Cytek IPO Presentation Deck

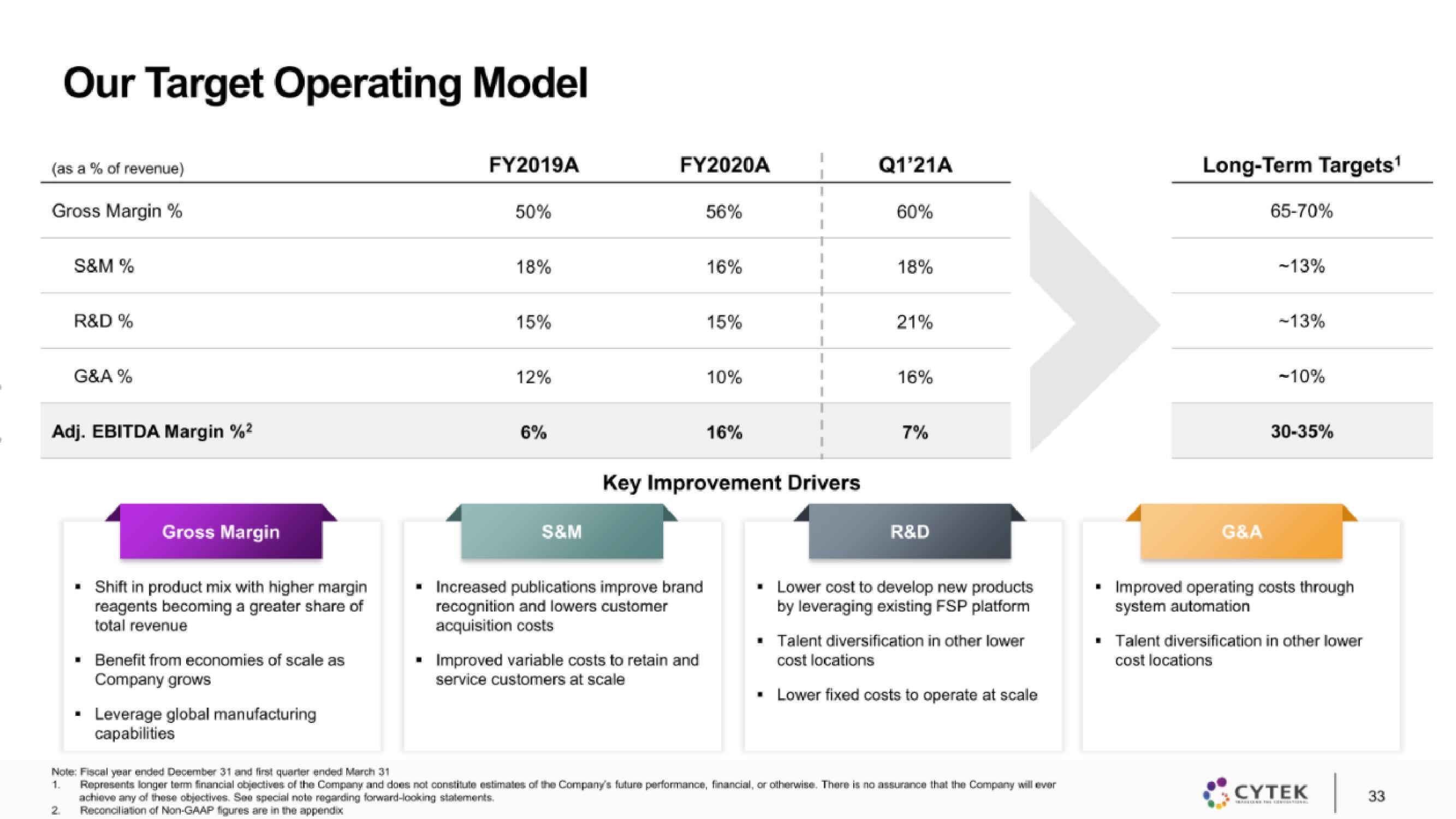

Our Target Operating Model

(as a % of revenue)

Gross Margin %

S&M %

2

R&D %

G&A %

Adj. EBITDA Margin %²

Gross Margin

■ Shift in product mix with higher margin

reagents becoming a greater share of

total revenue

▪ Benefit from economies of scale as

Company grows

Leverage global manufacturing

capabilities

■

FY2019A

50%

18%

15%

12%

6%

S&M

FY2020A

Increased publications improve brand

recognition and lowers customer

acquisition costs

56%

Improved variable costs to retain and

service customers at scale

16%

15%

10%

Key Improvement Drivers

16%

Q1'21A

60%

18%

21%

16%

7%

R&D

■ Lower cost to develop new products

by leveraging existing FSP platform

■ Talent diversification in other lower

cost locations

▪ Lower fixed costs to operate at scale

Note: Fiscal year ended December 31 and first quarter ended March 31

1.

Represents longer term financial objectives of the Company and does not constitute estimates of the Company's future performance, financial, or otherwise. There is no assurance that the Company will ever

achieve any of these objectives. See special note regarding forward-looking statements.

Reconciliation of Non-GAAP figures are in the appendix

Long-Term Targets¹

G&A

65-70%

-13%

-13%

-10%

30-35%

• Improved operating costs through

system automation

■ Talent diversification in other lower

cost locations

CYTEK

|

33View entire presentation