Truist Financial Corp Results Presentation Deck

Average loans & leases HFI

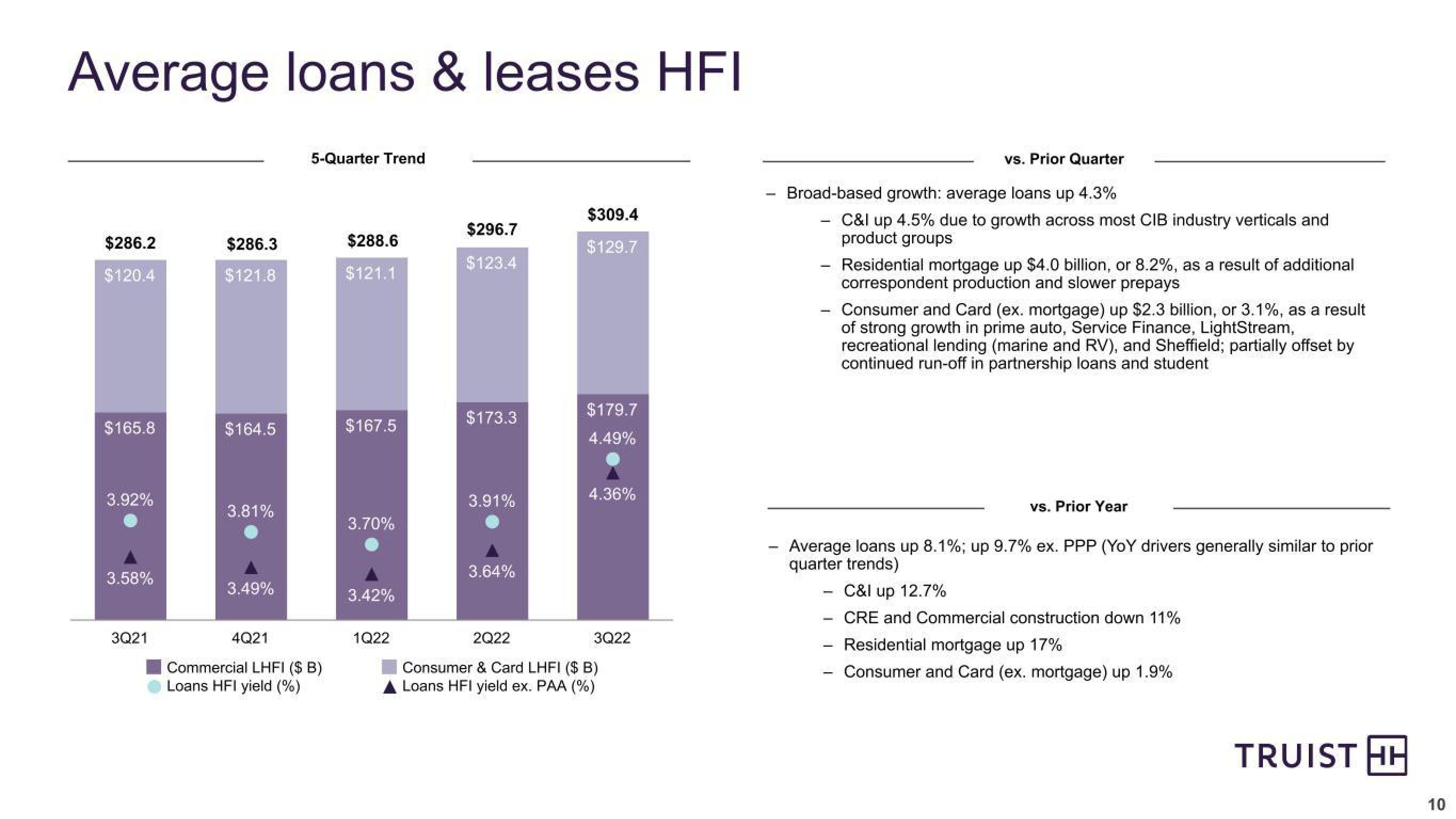

$286.2

$120.4

$165.8

3.92%

3.58%

3Q21

$286.3

$121.8

$164.5

3.81%

3.49%

4Q21

5-Quarter Trend

Commercial LHFI ($ B)

Loans HFI yield (%)

$288.6

$121.1

$167.5

3.70%

3.42%

1Q22

$296.7

$123.4

$173.3

3.91%

3.64%

$309.4

$129.7

$179.7

4.49%

4.36%

2Q22

Consumer & Card LHFI ($ B)

Loans HFI yield ex. PAA (%)

3Q22

F

vs. Prior Quarter

Broad-based growth: average loans up 4.3%

-

-

-

-

C&I up 4.5% due to growth across most CIB industry verticals and

product groups

Average loans up 8.1%; up 9.7% ex. PPP (YOY drivers generally similar to prior

quarter trends)

-

Residential mortgage up $4.0 billion, or 8.2%, as a result of additional

correspondent production and slower prepays

Consumer and Card (ex. mortgage) up $2.3 billion, or 3.1%, as a result

of strong growth in prime auto, Service Finance, LightStream,

recreational lending (marine and RV), and Sheffield; partially offset by

continued run-off in partnership loans and student

vs. Prior Year

C&I up 12.7%

CRE and Commercial construction down 11%

Residential mortgage up 17%

Consumer and Card (ex. mortgage) up 1.9%

TRUIST HH

10View entire presentation