Kore Results Presentation Deck

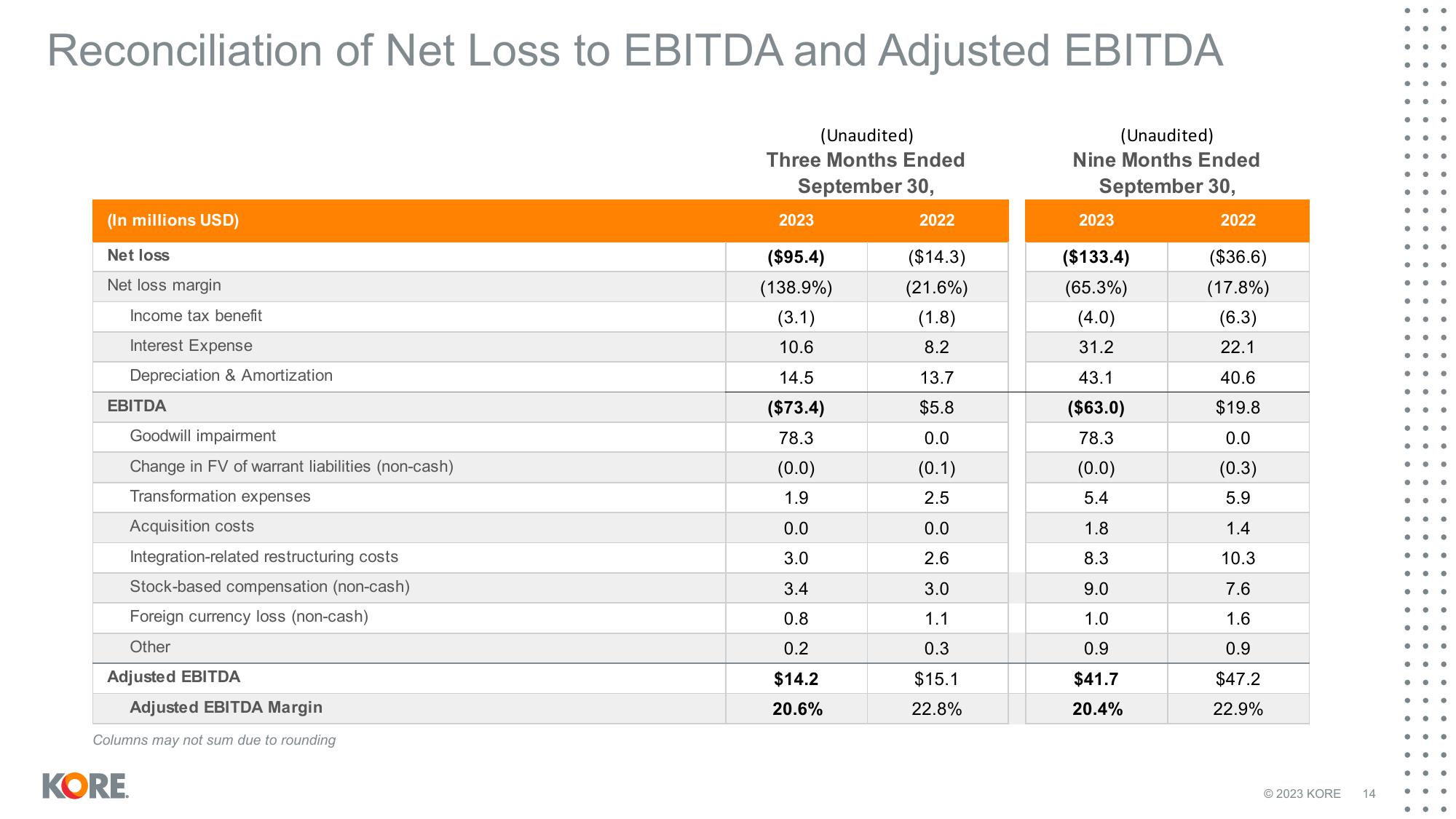

Reconciliation of Net Loss to EBITDA and Adjusted EBITDA

(In millions USD)

Net loss

Net loss margin

Income tax benefit

Interest Expense

Depreciation & Amortization

EBITDA

Goodwill impairment

Change in FV of warrant liabilities (non-cash)

Transformation expenses

Acquisition costs

Integration-related restructuring costs

Stock-based compensation (non-cash)

Foreign currency loss (non-cash)

Other

Adjusted EBITDA

KORE

Adjusted EBITDA Margin

Columns may not sum due to rounding

(Unaudited)

Three Months Ended

September 30,

2023

($95.4)

(138.9%)

(3.1)

10.6

14.5

($73.4)

78.3

(0.0)

1.9

0.0

3.0

3.4

0.8

0.2

$14.2

20.6%

2022

($14.3)

(21.6%)

(1.8)

8.2

13.7

$5.8

0.0

(0.1)

2.5

0.0

2.6

3.0

1.1

0.3

$15.1

22.8%

(Unaudited)

Nine Months Ended

September 30,

2023

($133.4)

(65.3%)

(4.0)

31.2

43.1

($63.0)

78.3

(0.0)

5.4

1.8

8.3

9.0

1.0

0.9

$41.7

20.4%

2022

($36.6)

(17.8%)

(6.3)

22.1

40.6

$19.8

0.0

(0.3)

5.9

1.4

10.3

7.6

1.6

0.9

$47.2

22.9%

© 2023 KORE 14

●

●

●

●

● ..

•

●

●

●

●

● ● ●

●

●

•

●

●

●

●

●

●

●

●

● 0

●View entire presentation