Lotus Cars SPAC Presentation Deck

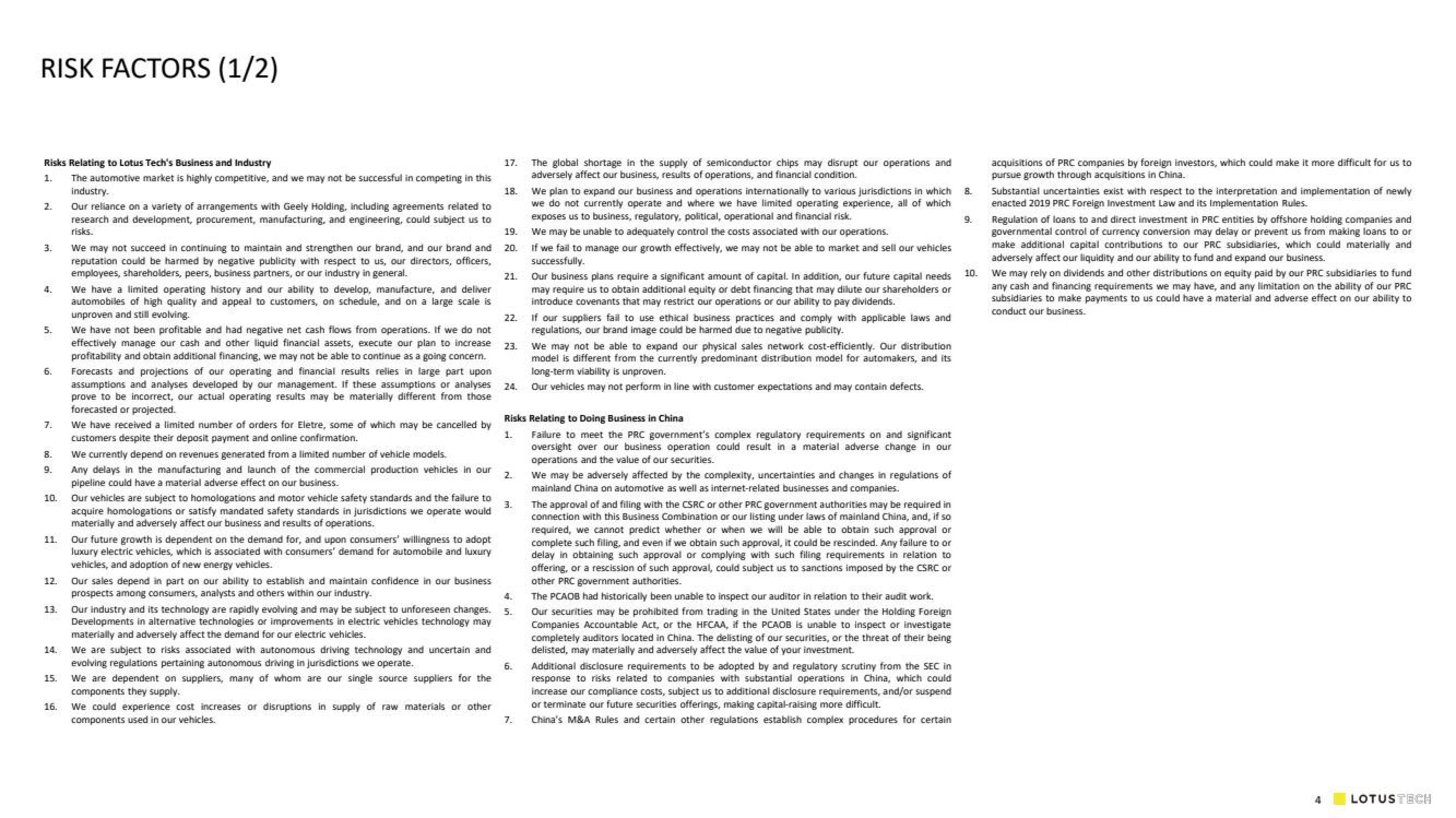

RISK FACTORS (1/2)

Risks Relating to Lotus Tech's Business and Industry

1. The automotive market is highly competitive, and we may not be successful in competing in this

industry.

Our reliance on a variety of arrangements with Geely Holding, including agreements related to

research and development, procurement, manufacturing, and engineering, could subject us to

risks.

2.

3.

4.

5.

6.

7.

9.

10.

11.

12.

13.

15.

We may not succeed in continuing to maintain and strengthen our brand, and our brand and

reputation could be harmed by negative publicity with respect to us, our directors, officers,

employees, shareholders, peers, business partners, or our industry in general.

We have a limited operating history and our ability to develop, manufacture, and deliver

automobiles of high quality and appeal to customers, on schedule, and on a large scale is

unproven and still evolving.

We have not been profitable and had negative net cash flows from operations. If we do not

effectively manage our cash and other liquid financial assets, execute our plan to increase

profitability and obtain additional financing, we may not be able to continue as a going concern.

