Eleusis SPAC

Transaction Details

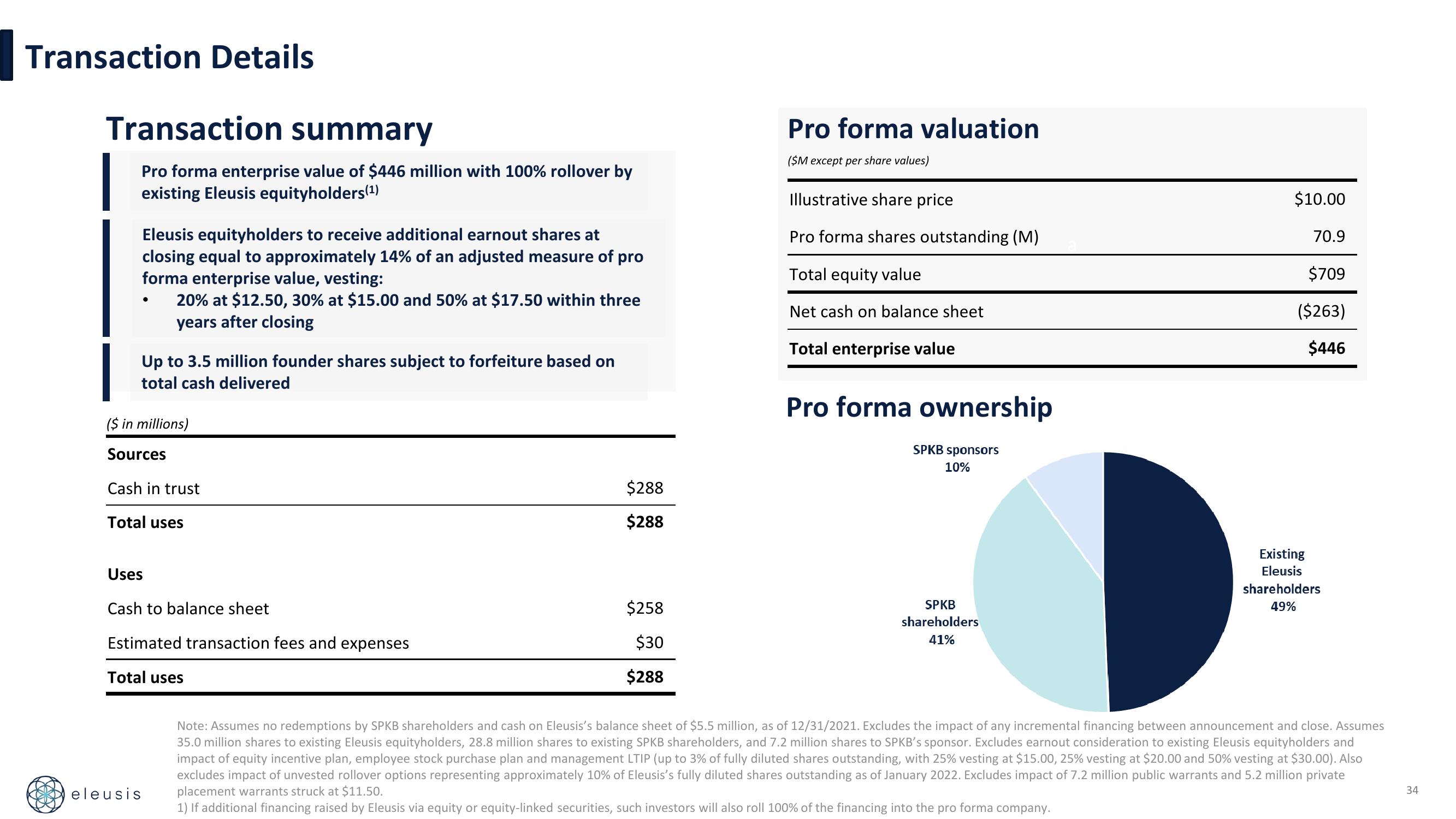

Transaction summary

Pro forma enterprise value of $446 million with 100% rollover by

existing Eleusis equityholders(¹)

Eleusis equityholders to receive additional earnout shares at

closing equal to approximately 14% of an adjusted measure of pro

forma enterprise value, vesting:

20% at $12.50, 30% at $15.00 and 50% at $17.50 within three

years after closing

Up to 3.5 million founder shares subject to forfeiture based on

total cash delivered

($ in millions)

Sources

Cash in trust

Total uses

Uses

Cash to balance sheet

Estimated transaction fees and expenses

Total uses

eleusis

$288

$288

$258

$30

$288

Pro forma valuation

($M except per share values)

Illustrative share price

Pro forma shares outstanding (M)

Total equity value

Net cash on balance sheet

Total enterprise value

Pro forma ownership

SPKB sponsors

10%

SPKB

shareholders

41%

$10.00

70.9

$709

($263)

$446

Existing

Eleusis

shareholders

49%

Note: Assumes no redemptions by SPKB shareholders and cash on Eleusis's balance sheet of $5.5 million, as of 12/31/2021. Excludes the impact of any incremental financing between announcement and close. Assumes

35.0 million shares to existing Eleusis equityholders, 28.8 million shares to existing SPKB shareholders, and 7.2 million shares to SPKB's sponsor. Excludes earnout consideration to existing Eleusis equityholders and

impact of equity incentive plan, employee stock purchase plan and management LTIP (up to 3% of fully diluted shares outstanding, with 25% vesting at $15.00, 25% vesting at $20.00 and 50% vesting at $30.00). Also

excludes impact of unvested rollover options representing approximately 10% of Eleusis's fully diluted shares outstanding as of January 2022. Excludes impact of 7.2 million public warrants and 5.2 million private

placement warrants struck at $11.50.

1) If additional financing raised by Eleusis via equity or equity-linked securities, such investors will also roll 100% of the financing into the pro forma company.

34View entire presentation