Servicing Portfolio Growth Deck

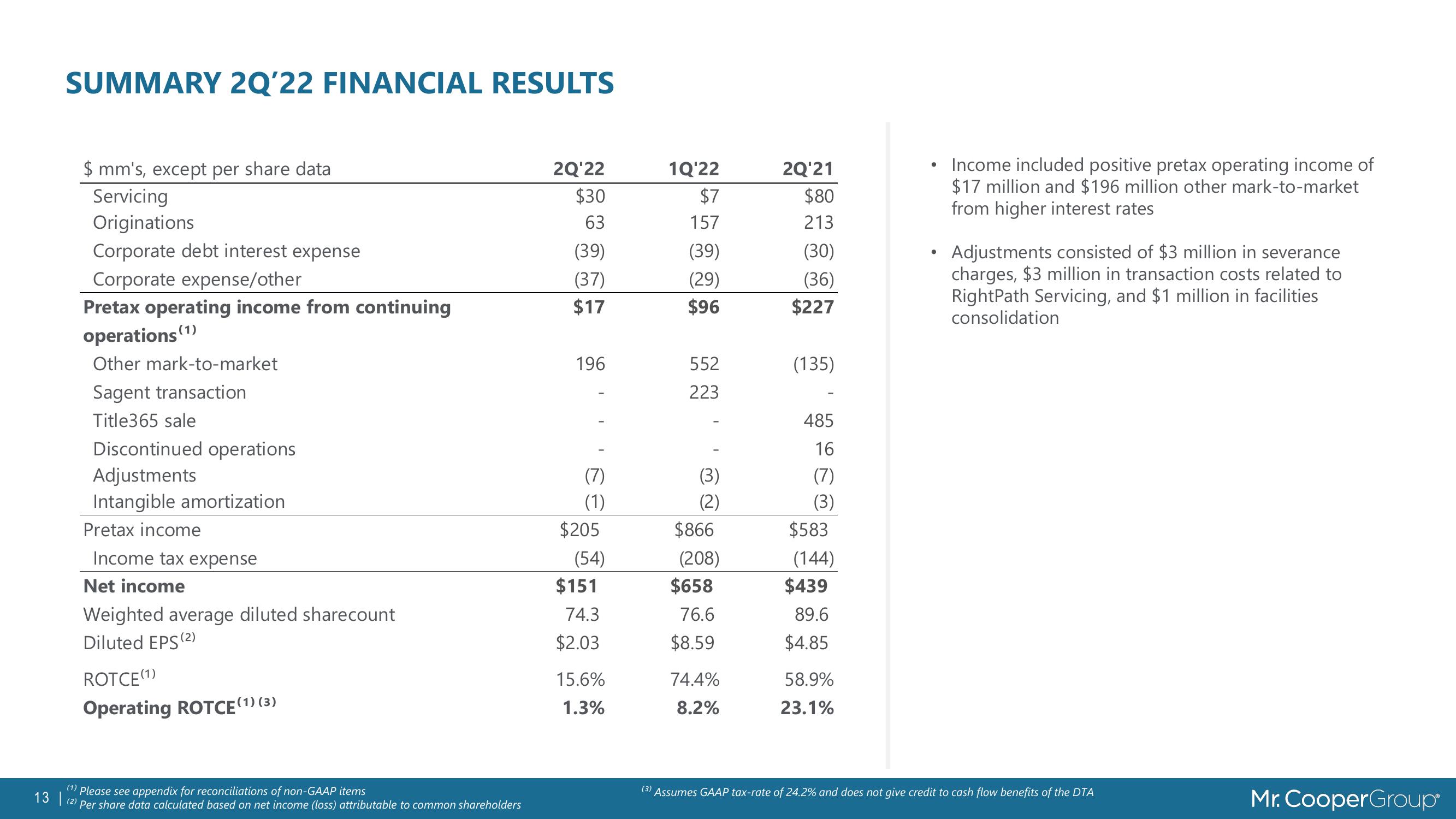

SUMMARY 2Q'22 FINANCIAL RESULTS

$ mm's, except per share data

Servicing

Originations

Corporate debt interest expense

Corporate expense/other

Pretax operating income from continuing

operations (1)

Other mark-to-market

Sagent transaction

Title365 sale

Discontinued operations

Adjustments

Intangible amortization

Pretax income

Income tax expense

Net income

Weighted average diluted sharecount

Diluted EPS (2)

ROTCE(1)

Operating ROTCE (1) (3)

13 |

(2) Per share data calculated based on net income (loss) attributable to common shareholders

(1) Please see appendix for reconciliations of non-GAAP items

2Q¹22

$30

63

(39)

(37)

$17

196

(7)

(1)

$205

(54)

$151

74.3

$2.03

15.6%

1.3%

1Q'22

$7

157

(39)

(29)

$96

552

223

(3)

(2)

$866

(208)

$658

76.6

$8.59

74.4%

8.2%

2Q¹21

$80

213

(30)

(36)

$227

(135)

485

16

(7)

(3)

$583

(144)

$439

89.6

$4.85

58.9%

23.1%

●

●

Income included positive pretax operating income of

$17 million and $196 million other mark-to-market

from higher interest rates

Adjustments consisted of $3 million in severance

charges, $3 million in transaction costs related to

RightPath Servicing, and $1 million in facilities

consolidation

(3) Assumes GAAP tax-rate of 24.2% and does not give credit to cash flow benefits of the DTA

Mr. CooperGroupView entire presentation