Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

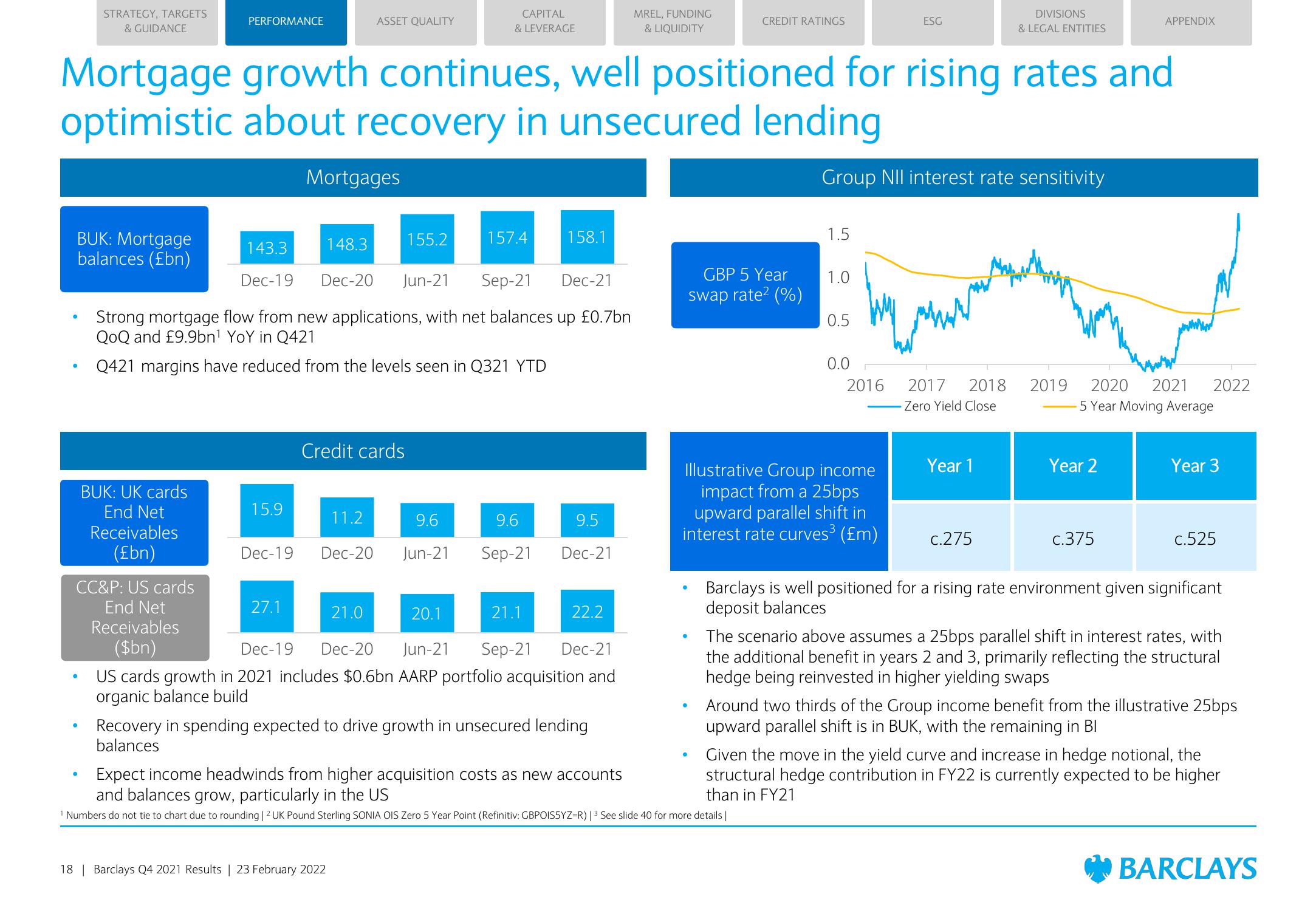

BUK: Mortgage

balances (£bn)

●

PERFORMANCE

BUK: UK cards

End Net

Receivables

(£bn)

CC&P: US cards

End Net

Receivables

($bn)

143.3

148.3

Dec-19 Dec-20

Mortgage growth continues, well positioned for rising rates and

optimistic about recovery in unsecured lending

15.9

Mortgages

ASSET QUALITY

27.1

Jun-21 Sep-21

Strong mortgage flow from new applications, with net balances up £0.7bn

QoQ and £9.9bn¹ YoY in Q421

Q421 margins have reduced from the levels seen in Q321 YTD

Credit cards

CAPITAL

& LEVERAGE

155.2

21.0

11.2

9.6

9.6

Dec-19 Dec-20 Jun-21 Sep-21

157.4

18 | Barclays Q4 2021 Results | 23 February 2022

158.1

21.1

Dec-21

9.5

Dec-21

20.1

Dec-20 Jun-21 Sep-21 Dec-21

Dec-19

US cards growth in 2021 includes $0.6bn AARP portfolio acquisition and

organic balance build

22.2

Recovery in spending expected to drive growth in unsecured lending

balances

MREL, FUNDING

& LIQUIDITY

CREDIT RATINGS

GBP 5 Year

swap rate² (%)

1.5

Expect income headwinds from higher acquisition costs as new accounts

and balances grow, particularly in the US

Numbers do not tie to chart due to rounding | 2 UK Pound Sterling SONIA OIS Zero 5 Year Point (Refinitiv: GBPOIS5YZ=R) |3 See slide 40 for more details |

Group NII interest rate sensitivity

1.0

0.5

0.0

hy

ESG

2016

Illustrative Group income

impact from a 25bps

upward parallel shift in

interest rate curves³ (£m)

2017 2018

Zero Yield Close

DIVISIONS

& LEGAL ENTITIES

Year 1

c.275

APPENDIX

2019 2020 2021 2022

5 Year Moving Average

Year 2

c.375

Year 3

c.525

Barclays is well positioned for a rising rate environment given significant

deposit balances

The scenario above assumes a 25bps parallel shift in interest rates, with

the additional benefit in years 2 and 3, primarily reflecting the structural

hedge being reinvested in higher yielding swaps

Around two thirds of the Group income benefit from the illustrative 25bps

upward parallel shift is in BUK, with the remaining in Bl

Given the move in the yield curve and increase in hedge notional, the

structural hedge contribution in FY22 is currently expected to be higher

than in FY21

BARCLAYSView entire presentation