Bank of America Investment Banking Pitch Book

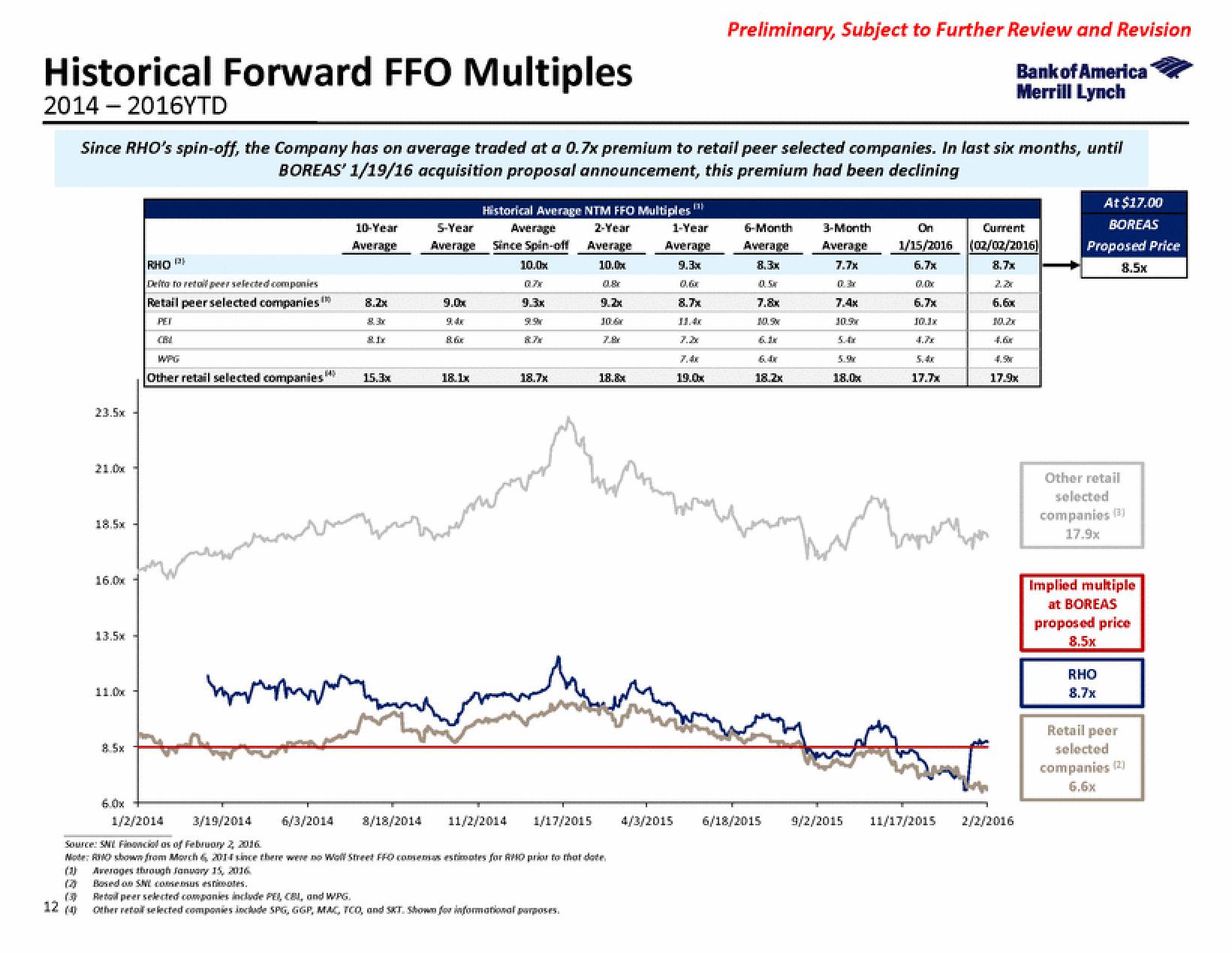

Historical Forward FFO Multiples

2014 - 2016YTD

(3)

12 (

Since RHO's spin-off, the Company has on average traded at a 0.7x premium to retail peer selected companies. In last six months, until

BOREAS' 1/19/16 acquisition proposal announcement, this premium had been declining

115

185

16.0x

135.

11.0x

8.5x

RHO P

Delto to retail peer selected companies

Retail peer selected companies™

PET

CA

143

Other retail selected companies"

10-Year

Average

6/3/2014

8.2x

8.3

8.1x

15.3x

8/18/2014

S-Year

Average

9.0x

86

18.1x

Historical Average NTM FFO Multiples

Average

2-Year

Since Spin-off Average

10.0x

10.0x

0%

9.2x

10.6x

7.8

1/2/2014

3/19/2014

Source: SML Financial os of February 2 2016

Mote: RHOsbown from March 2014 since there were no Woll Street PRO consemas estimates for RO prior to that date

(1) Averages through January 15, 2016

(2)

Bosed on SMC comemus estimates.

11/2/2014

9.3x

9%

18.7x

1/17/2015

18.&x

Repeer selected companies include PEI, CBI, and WPG.

Other real selected companies include SPG, GGP, MAC, TCO, and SKT. Shown for informational purposes.

1-Year

Average

9.3x

4/3/2015

8.7x

11.4x

7.2x

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

19.0x

6-Month

Average

8.3x

0.5

7.8x

10.9

6.dr

18.2x

3-Month

Average

7.7%

7.4x

10.90

5.4x

18.0%

6/18/2015 9/2/2015

On

1/15/2016

6.7x

6.7x

4.7

17.7x

Current

(02/02/2016)

8.7x

причет

11/17/2015

6.6x

10.2x

4.6

17.9x

2/2/2016

At $17.00

BOREAS

Proposed Price

8.5x

Other retail

selected

companies (3)

17.9x

Implied multiple

at BOREAS

proposed price

8.5x

RHO

8.7x

Retail peer

selected

companies (2)

6.6xView entire presentation