Hertz Investor Presentation Deck

CURRENT SITUATION SUMMARY

Commentary

▪ The Company entered 2020 riding tailwinds from a strong FY2019 performance

FY2019 revenue and EBITDA grew at 3% and 50% respectively year-over-year, and were projected to continue this positive momentum into

2020 with initial full year 2020 of revenue and EBITDA projected growth of 5% and 16%, respectively

In July 2019, the Company closed an over-subscribed $750mm rights offering

Prior to the COVID-19 crisis in the U.S., U.S. RAC revenue was up by -7% and -9% YoY in January and February, respectively

In March 2020, the Company experienced a sudden and dramatic drop in revenue due to the restriction in movement that resulted from the

COVID-19 crisis, resulting in a decline in March U.S. RAC revenue of -37% YoY

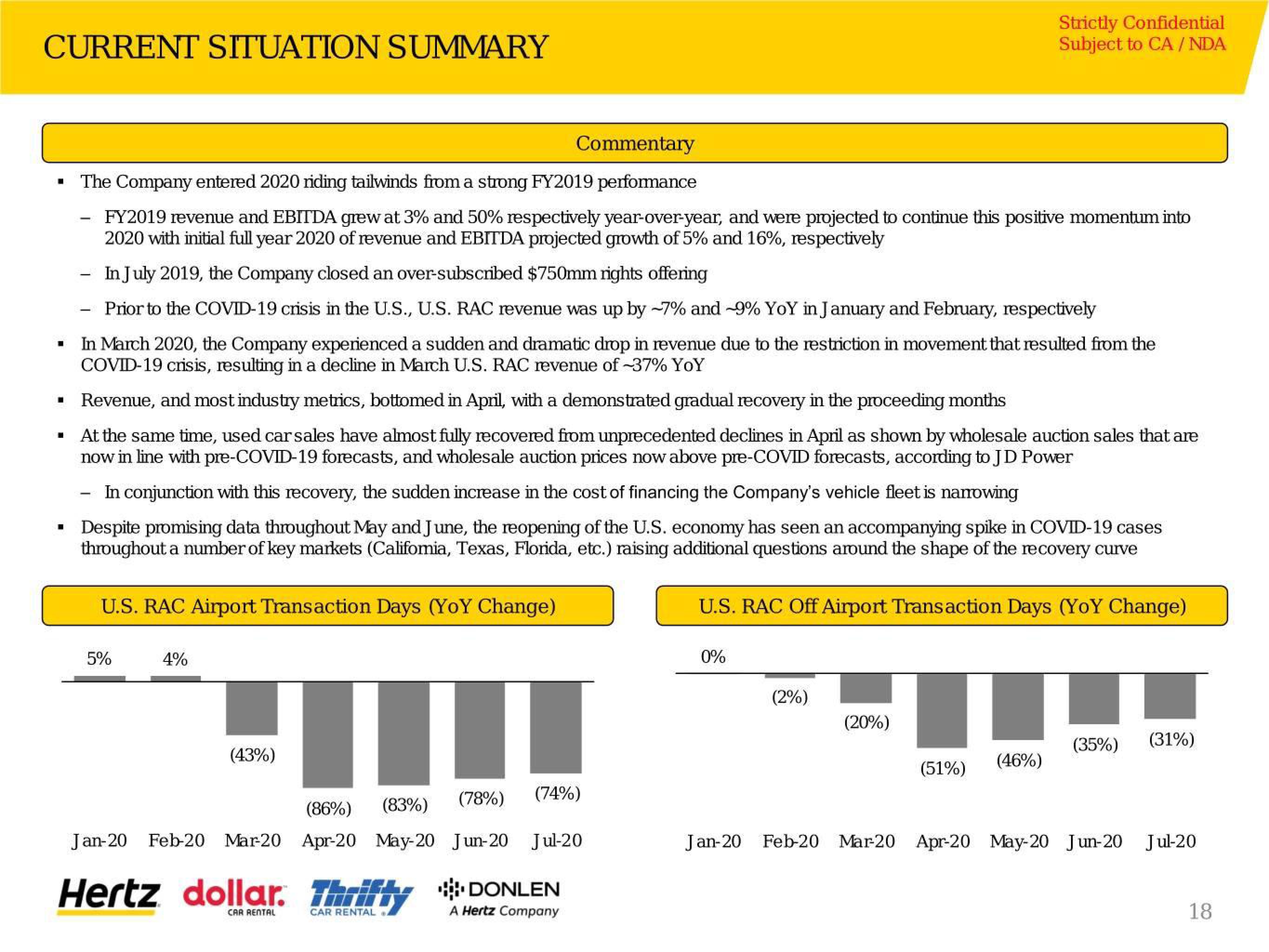

▪ Revenue, and most industry metrics, bottomed in April, with a demonstrated gradual recovery the proceeding months

At the same time, used car sales have almost fully recovered from unprecedented declines in April as shown by wholesale auction sales that are

now in line with pre-COVID-19 forecasts, and wholesale auction prices now above pre-COVID forecasts, according to JD Power

- In conjunction with this recovery, the sudden increase in the cost of financing the Company's vehicle fleet is narrowing

Despite promising data throughout May and June, the reopening of the U.S. economy has seen an accompanying spike in COVID-19 cases

throughout a number of key markets (Califomia, Texas, Florida, etc.) raising additional questions around the shape of the recovery curve

■

■

■

U.S. RAC Airport Transaction Days (YoY Change)

5%

4%

(43%)

(78%) (74%)

(86%) (83%)

Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20

Hertz dollar. Thrifty DONLEN

CAR RENTAL

CAR RENTAL

A Hertz Company

U.S. RAC Off Airport Transaction Days (YoY Change)

0%

(2%)

(20%)

Strictly Confidential

Subject to CA/ NDA

(51%)

(46%)

(35%) (31%)

Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20

18View entire presentation