Silicon Valley Bank Results Presentation Deck

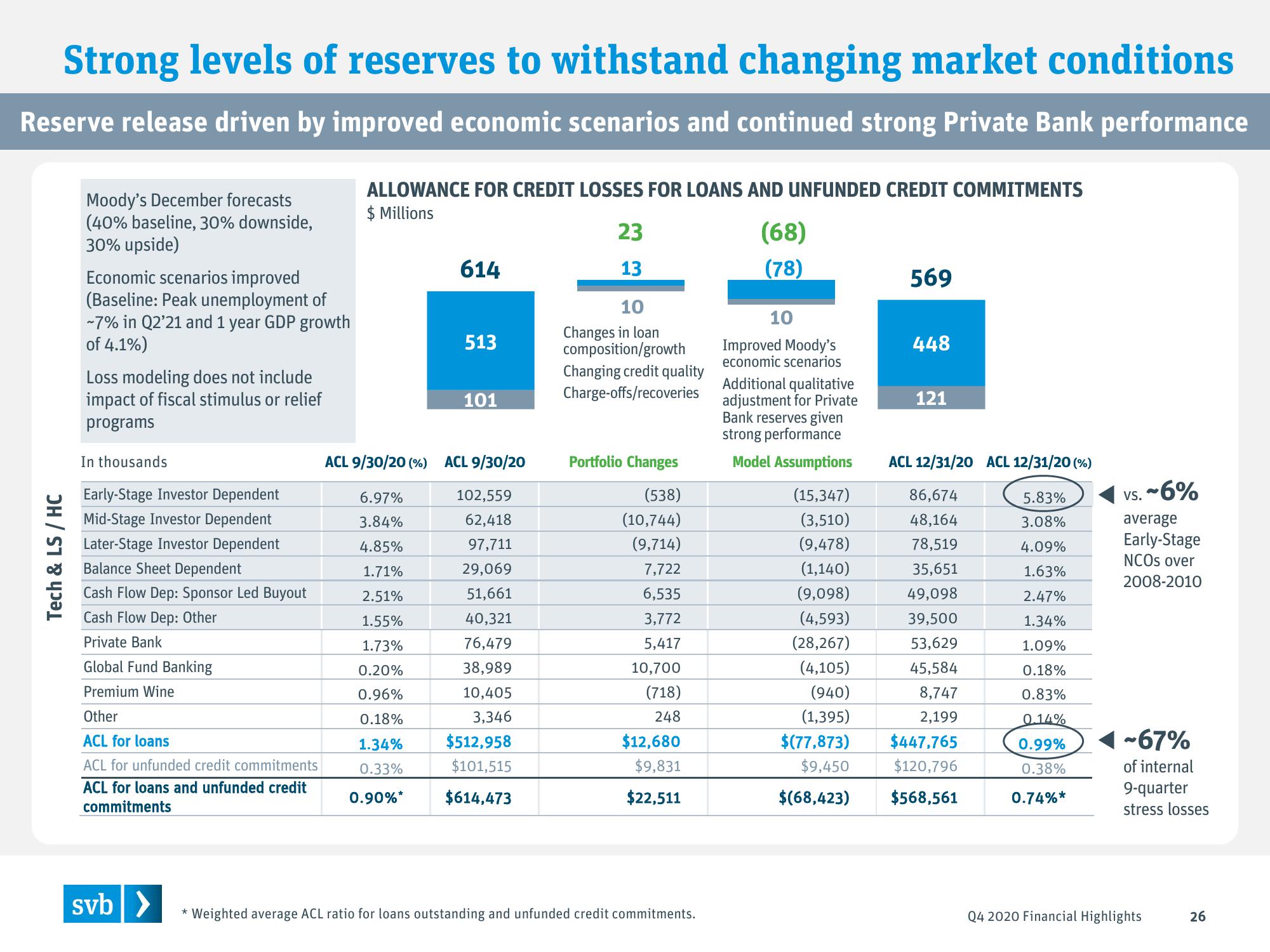

Strong levels of reserves to withstand changing market conditions

Reserve release driven by improved economic scenarios and continued strong Private Bank performance

Tech & LS / HC

Moody's December forecasts

(40% baseline, 30% downside,

30% upside)

Economic scenarios improved

(Baseline: Peak unemployment of

~7% in Q2'21 and 1 year GDP growth

of 4.1%)

Loss modeling does not include

impact of fiscal stimulus or relief

programs

In thousands

Early-Stage Investor Dependent

Mid-Stage Investor Dependent

Later-Stage Investor Dependent

Balance Sheet Dependent

Cash Flow Dep: Sponsor Led Buyout

Cash Flow Dep: Other

Private Bank

Global Fund Banking

Premium Wine

Other

ACL for loans

ACL for unfunded credit commitments

ACL for loans and unfunded credit

commitments

svb >

ALLOWANCE FOR CREDIT LOSSES FOR LOANS AND UNFUNDED CREDIT COMMITMENTS

$ Millions

614

6.97%

3.84%

4.85%

1.71%

2.51%

1.55%

1.73%

0.20%

0.96%

0.18%

1.34%

0.33%

0.90%*

513

101

ACL 9/30/20 (%) ACL 9/30/20

102,559

62,418

97,711

29,069

51,661

40,321

76,479

38,989

10,405

3,346

$512,958

$101,515

$614,473

23

13

10

Changes in loan

composition/growth

Changing credit quality

Charge-offs/recoveries

Portfolio Changes

(538)

(10,744)

(9,714)

7,722

6,535

3,772

5,417

10,700

(718)

248

$12,680

$9,831

$22,511

* Weighted average ACL ratio for loans outstanding and unfunded credit commitments.

(68)

(78)

10

Improved Moody's

economic scenarios

Additional qualitative

adjustment for Private

Bank reserves given

strong performance

Model Assumptions

(15,347)

(3,510)

(9,478)

(1,140)

(9,098)

(4,593)

(28,267)

(4,105)

(940)

(1,395)

569

448

121

ACL 12/31/20 ACL 12/31/20 (%)

86,674

48,164

78,519

35,651

49,098

39,500

53,629

45,584

8,747

2,199

$(77,873) $447,765

$9,450 $120,796

$(68,423) $568,561

5.83%

3.08%

4.09%

1.63%

2.47%

1.34%

1.09%

0.18%

0.83%

0.14%

0.99%

0.38%

0.74%*

~6%

average

Early-Stage

NCOS over

2008-2010

VS.

◄ -67%

of internal

9-quarter

stress losses

Q4 2020 Financial Highlights

26View entire presentation