Ares US Real Estate Opportunity Fund III

Additional Investments In-Closing

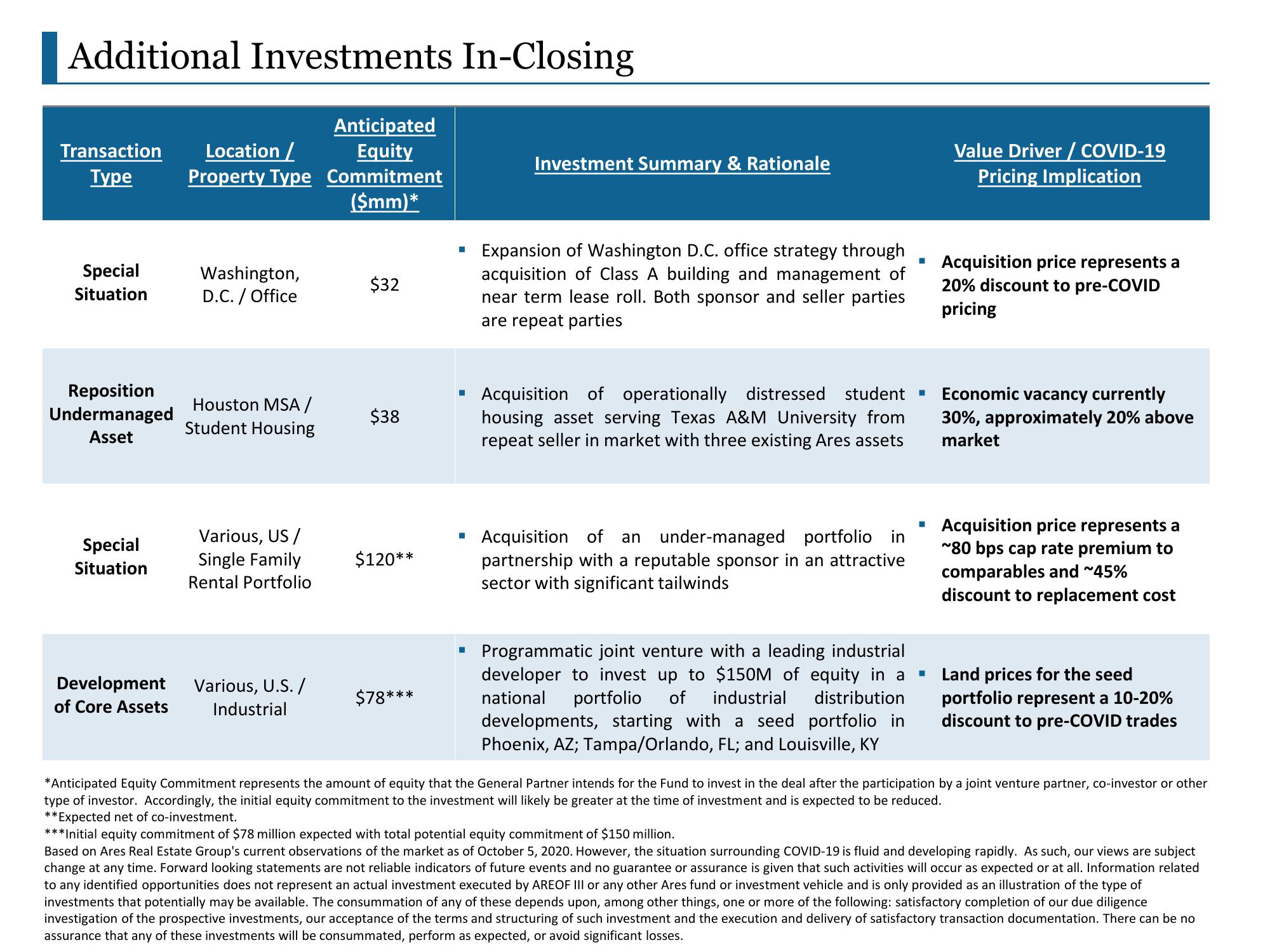

Transaction Location /

Type

Property Type

Special

Situation

Reposition

Undermanaged

Asset

Special

Situation

Development

of Core Assets

Washington,

D.C. / Office

Houston MSA /

Student Housing

Various, US /

Single Family

Rental Portfolio

Various, U.S. /

Industrial

Anticipated

Equity

Commitment

($mm)*

$32

$38

$120**

$78***

■

Investment Summary & Rationale

Expansion of Washington D.C. office strategy through

acquisition of Class A building and management of

near term lease roll. Both sponsor and seller parties

are repeat parties

Acquisition of operationally distressed student ▪

housing asset serving Texas A&M University from

repeat seller in market with three existing Ares assets

▪ Acquisition of an under-managed portfolio in

partnership with a reputable sponsor in an attractive

sector with significant tailwinds

■

Programmatic joint venture with a leading industrial

developer to invest up to $150M of equity in a

national portfolio of industrial distribution

developments, starting with a seed portfolio in

Phoenix, AZ; Tampa/Orlando, FL; and Louisville, KY

Value Driver / COVID-19

Pricing Implication

Acquisition price represents a

20% discount to pre-COVID

pricing

Economic vacancy currently

30%, approximately 20% above

market

Acquisition price represents a

~80 bps cap rate premium to

comparables and ~45%

discount to replacement cost

■ Land prices for the seed

portfolio represent a 10-20%

discount to pre-COVID trades

*Anticipated Equity Commitment represents the amount of equity that the General Partner intends for the Fund to invest in the deal after the participation by a joint venture partner, co-investor or other

type of investor. Accordingly, the initial equity commitment to the investment will likely be greater at the time of investment and is expected to be reduced.

**Expected net of co-investment.

***Initial equity commitment of $78 million expected with total potential equity commitment of $150 million.

Based on Ares Real Estate Group's current observations of the market as of October 5, 2020. However, the situation surrounding COVID-19 is fluid and developing rapidly. As such, our views are subject

change at any time. Forward looking statements are not reliable indicators of future events and no guarantee or assurance is given that such activities will occur as expected or at all. Information related

to any identified opportunities does not represent an actual investment executed by AREOF III or any other Ares fund or investment vehicle and is only provided as an illustration of the type of

investments that potentially may be available. The consummation of any of these depends upon, among other things, one or more of the following: satisfactory completion of our due diligence

investigation of the prospective investments, our acceptance of the terms and structuring of such investment and the execution and delivery of satisfactory transaction documentation. There can be no

assurance that any of these investments will be consummated, perform as expected, or avoid significant losses.View entire presentation