Spirit Mergers and Acquisitions Presentation Deck

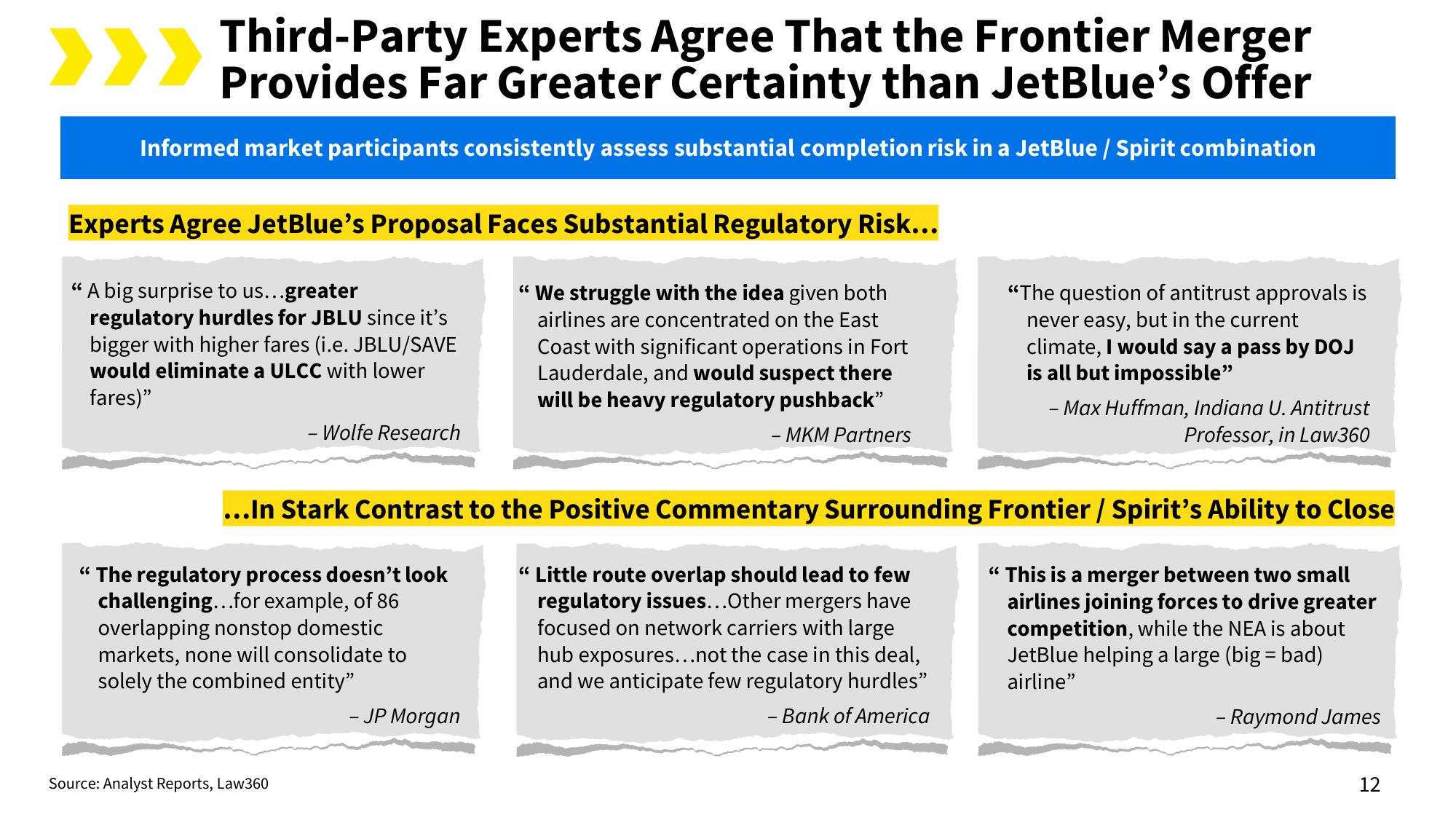

》》》 Third-Party Experts Agree That the Frontier Merger

Provides Far Greater Certainty than JetBlue's Offer

Informed market participants consistently assess substantial completion risk in a JetBlue / Spirit combination

Experts Agree JetBlue's Proposal Faces Substantial Regulatory Risk...

"A big surprise to us...greater

regulatory hurdles for JBLU since it's

bigger with higher fares (i.e. JBLU/SAVE

would eliminate a ULCC with lower

fares)"

"We struggle with the idea given both

airlines are concentrated on the East

Coast with significant operations in Fort

Lauderdale, and would suspect there

will be heavy regulatory pushback"

MKM Partners

- Wolfe Research

"The regulatory process doesn't look

challenging...for example, of 86

overlapping nonstop domestic

markets, none will consolidate to

solely the combined entity"

- JP Morgan

Source: Analyst Reports, Law360

"The question of antitrust approvals is

never easy, but in the current

climate, I would say a pass by DOJ

is all but impossible"

...In Stark Contrast to the Positive Commentary Surrounding Frontier / Spirit's Ability to Close

"Little route overlap should lead to few

regulatory issues...Other mergers have

focused on network carriers with large

hub exposures...not the case in this deal,

and we anticipate few regulatory hurdles"

- Bank of America

"This is a merger between two small

airlines joining forces to drive greater

competition, while the NEA is about

JetBlue helping a large (big = bad)

airline"

- Max Huffman, Indiana U. Antitrust

Professor, in Law360

- Raymond James

12View entire presentation