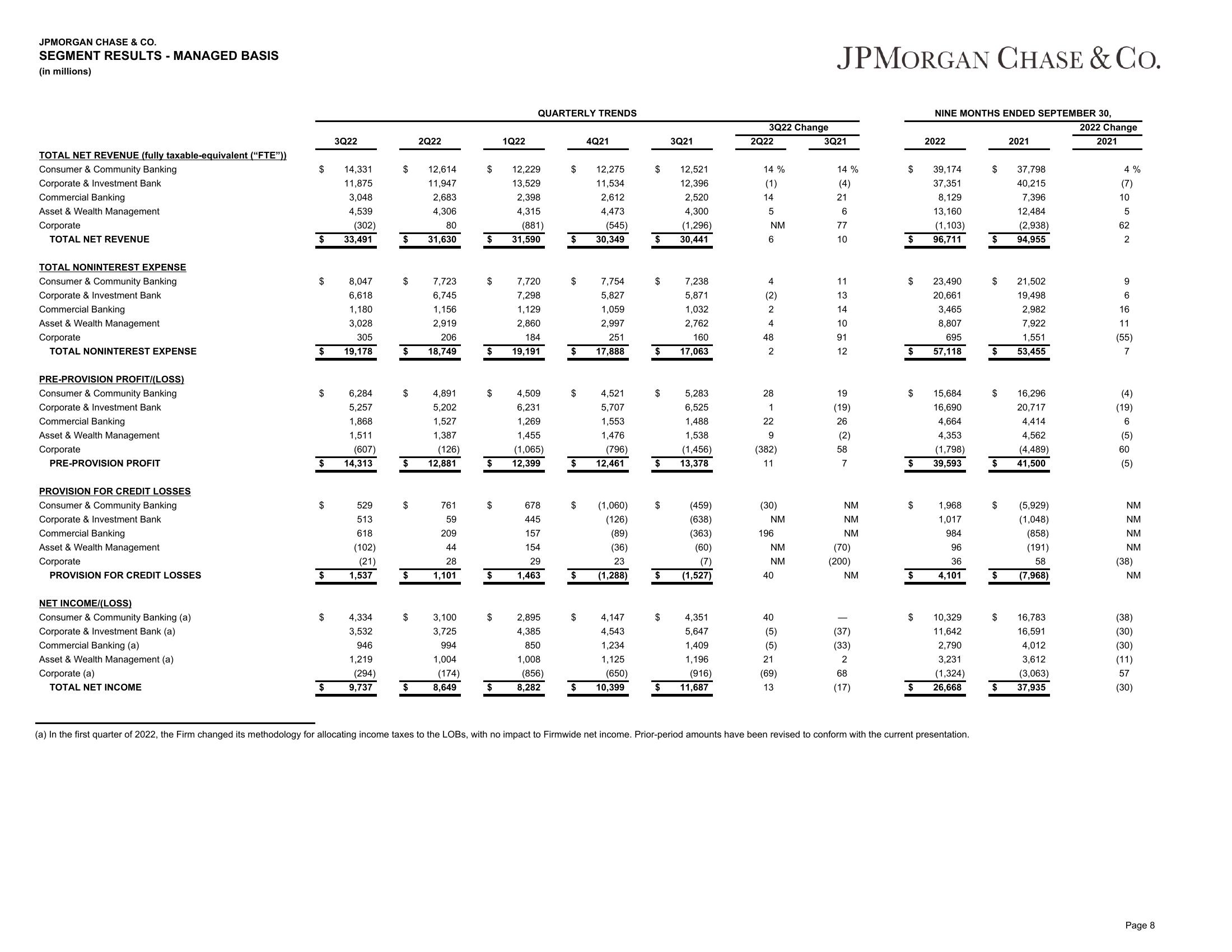

SEGMENT RESULTS - MANAGED BASIS

(in millions)

TOTAL NET REVENUE (fully taxable-equivalent ("FTE"))

