Truist Financial Corp Results Presentation Deck

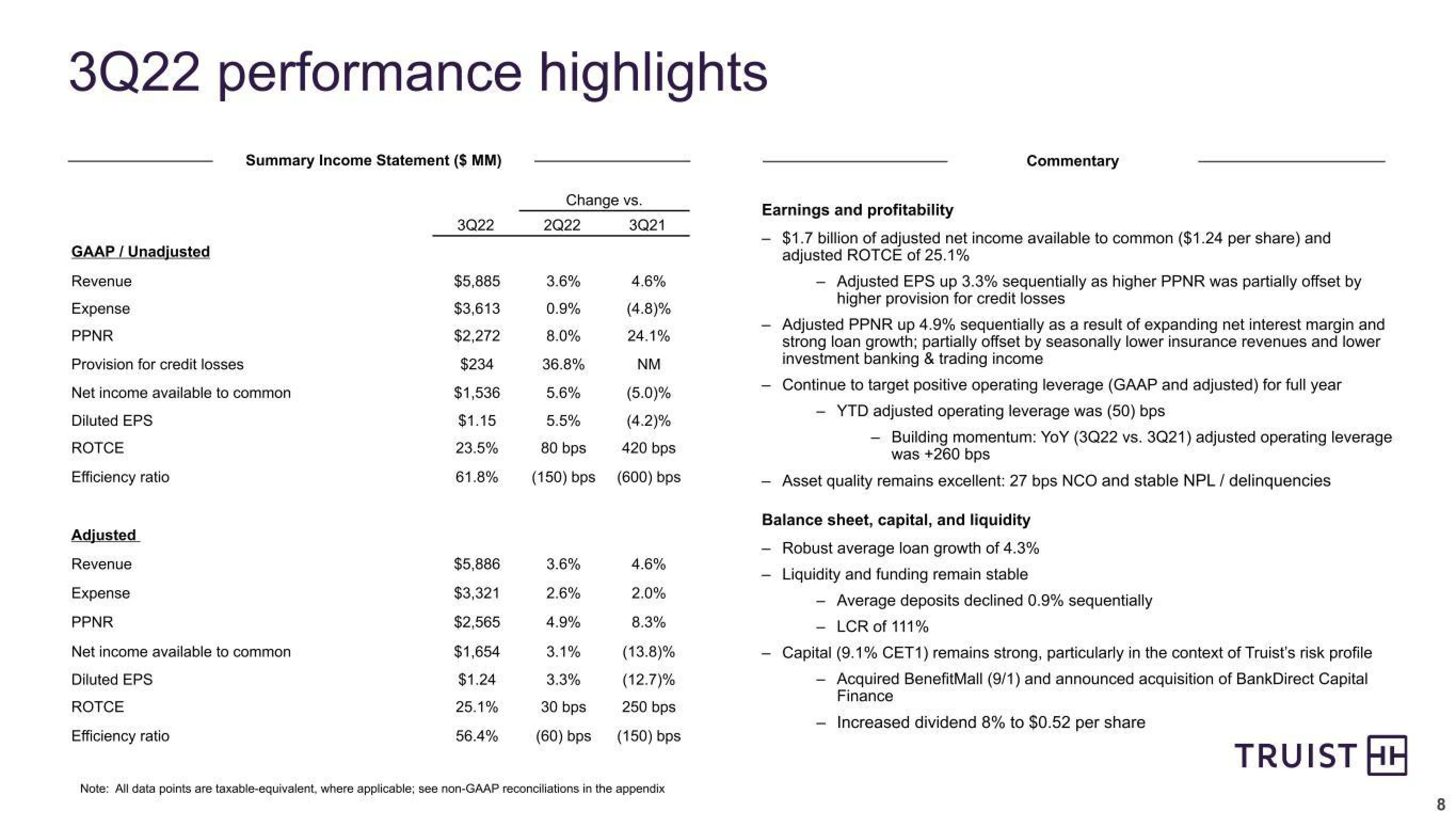

3Q22 performance highlights

GAAP/Unadjusted

Summary Income Statement ($ MM)

Revenue

Expense

PPNR

Provision for credit losses

Net income available to common

Diluted EPS

ROTCE

Efficiency ratio

Adjusted

Revenue

Expense

PPNR

Net income available to common

Diluted EPS

ROTCE

Efficiency ratio

3Q22

$5,885

$3,613

$2,272

$234

$1,536

$1.15

23.5%

61.8%

$5,886

$3,321

$2,565

$1,654

$1.24

25.1%

56.4%

Change vs.

2Q22

3.6%

0.9%

8.0%

36.8%

5.6%

5.5%

80 bps

(150) bps

3.6%

2.6%

4.9%

3.1%

3.3%

30 bps

(60) bps

3Q21

4.6%

(4.8)%

24.1%

NM

(5.0)%

(4.2)%

420 bps

(600) bps

4.6%

2.0%

8.3%

(13.8)%

(12.7)%

250 bps

(150) bps

Note: All data points are taxable-equivalent, where applicable; see non-GAAP reconciliations in the appendix

Commentary

Earnings and profitability

$1.7 billion of adjusted net income available to common ($1.24 per share) and

adjusted ROTCE of 25.1%

-

Adjusted EPS up 3.3% sequentially as higher PPNR was partially offset by

higher provision for credit losses

Adjusted PPNR up 4.9% sequentially as a result of expanding net interest margin and

strong loan growth; partially offset by seasonally lower insurance revenues and lower

investment banking & trading income

Continue to target positive operating leverage (GAAP and adjusted) for full year

YTD adjusted operating leverage was (50) bps

Building momentum: YoY (3Q22 vs. 3Q21) adjusted operating leverage

was +260 bps

Asset quality remains excellent: 27 bps NCO and stable NPL / delinquencies

Balance sheet, capital, and liquidity

Robust average loan growth of 4.3%

Liquidity and funding remain stable

Average deposits declined 0.9% sequentially

LCR of 111%

Capital (9.1% CET1) remains strong, particularly in the context of Truist's risk profile

Acquired BenefitMall (9/1) and announced acquisition of BankDirect Capital

Finance

Increased dividend 8% to $0.52 per share

TRUIST HH

8View entire presentation