Pathward Financial Results Presentation Deck

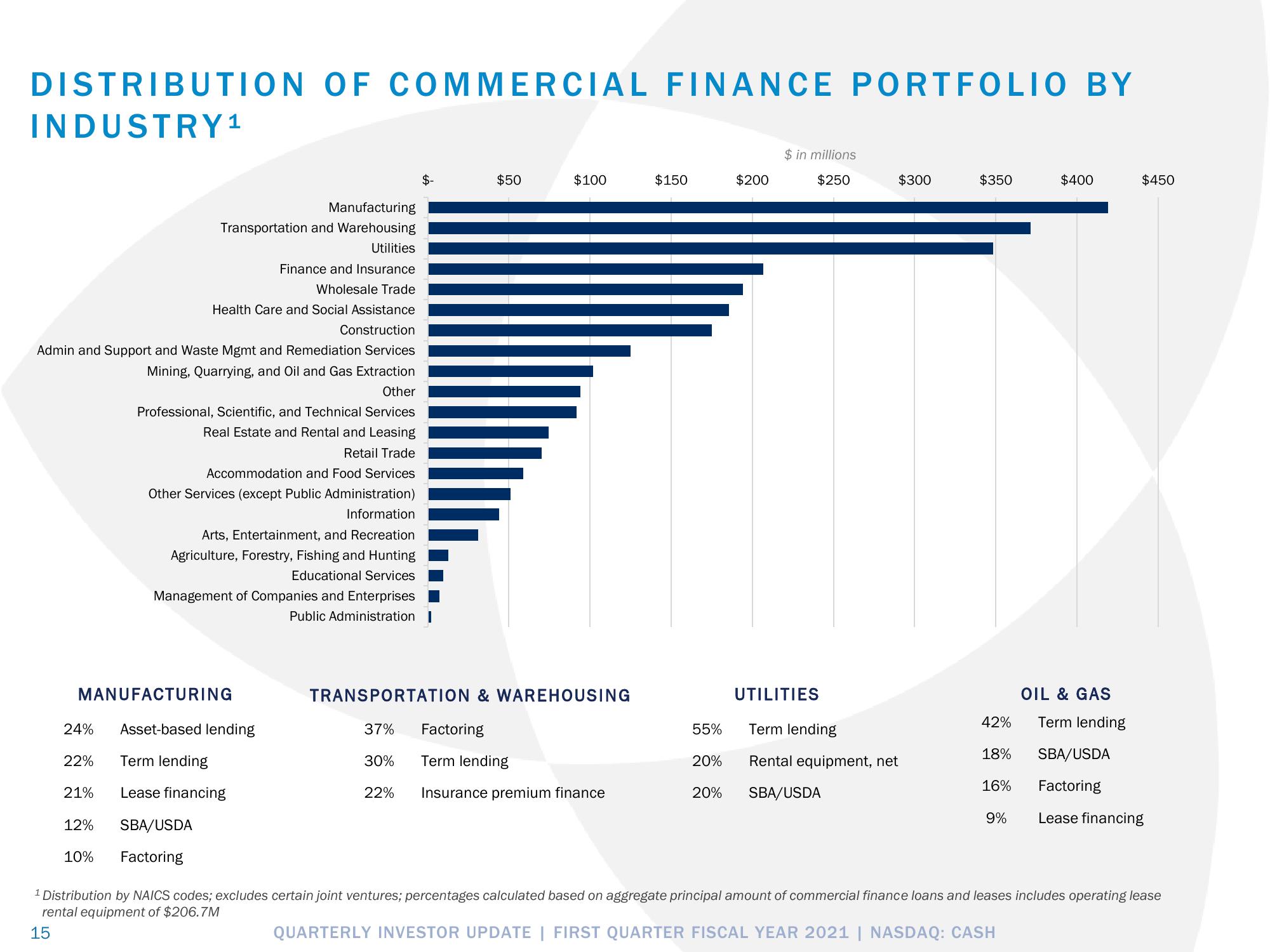

DISTRIBUTION OF COMMERCIAL FINANCE PORTFOLIO BY

INDUSTRY ¹

Manufacturing

Transportation and Warehousing

24%

MANUFACTURING

Health Care and Social Assistance

Construction

Admin and Support and Waste Mgmt and Remediation Services

Mining, Quarrying, and Oil and Gas Extraction

Other

Professional, Scientific, and Technical Services

Real Estate and Rental and Leasing

Retail Trade

Accommodation and Food Services

Other Services (except Public Administration)

Information

Arts, Entertainment, and Recreation

Agriculture, Forestry, Fishing and Hunting

Educational Services

Management of Companies and Enterprises

Public Administration I

22%

Utilities

Finance and Insurance

Wholesale Trade

Asset-based lending

Term lending

21% Lease financing

12% SBA/USDA

10%

Factoring

$-

37%

30%

22%

...

$50

TRANSPORTATION & WAREHOUSING

$100

Factoring

Term lending

Insurance premium finance

$150

55%

20%

20%

$200

$ in millions

$250

$300

UTILITIES

Term lending

Rental equipment, net

SBA/USDA

$350

42%

18%

16%

9%

$400

OIL & GAS

Term lending

$450

SBA/USDA

Factoring

Lease financing

¹ Distribution by NAICS codes; excludes certain joint ventures; percentages calculated based on aggregate principal amount of commercial finance loans and leases includes operating lease

rental equipment of $206.7M

15

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASHView entire presentation