Ares U.S. Real Estate Opportunity Fund IV, L.P. (“AREOF IV”)

AREOF IV Portfolio Construction

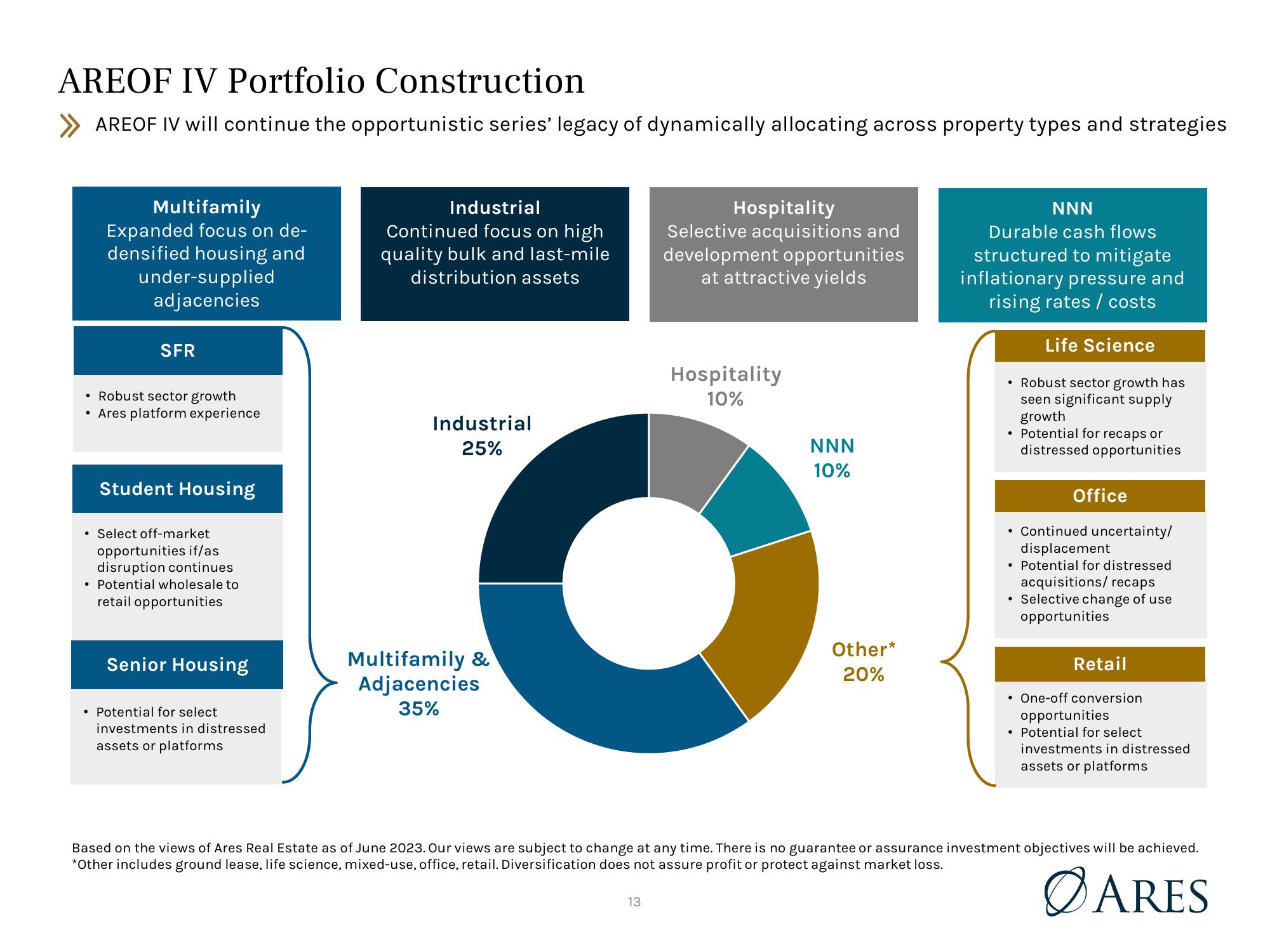

AREOF IV will continue the opportunistic series' legacy of dynamically allocating across property types and strategies

Multifamily

Expanded focus on de-

densified housing and

under-supplied

adjacencies

●

SFR

• Robust sector growth

Ares platform experience

Student Housing

Select off-market

opportunities if/as

disruption continues

• Potential wholesale to

retail opportunities

Senior Housing

• Potential for select

investments in distressed

assets or platforms

Industrial

Continued focus on high

quality bulk and last-mile

distribution assets

Industrial

25%

Multifamily &

Adjacencies

35%

Hospitality

Selective acquisitions and

development opportunities

at attractive yields

13

Hospitality

10%

NNN

10%

Other*

20%

NNN

Durable cash flows

structured to mitigate

inflationary pressure and

rising rates / costs

Life Science

Robust sector growth has

seen significant supply

growth

• Potential for recaps or

distressed opportunities

Office

• Continued uncertainty/

displacement

• Potential for distressed

acquisitions/ recaps

• Selective change of use

opportunities

Retail

• One-off conversion

opportunities

• Potential for select

investments in distressed

assets or platforms

Based on the views of Ares Real Estate as of June 2023. Our views are subject to change at any time. There is no guarantee or assurance investment objectives will be achieved.

*Other includes ground lease, life science, mixed-use, office, retail. Diversification does not assure profit or protect against market loss.

ØARESView entire presentation