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NET REVENUE

TOTAL NONINTEREST EXPENSE

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NONINTEREST EXPENSE

PRE-PROVISION PROFIT/(LOSS)

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

PRE-PROVISION PROFIT

PROVISION FOR CREDIT LOSSES

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

PROVISION FOR CREDIT LOSSES

NET INCOME/(LOSS)

Consumer & Community Banking (a)

Corporate & Investment Bank (a)

Commercial Banking (a)

Asset & Wealth Management (a)

Corporate (a)

TOTAL NET INCOME

$

$

$

$

$

$

$

$

3Q22

(607)

$ 14,313

$

14,331

11,875

3,048

4,539

(302)

33,491

8,047

6,618

1,180

3,028

305

19,178

6,284

5,257

1,868

1,511

529

513

618

(102)

(21)

1,537

4,334

3,532

946

1,219

(294)

9,737

$

$

$

7,723

6,745

1,156

2,919

206

$ 18,749

$

$

2Q22

(126)

$ 12,881

$

12,614

11,947

2,683

4,306

80

31,630

$

4,891

5,202

1,527

1,387

761

59

209

44

28

1,101

3,100

3,725

994

1,004

(174)

8,649

$

12,229

13,529

2,398

4,315

(881)

$ 31,590

$

$

$

$

$

$

1Q22

$

QUARTERLY TRENDS

7,720

7,298

1,129

2,860

184

19,191

4,509

6,231

1,269

1,455

(1,065)

12,399

678

445

157

154

29

1,463

2,895

4,385

850

1,008

(856)

8,282

$

$

(545)

$ 30,349

$

7,754

5,827

1,059

2,997

251

$ 17,888

$

4Q21

$

12,275

11,534

2,612

4,473

$

4,521

5,707

1,553

1,476

(796)

12,461

4,147

4,543

1,234

1,125

$

(650)

$ 10,399

$

$

$

$

(1,060) $

(126)

(89)

(36)

23

(1,288)

$

$

$

$

3Q21

12,521

12,396

2,520

4,300

(1,296)

30,441

7,238

5,871

1,032

2,762

160

17,063

5,283

6,525

1,488

1,538

(1,456)

13,378

(459)

(638)

(363)

(60)

(7)

(1,527)

4,351

5,647

1,409

1,196

(916)

11,687

3Q22 Change

2Q22

14%

(1)

14

5

NM

6

4

(2)

2

4

48

2

28

1

22

9

(382)

11

(30)

NM

196

NM

NM

40

40

(5)

(5)

21

(69)

13

JPMORGAN CHASE & CO.

3Q21

14%

21

6

10

11

13

14

10

91

12

19

(19)

26

(2)

58

7

NM

NM

NM

(70)

(200)

NM

(37)

(33)

2

68

(17)

$

$

$

23,490

20,661

3,465

8,807

695

$ 57,118

$

$

$ 15,684

16,690

4,664

4,353

(1,798)

39,593

$

NINE MONTHS ENDED SEPTEMBER 30,

$

2022

$

39,174

37,351

8,129

13,160

(1,103)

96,711

1,968

1,017

984

96

36

4,101

10,329

11,642

2,790

3,231

(1,324)

26,668

(a) In the first quarter of 2022, the Firm changed its methodology for allocating income taxes to the LOBS, with no impact to Firmwide net income. Prior-period amounts have been revised to conform with the current presentation.

$

$

12,484

(2,938)

$ 94,955

$

$

$

$

$

$

2021

$

37,798

40,215

7,396

21,502

19,498

2,982

7,922

1,551

53,455

16,296

20,717

4,414

4,562

(4,489)

41,500

(5,929)

(1,048)

(858)

(191)

58

(7,968)

16,783

16,591

4,012

3,612

(3,063)

37,935

2022 Change

2021

4%

(7)

10

5

62

2

9

6

16

11

(55)

7

(4)

(19)

6

(5)

60

(5)

NM

NM

NM

NM

(38)

NM

(38)

(30)

(30)

(11)

57

(30)

Page 8View entire presentation