Cameco IPO Presentation Deck

■

-

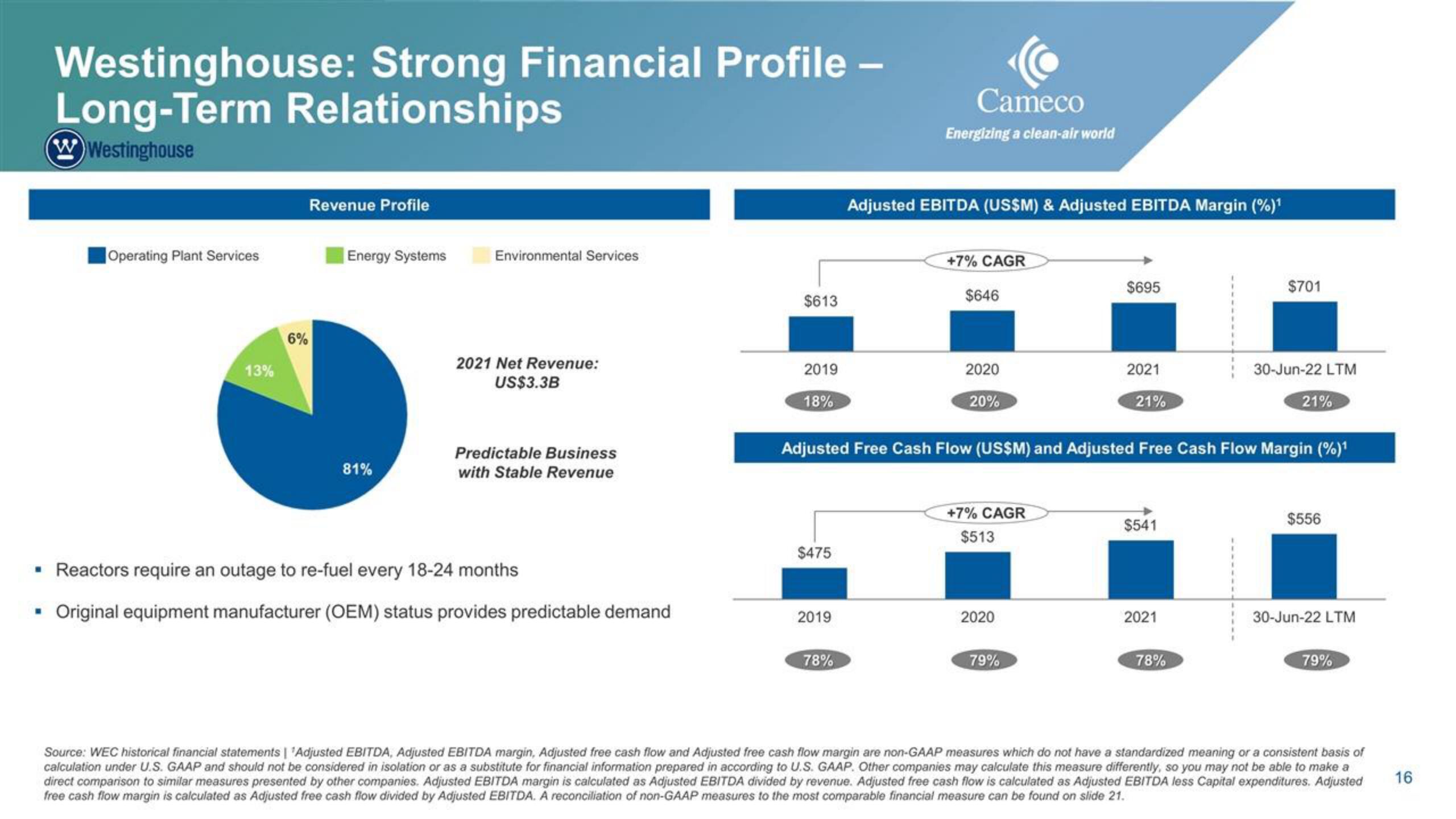

Westinghouse: Strong Financial Profile -

Long-Term Relationships

W Westinghouse

Operating Plant Services

13%

6%

Revenue Profile

Energy Systems

81%

Environmental Services

2021 Net Revenue:

US$3.3B

Predictable Business

with Stable Revenue

Reactors require an outage to re-fuel every 18-24 months

Original equipment manufacturer (OEM) status provides predictable demand

$613

2019

18%

$475

2019

Cameco

Energizing a clean-air world

78%

Adjusted EBITDA (US$M) & Adjusted EBITDA Margin (%)¹

+7% CAGR

$646

2020

20%

2021

21%

Adjusted Free Cash Flow (US$M) and Adjusted Free Cash Flow Margin (%)¹

+7% CAGR

$513

2020

$695

79%

$541

2021

$701

78%

30-Jun-22 LTM

21%

$556

30-Jun-22 LTM

79%

Source: WEC historical financial statements | Adjusted EBITDA, Adjusted EBITDA margin, Adjusted free cash flow and Adjusted free cash flow margin are non-GAAP measures which do not have a standardized meaning or a consistent basis of

calculation under U.S. GAAP and should not be considered in isolation or as a substitute for financial information prepared in according to U.S. GAAP. Other companies may calculate this measure differently, so you may not be able to make a

direct comparison to similar measures presented by other companies. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by revenue. Adjusted free cash flow is calculated as Adjusted EBITDA less Capital expenditures. Adjusted

free cash flow margin is calculated as Adjusted free cash flow divided by Adjusted EBITDA. A reconciliation of non-GAAP measures to the most comparable financial measure can be found on slide 21.

16View entire presentation