Apollo Global Management Investor Presentation Deck

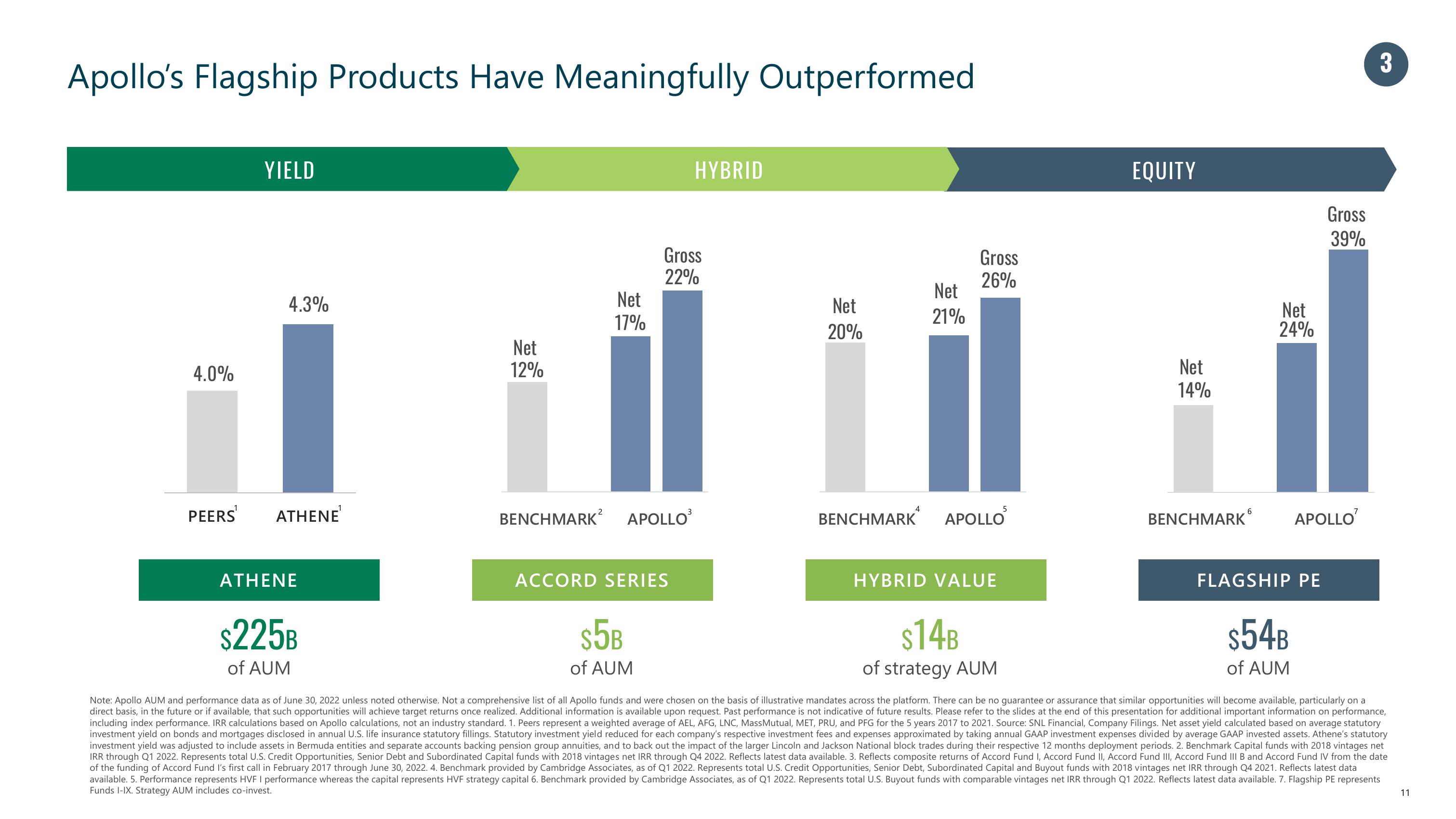

Apollo's Flagship Products Have Meaningfully Outperformed

4.0%

PEERS¹

YIELD

4.3%

ATHENE

ATHENE

$225B

of AUM

Net

12%

Net

17%

BENCHMARK² APOLLO³

Gross

22%

ACCORD SERIES

$5B

of AUM

HYBRID

Net

20%

Net

21%

Gross

26%

BENCHMARK APOLLO

HYBRID VALUE

5

$14B

of strategy AUM

EQUITY

Net

14%

BENCHMARK

6

Net

24%

FLAGSHIP PE

$54B

of AUM

Gross

39%

7

APOLLO

3

Note: Apollo AUM and performance data as of June 30, 2022 unless noted otherwise. Not a comprehensive list of all Apollo funds and were chosen on the basis of illustrative mandates across the platform. There can be no guarantee or assurance that similar opportunities will become available, particularly on a

direct basis, in the future or if available, that such opportunities will achieve target returns once realized. Additional information available upon request. Past performance is not indicative of future results. Please refer to the slides at the end of this presentation for additional important information on performance,

including index performance. IRR calculations based on Apollo calculations, not an industry standard. 1. Peers represent a weighted average of AEL, AFG, LNC, MassMutual, MET, PRU, and PFG for the 5 years 2017 to 2021. Source: SNL Financial, Company Filings. Net asset yield calculated based on average statutory

investment yield on bonds and mortgages disclosed in annual U.S. life insurance statutory fillings. Statutory investment yield reduced for each company's respective investment fees and expenses approximated by taking annual GAAP investment expenses divided by average GAAP invested assets. Athene's statutory

investment yield was adjusted to include assets in Bermuda entities and separate accounts backing pension group annuities, and to back out the impact of the larger Lincoln and Jackson National block trades during their respective 12 months deployment periods. 2. Benchmark Capital funds with 2018 vintages net

IRR through Q1 2022. Represents total U.S. Credit Opportunities, Senior Debt and Subordinated Capital funds with 2018 vintages net IRR through Q4 2022. Reflects latest data available. 3. Reflects composite returns of Accord Fund I, Accord Fund II, Accord Fund III, Accord Fund III B and Accord Fund IV from the date

of the funding of Accord Fund I's first call in February 2017 through June 30, 2022. 4. Benchmark provided by Cambridge Associates, as of Q1 2022. Represents total U.S. Credit Opportunities, Senior Debt, Subordinated Capital and Buyout funds with 2018 vintages net IRR through Q4 2021. Reflects latest data

available. 5. Performance represents HVF I performance whereas the capital represents HVF strategy capital 6. Benchmark provided by Cambridge Associates, as of Q1 2022. Represents total U.S. Buyout funds with comparable vintages net IRR through Q1 2022. Reflects latest data available. 7. Flagship PE represents

Funds I-IX. Strategy AUM includes co-invest.

11View entire presentation