SmileDirectClub Investor Presentation Deck

Convertible Debt Offering.

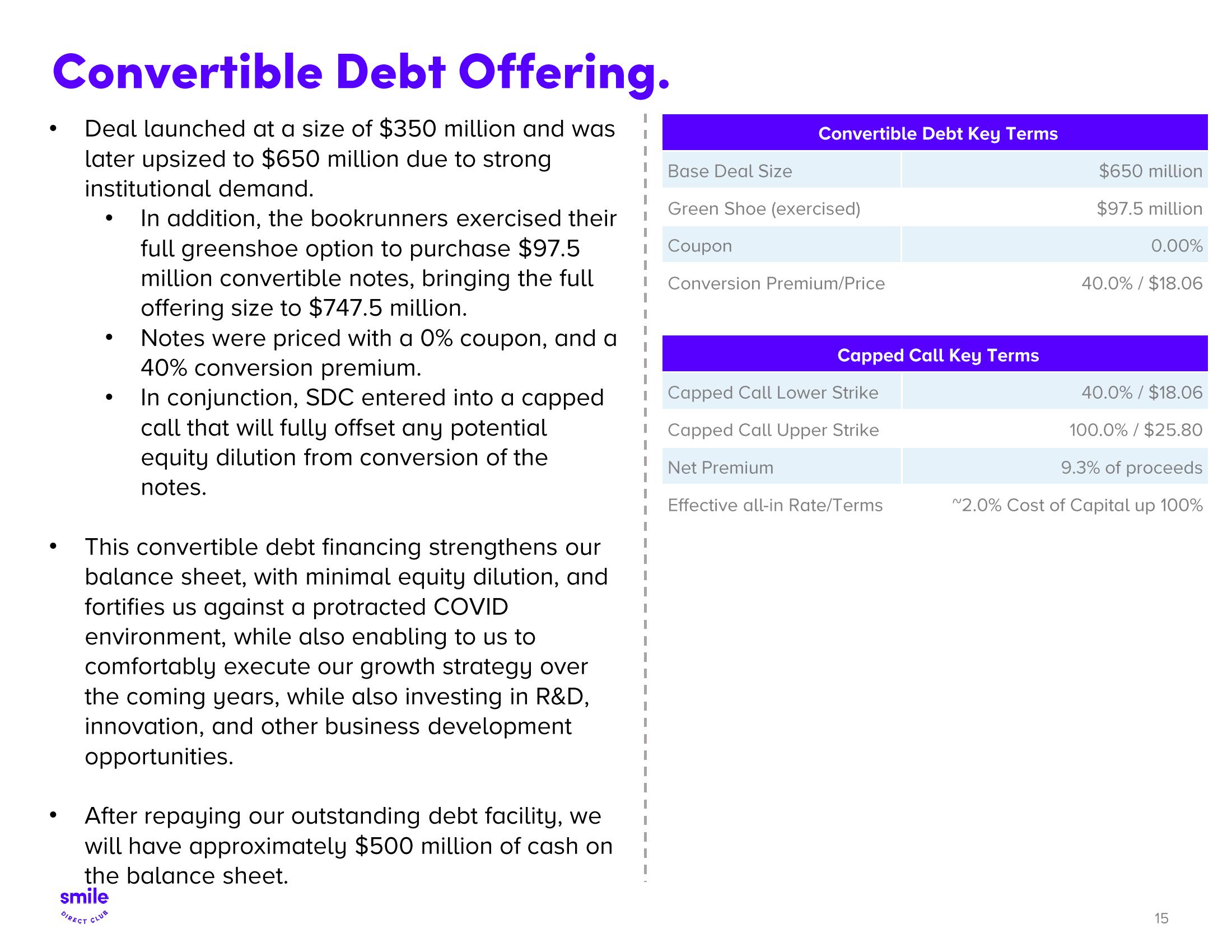

Deal launched at a size of $350 million and was

later upsized to $650 million due to strong

institutional demand.

In addition, the bookrunners exercised their

full greenshoe option to purchase $97.5

million convertible notes, bringing the full

offering size to $747.5 million.

Notes were priced with a 0% coupon, and a

40% conversion premium.

●

●

In conjunction, SDC entered into a capped

call that will fully offset any potential

equity dilution from conversion of the

notes.

This convertible debt financing strengthens our

balance sheet, with minimal equity dilution, and

fortifies us against a protracted COVID

environment, while also enabling to us to

comfortably execute our growth strategy over

the coming years, while also investing in R&D,

innovation, and other business development

opportunities.

After repaying our outstanding debt facility, we

will have approximately $500 million of cash on

the balance sheet.

smile

DIRECT CLUB

Convertible Debt Key Terms

Base Deal Size

Green Shoe (exercised)

Coupon

Conversion Premium/Price

Net Premium

Capped Call Key Terms

Capped Call Lower Strike

Capped Call Upper Strike

Effective all-in Rate/Terms

$650 million

$97.5 million

0.00%

40.0% / $18.06

40.0% / $18.06

100.0% / $25.80

9.3% of proceeds

~2.0% Cost of Capital up 100%

15View entire presentation