KKR Real Estate Finance Trust Results Presentation Deck

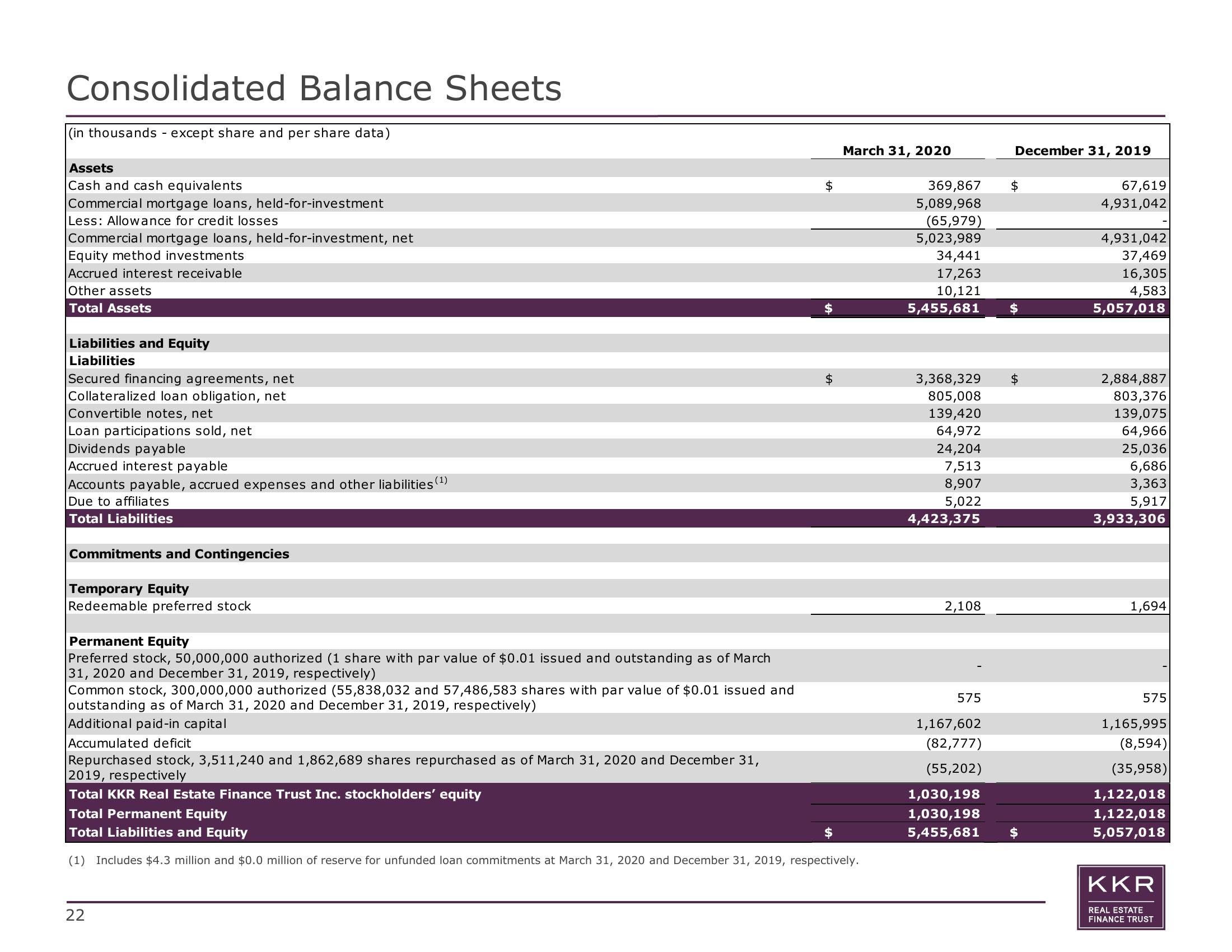

Consolidated Balance Sheets

(in thousands - except share and per share data)

Assets

Cash and cash equivalents

Commercial mortgage loans, held-for-investment

Less: Allowance for credit losses

Commercial mortgage loans, held-for-investment, net

Equity method investments

Accrued interest receivable

Other assets

Total Assets

Liabilities and Equity

Liabilities

Secured financing agreements, net

Collateralized loan obligation, net

Convertible notes, net

Loan participations sold, net

Dividends payable

Accrued interest payable

Accounts payable, accrued expenses and other liabilities

Due to affiliates

Total Liabilities

Commitments and Contingencies

Temporary Equity

Redeemable preferred stock

(1)

Permanent Equity

Preferred stock, 50,000,000 authorized (1 share with par value of $0.01 issued and outstanding as of March

31, 2020 and December 31, 2019, respectively)

Common stock, 300,000,000 authorized (55,838,032 and 57,486,583 shares with par value of $0.01 issued and

outstanding as of March 31, 2020 and December 31, 2019, respectively)

Additional paid-in capital

Accumulated deficit

Repurchased stock, 3,511,240 and 1,862,689 shares repurchased as of March 31, 2020 and December 31,

2019, respectively

Total KKR Real Estate Finance Trust Inc. stockholders' equity

22

$

$

March 31, 2020

Total Permanent Equity

Total Liabilities and Equity

(1) Includes $4.3 million and $0.0 million of reserve for unfunded loan commitments at March 31, 2020 and December 31, 2019, respectively.

369,867

5,089,968

(65,979)

5,023,989

34,441

17,263

10,121

5,455,681

3,368,329

805,008

139,420

64,972

24,204

7,513

8,907

5,022

4,423,375

2,108

575

1,167,602

(82,777)

(55,202)

1,030,198

1,030,198

5,455,681

December 31, 2019

$

$

$

67,619

4,931,042

4,931,042

37,469

16,305

4,583

5,057,018

2,884,887

803,376

139,075

64,966

25,036

6,686

3,363

5,917

3,933,306

1,694

575

1,165,995

(8,594)

(35,958)

1,122,018

1,122,018

5,057,018

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation