Greenlight Company Presentation

Compare this to Raising the Dividend

5 iPrefs per common share

o $236 billion iPrefs issued

o 4% dividend: $9.5 billion

o Total value: $600/share

$150 / Share Unlocked

Raising Common Dividend by $9.5 billion

o Current $10 billion in dividends:

$10.60 per share dividend

Greenlight Capital, Inc.

o $19.5 billion in dividends:

$20.60 per share dividend

o $20.60 at 4% yield: $515 stock price

$65 / Share Unlocked

Dollar for Dollar, iPrefs Unlock Much More Value than Common Dividends

42

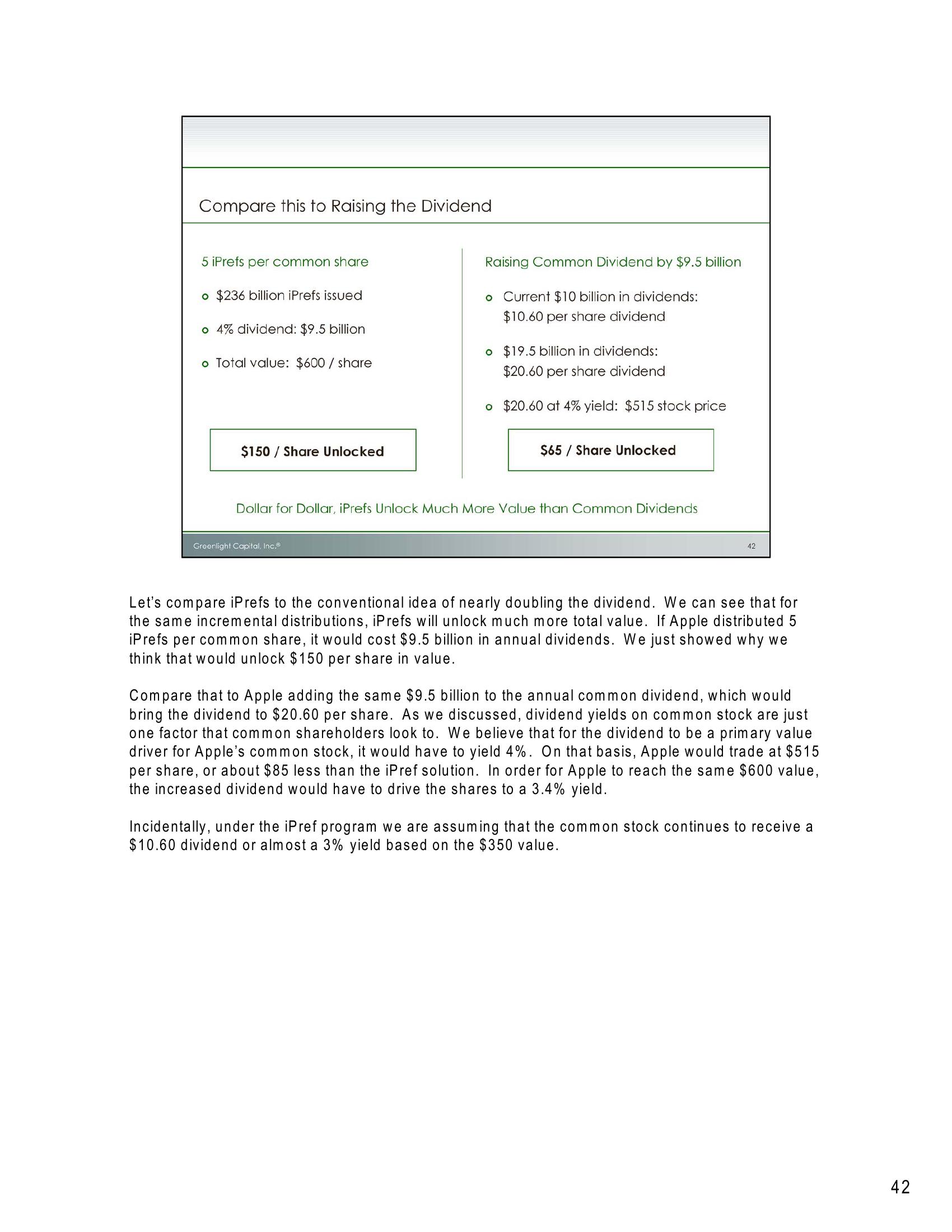

Let's compare iPrefs to the conventional idea of nearly doubling the dividend. We can see that for

the same incremental distributions, iPrefs will unlock much more total value. If Apple distributed 5

iPrefs per common share, it would cost $9.5 billion in annual dividends. We just showed why we

think that would unlock $150 per share in value.

Compare that to Apple adding the same $9.5 billion to the annual common dividend, which would

bring the dividend to $20.60 per share. As we discussed, dividend yields on common stock are just

one factor that common shareholders look to. We believe that for the dividend to be a primary value

driver for Apple's common stock, it would have to yield 4%. On that basis, Apple would trade at $515

per share, or about $85 less than the iPref solution. In order for Apple to reach the same $600 value,

the increased dividend would have to drive the shares to a 3.4% yield.

Incidentally, under the iPref program we are assuming that the common stock continues to receive a

$10.60 dividend or almost a 3% yield based on the $350 value.

42View entire presentation