Forecasts and projections of our operating and financial results relles in large part upon

assumptions and analyses developed by our management. If these assumptions or analyses

prove to be incorrect, our actual operating results may be materially different from those

forecasted or projected.

We have received a limited number of orders for Eletre, some of which may be cancelled by

customers despite their deposit payment and online confirmation.

We currently depend on revenues generated from a limited number of vehicle models.

Any delays in the manufacturing and launch of the commercial production vehicles in our

pipeline could have a material adverse effect on our business.

Our vehicles are subject to homologations and motor vehicle safety standards and the failure to

acquire homologations or satisfy mandated safety standards in jurisdictions we operate would

materially and adversely affect our business and results of operations.

Our future growth is dependent on the demand for, and upon consumers' willingness to adopt

luxury electric vehicles, which is associated with consumers' demand for automobile and luxury

vehicles, and adoption of new energy vehicles.

Our sales depend in part on our ability to establish and maintain confidence in our business

prospects among consumers, analysts and others within our industry.

Our industry and its technology are rapidly evolving and may be subject to unforeseen changes.

Developments in alternative technologies or improvements in electric vehicles technology may

materially and adversely affect the demand for our electric vehicles.

We are subject to risks associated with autonomous driving technology and uncertain and

evolving regulations pertaining autonomous driving in jurisdictions we operate.

We are dependent on suppliers, many of whom are our single source suppliers for the

components they supply.

16. We could experience cost increases or disruptions in supply of raw materials or other

components used in our vehicles.

17.

18.

19.

20.

21.

22.

23.

24.

2.

3.

5.

The global shortage in the supply of semiconductor chips may disrupt our operations and

adversely affect our business, results of operations, and financial condition.

6.

We plan to expand our business and operations internationally to various jurisdictions in which

we do not currently operate and where we have limited operating experience, all of which

exposes us to business, regulatory, political, operational and financial risk.

We may be unable to adequately control the costs associated with our operations.

If we fail to manage our growth effectively, we may not be able to market and sell our vehicles

successfully.

Risks Relating to Doing Business in China

1.

Failure to meet the PRC government's complex regulatory requirements on and significant

oversight over our business operation could result in a material adverse change in our

operations and the value of our securities.

Our business plans require a significant amount of capital. In addition, our future capital needs

may require us to obtain additional equity or debt financing that may dilute our shareholders or

introduce covenants that may restrict our operations or our ability to pay dividends.

If our suppliers fail to use ethical business practices and comply with applicable laws and

regulations, our brand image could be harmed due to negative publicity.

We may not be able to expand our physical sales network cost-efficiently. Our distribution

model is different from the currently predominant distribution model for automakers, and its

long-term viability is unproven.

Our vehicles may not perform in line with customer expectations and may contain defects.

We may be adversely affected by the complexity, uncertainties and changes in regulations of

mainland China on automotive as well as internet-related businesses and companies.

The approval of and filing with the CSRC or other PRC government authorities may be required in

connection with this Business Combination or our listing under laws of mainland China, and, if so

required, we cannot predict whether or when we will be able to obtain such approval or

complete such filing, and even if we obtain such approval, it could be rescinded. Any failure to or

delay in obtaining such approval or complying with such filing requirements in relation to

offering, or a rescission of such approval, could subject us to sanctions imposed by the CSRC or

other PRC government authorities.

The PCAOB had historically been unable to inspect our auditor in relation to their audit work.

Our securities may be prohibited from trading in the United States under the Holding Foreign

Companies Accountable Act, or the HFCAA, if the PCAOB is unable to inspect or investigate

completely auditors located in China. The delisting of our securities, or the threat of their being

delisted, may materially and adversely affect the value of your investment.

Additional disclosure requirements to be adopted by and regulatory scrutiny from the SEC in

response to risks related to companies with substantial operations in China, which could

increase our compliance costs, subject us to additional disclosure requirements, and/or suspend

or terminate our future securities offerings, making capital-raising more difficult.

China's M&A Rules and certain other regulations establish complex procedures for certain

BL

9.

10.

acquisitions of PRC companies by foreign investors, which could make it more difficult for us to

pursue growth through acquisitions in China.

Substantial uncertainties exist with respect to the interpretation and implementation of newly

enacted 2019 PRC Foreign Investment Law and its Implementation Rules.

Regulation of loans to and direct investment in PRC entities by offshore holding companies and

governmental control of currency conversion may delay or prevent us from making loans to or

make additional capital contributions to our PRC subsidiaries, which could materially and

adversely affect our liquidity and our ability to fund and expand our business.

We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund

any cash and financing requirements we may have, and any limitation on the ability of our PRC

subsidiaries to make payments to us could have a material and adverse effect on our ability to

conduct our business.

4 LOTUSTECHView entire presentation