Opendoor SPAC Presentation Deck

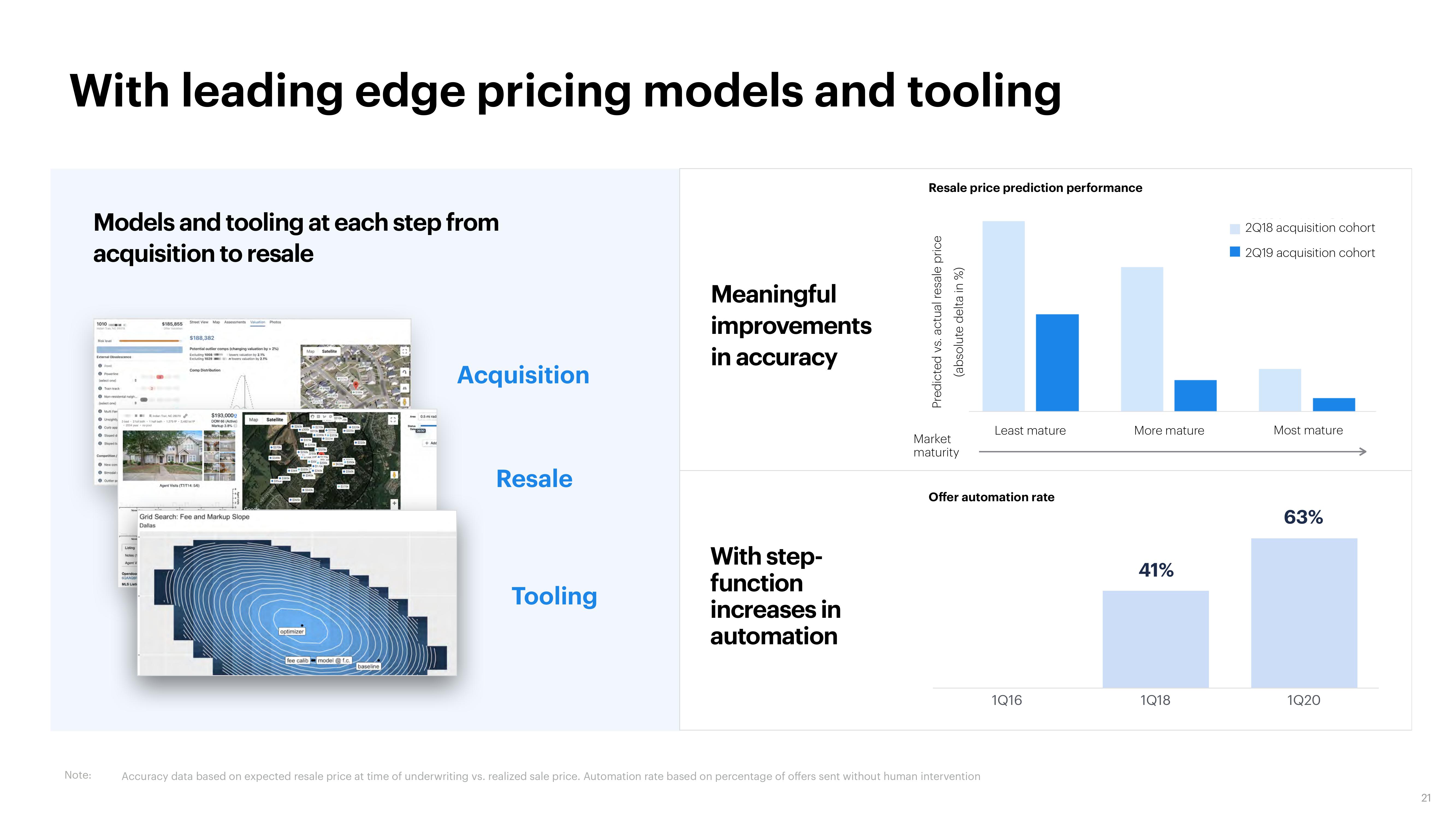

With leading edge pricing models and tooling

Note:

Models and tooling at each step from

acquisition to resale

1010

belect one

$185,855

$188.382

Potential outer comps changing valuation by 2

Eugevaluation by 2

Agents (45)

$193,000

DOM (A)

26-201

AMHARE

Grid Search: Fee and Markup Slope

Dallas

optimizer

ORPOR

fee calib model @f.c.

baseline

3.5m

Acquisition

Resale

Tooling

Meaningful

improvements

in accuracy

With step-

function

increases in

automation

Resale price prediction performance

Predicted vs. actual resale price

(absolute delta in %)

Market

maturity

Least mature

Offer automation rate

Accuracy data based on expected resale price at time of underwriting vs. realized sale price. Automation rate based on percentage of offers sent without human intervention

1Q16

More mature

41%

1Q18

2Q18 acquisition cohort

2Q19 acquisition cohort

Most mature

63%

1Q20

21View entire presentation