Synchrony Financial Results Presentation Deck

Platform Results

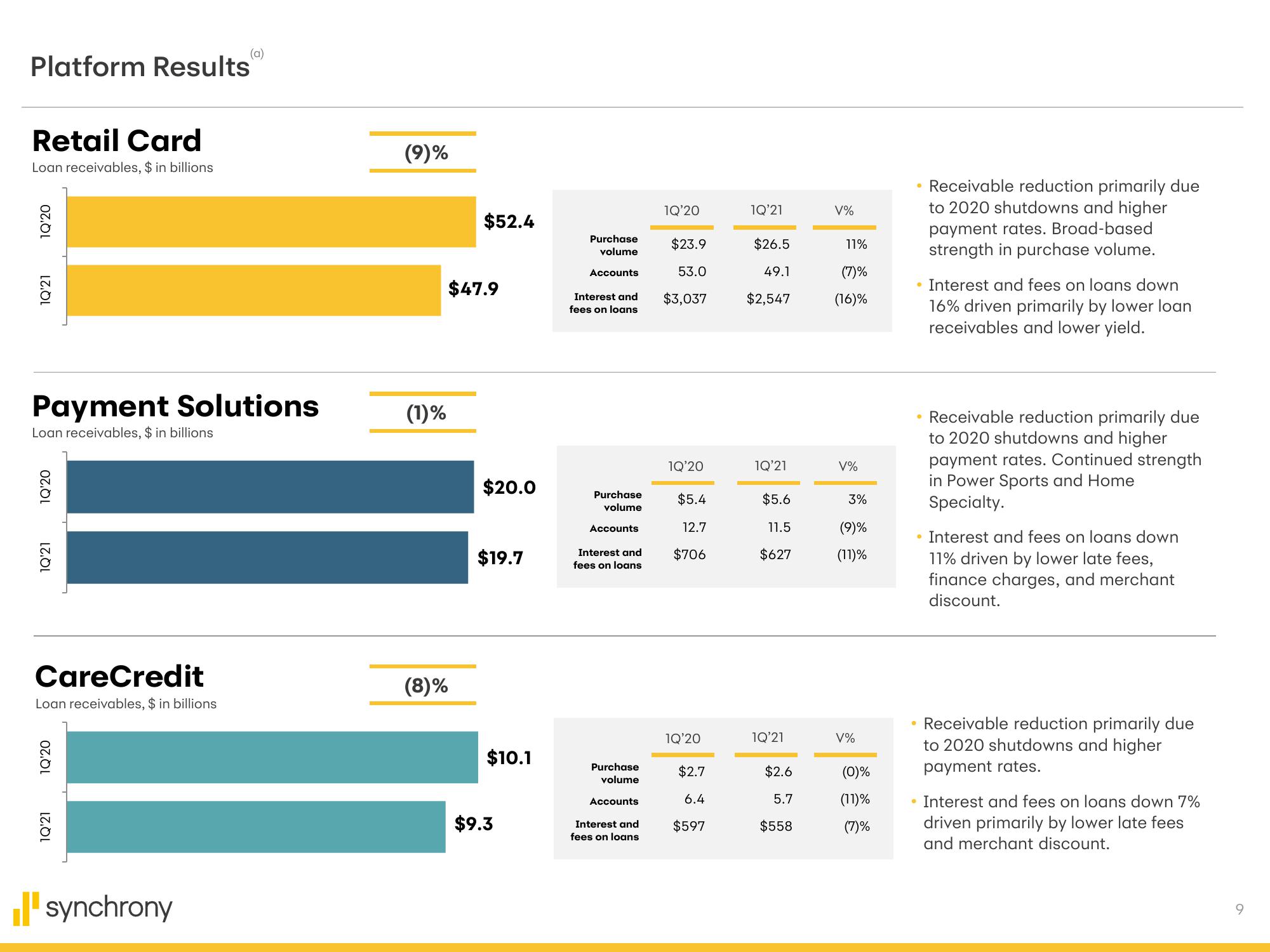

Retail Card

Loan receivables, $ in billions

1Q'20

1Q'21

Payment Solutions

Loan receivables, $ in billions

1Q'20

1Q'21

CareCredit

Loan receivables, $ in billions

1Q'20

(a)

1Q'21

synchrony

(9)%

(1)%

$52.4

$47.9

(8)%

$20.0

$19.7

$10.1

$9.3

Purchase

volume

Accounts

Interest and

fees on loans

Purchase

volume

Accounts

Interest and

fees on loans

Purchase

volume

Accounts

Interest and

fees on loans

1Q'20

$23.9

53.0

$3,037

1Q'20

$5.4

12.7

$706

1Q'20

$2.7

6.4

$597

1Q'21

$26.5

49.1

$2,547

1Q'21

$5.6

11.5

$627

1Q'21

$2.6

5.7

$558

V%

11%

(7)%

(16)%

V%

3%

(9)%

(11)%

V%

(0)%

(11)%

(7)%

• Receivable reduction primarily due

to 2020 shutdowns and higher

payment rates. Broad-based

strength in purchase volume.

• Receivable reduction primarily due

to 2020 shutdowns and higher

payment rates. Continued strength

in Power Sports and Home

Specialty.

Interest and fees on loans down

16% driven primarily by lower loan

receivables and lower yield.

• Interest and fees on loans down

11% driven by lower late fees,

finance charges, and merchant

discount.

●

@

Receivable reduction primarily due

to 2020 shutdowns and higher

payment rates.

Interest and fees on loans down 7%

driven primarily by lower late fees

and merchant discount.

9View entire presentation