Allwyn Results Presentation Deck

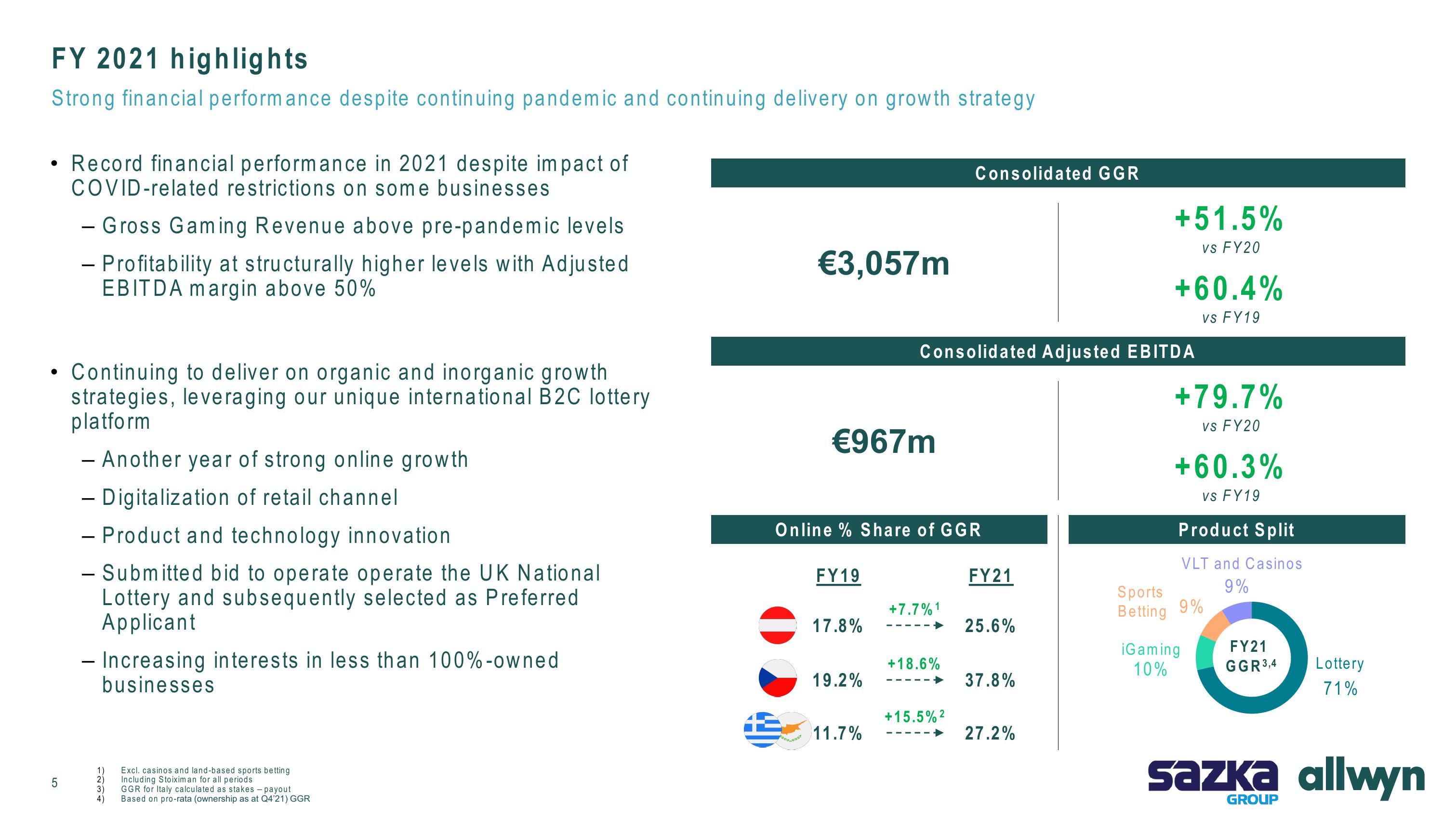

FY 2021 highlights

Strong financial performance despite continuing pandemic and continuing delivery on growth strategy

●

●

LO

5

Record financial performance in 2021 despite impact of

COVID-related restrictions on some businesses

- Gross Gaming Revenue above pre-pandemic levels

- Profitability at structurally higher levels with Adjusted

EBITDA margin above 50%

Continuing to deliver on organic and inorganic growth

strategies, leveraging our unique international B2C lottery

platform

- Another year of strong online growth

- Digitalization of retail channel

- Product and technology innovation

- Submitted bid to operate operate the UK National

Lottery and subsequently selected as Preferred

Applicant

- Increasing interests in less than 100%-owned

businesses

1)

2)

3)

4)

Excl. casinos and land-based sports betting

Including Stoiximan for all periods

GGR for Italy calculated as stakes-payout

Based on pro-rata (ownership as at Q4'21) GGR

€3,057m

€967m

FY19

Online % Share of GGR

17.8%

19.2%

11.7%

Consolidated Adjusted EBITDA

+7.7% 1

Consolidated GGR

+18.6%

+15.5% ²

FY21

25.6%

37.8%

+51.5%

vs FY20

27.2%

+60.4%

vs FY19

+79.7%

vs FY20

+60.3%

vs FY19

Product Split

VLT and Casinos

9%

Sports

Betting 9%

iGaming

10%

FY21

GGR 3,4

Lottery

71%

sazka allwyn

GROUPView entire presentation