Credit Suisse Investment Banking Pitch Book

Preliminary illustrative Maine NAV analysis summary

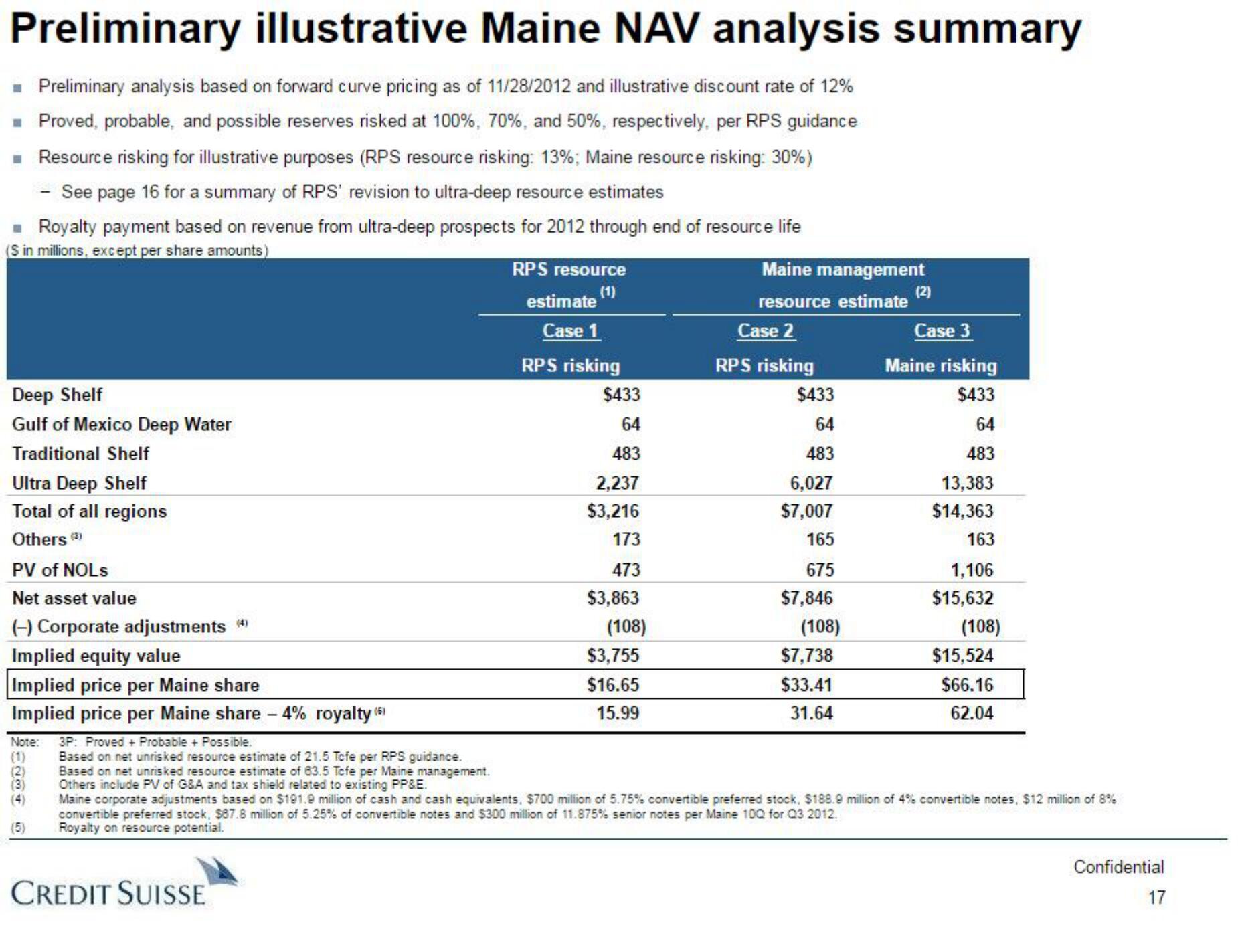

■ Preliminary analysis based on forward curve pricing as of 11/28/2012 and illustrative discount rate of 12%

■ Proved, probable, and possible reserves risked at 100%, 70%, and 50%, respectively, per RPS guidance

■ Resource risking for illustrative purposes (RPS resource risking: 13%; Maine resource risking: 30%)

See page 16 for a summary of RPS' revision to ultra-deep resource estimates

Royalty payment based on revenue from ultra-deep prospects for 2012 through end of resource life

(S in millions, except per share amounts)

Deep Shelf

Gulf of Mexico Deep Water

Traditional Shelf

Ultra Deep Shelf

Total of all regions

Others (3)

PV of NOLS

Net asset value

(-) Corporate adjustments (4)

Implied equity value

Implied price per Maine share

Implied price per Maine share - 4% royalty (5)

Note:

(2)

(3)

(5)

RPS resource

estimate (1)

Case 1

RPS risking

CREDIT SUISSE

$433

64

483

2,237

$3,216

173

473

$3,863

(108)

$3,755

$16.65

15.99

Maine management

resource estimate

Case 2

RPS risking

$433

64

483

6,027

$7,007

165

675

$7,846

(108)

$7,738

$33.41

31.64

(2)

Case 3

Maine risking

$433

64

483

13,383

$14,363

163

1,106

$15,632

(108)

$15,524

$66.16

62.04

3P: Proved + Probable + Possible.

Based on net unrisked resource estimate of 21.5 Tofe per RPS guidance.

Based on net unrisked resource estimate of 83.5 Tofe per Maine management.

Others include PV of G&A and tax shield related to existing PP&E.

Maine corporate adjustments based on $191.9 million of cash and cash equivalents, $700 million of 5.75% convertible preferred stock, $188.9 million of 4% convertible notes, $12 million of 8%

convertible preferred stock, $87.8 million of 5.25% of convertible notes and $300 million of 11.875% senior notes per Maine 100 for Q3 2012.

Royalty on resource potential.

Confidential

17View entire presentation