First Foundation Investor Presentation Deck

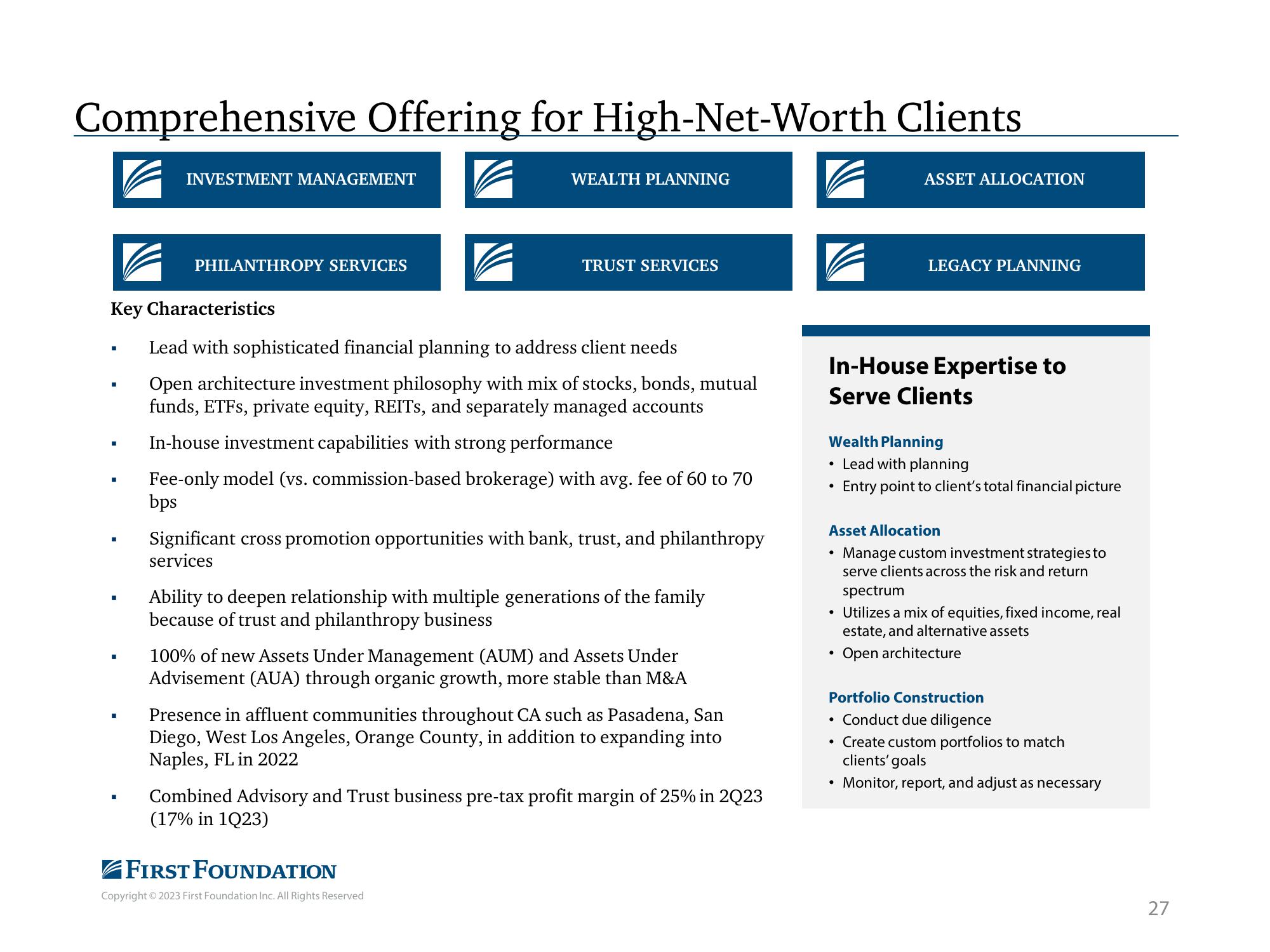

Comprehensive Offering for High-Net-Worth Clients

INVESTMENT MANAGEMENT

■

PHILANTHROPY SERVICES

WEALTH PLANNING

Key Characteristics

Lead with sophisticated financial planning to address client needs

Open architecture investment philosophy with mix of stocks, bonds, mutual

funds, ETFs, private equity, REITs, and separately managed accounts

TRUST SERVICES

In-house investment capabilities with strong performance

Fee-only model (vs. commission-based brokerage) with avg. fee of 60 to 70

bps

Significant cross promotion opportunities with bank, trust, and philanthropy

services

Ability to deepen relationship with multiple generations of the family

because of trust and philanthropy business

100% of new Assets Under Management (AUM) and Assets Under

Advisement (AUA) through organic growth, more stable than M&A

Presence in affluent communities throughout CA such as Pasadena, San

Diego, West Los Angeles, Orange County, in addition to expanding into

Naples, FL in 2022

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

Combined Advisory and Trust business pre-tax profit margin of 25% in 2Q23

(17% in 1Q23)

In-House Expertise to

Serve Clients

●

ASSET ALLOCATION

Wealth Planning

●

LEGACY PLANNING

●

Lead with planning

Entry point to client's total financial picture

Asset Allocation

Manage custom investment strategies to

serve clients across the risk and return

spectrum

• Utilizes a mix of equities, fixed income, real

estate, and alternative assets

Open architecture

Portfolio Construction

Conduct due diligence

Create custom portfolios to match

clients' goals

• Monitor, report, and adjust as necessary

27View entire presentation