Main Street Capital Investor Day Presentation Deck

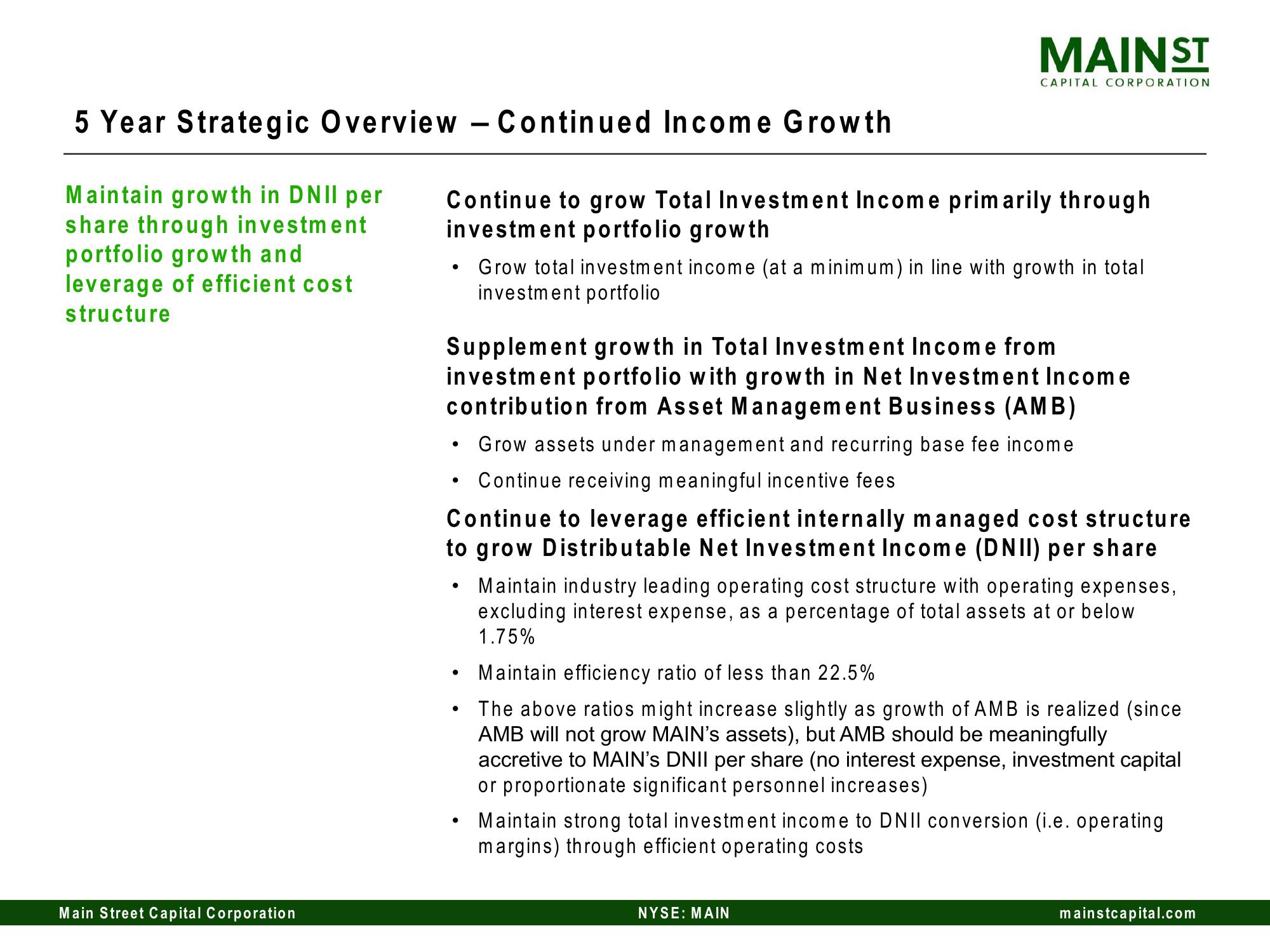

5 Year Strategic Overview - Continued Income Growth

Maintain growth in DNII per

share through investment

portfolio growth and

leverage of efficient cost

structure

Main Street Capital Corporation

MAIN ST

Continue to grow Total Investment Income primarily through

investment portfolio growth

CAPITAL CORPORATION

• Grow total investment income (at a minimum) in line with growth in total

investment portfolio

Supplement growth in Total Investment Income from

investment portfolio with growth in Net Investment Income

contribution from Asset Management Business (AMB)

• Grow assets under management and recurring base fee income

Continue receiving meaningful incentive fees

●

Continue to leverage efficient internally managed cost structure

to grow Distributable Net Investment Income (DNII) per share

Maintain industry leading operating cost structure with operating expenses,

excluding interest expense, as a percentage of total assets at or below

1.75%

Maintain efficiency ratio of less than 22.5%

The above ratios might increase slightly as growth of AMB is realized (since

AMB will not grow MAIN's assets), but AMB should be meaningfully

accretive to MAIN's DNII per share (no interest expense, investment capital

or proportionate significant personnel increases)

NYSE: MAIN

Maintain strong total investment income to DNII conversion (i.e. operating

margins) through efficient operating costs

mainstcapital.comView entire presentation