Metals Company SPAC

BETTER METALS FOR EVs

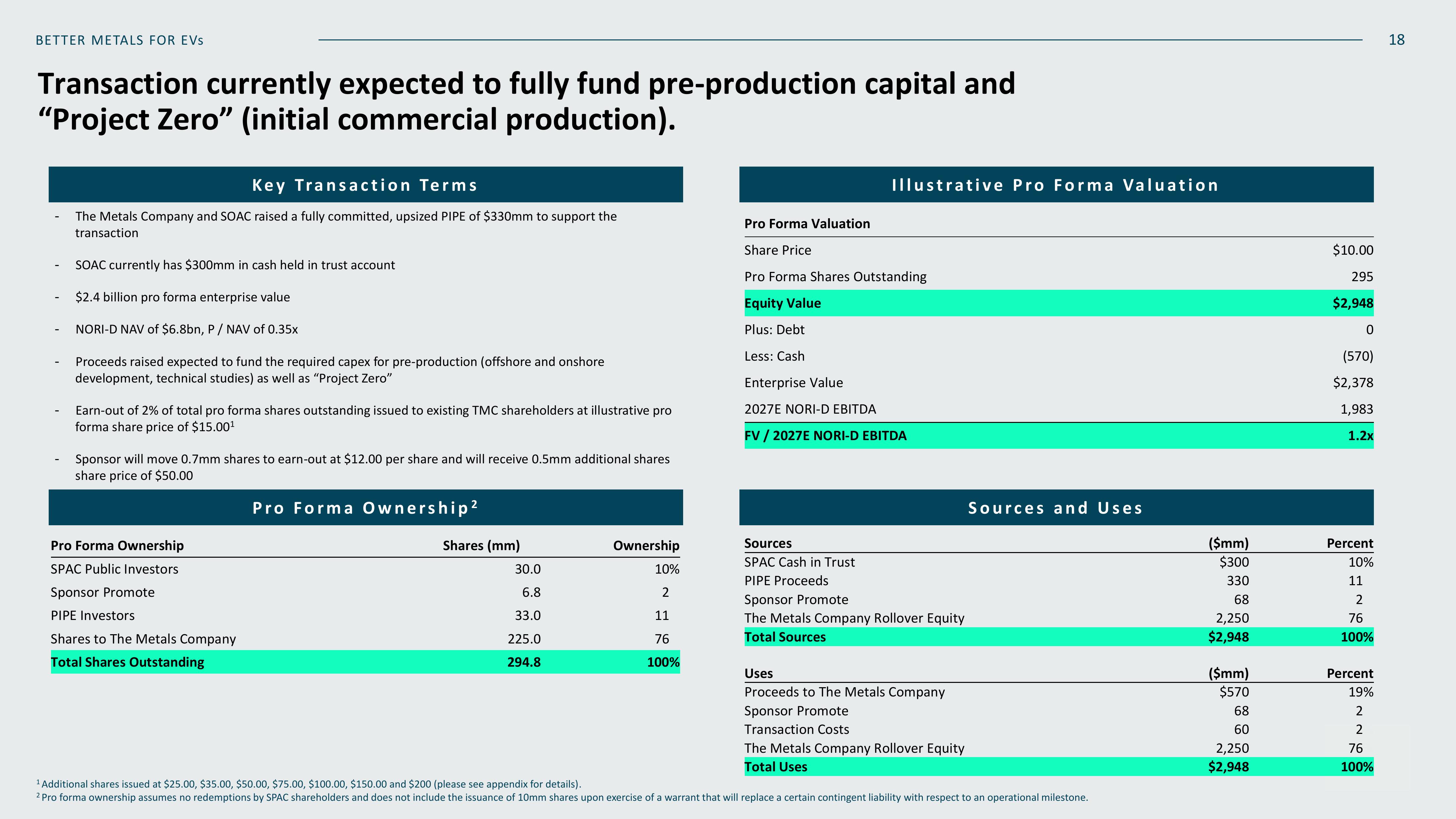

Transaction currently expected to fully fund pre-production capital and

"Project Zero" (initial commercial production).

Key Transaction Terms

The Metals Company and SOAC raised a fully committed, upsized PIPE of $330mm to support the

transaction

SOAC currently has $300mm in cash held in trust account

$2.4 billion pro forma enterprise value

NORI-D NAV of $6.8bn, P/ NAV of 0.35x

Proceeds raised expected to fund the required capex for pre-production (offshore and onshore

development, technical studies) as well as "Project Zero"

Earn-out of 2% of total pro forma shares outstanding issued to existing TMC shareholders at illustrative pro

forma share price of $15.00¹

Sponsor will move 0.7mm shares to earn-out at $12.00 per share and will receive 0.5mm additional shares

share price of $50.00

Pro Forma Ownership

SPAC Public Investors

Sponsor Promote

PIPE Investors

Shares to The Metals Company

Total Shares Outstanding

Pro Forma Ownership²

Shares (mm)

30.0

6.8

33.0

225.0

294.8

Ownership

10%

2

11

76

100%

Illustrative Pro Forma Valuation

Pro Forma Valuation

Share Price

Pro Forma Shares Outstanding

Equity Value

Plus: Debt

Less: Cash

Enterprise Value

2027E NORI-D EBITDA

FV/2027E NORI-D EBITDA

Sources

SPAC Cash in Trust

PIPE Proceeds

Sponsor Promote

The Metals Company Rollover Equity

Total Sources

Uses

Proceeds to The Metals Company

Sponsor Promote

Transaction Costs

The Metals Company Rollover Equity

Total Uses

Sources and Uses

¹ Additional shares issued at $25.00, $35.00, $50.00, $75.00, $100.00, $150.00 and $200 (please see appendix for details).

2 Pro forma ownership assumes no redemptions by SPAC shareholders and does not include the issuance of 10mm shares upon exercise of a warrant that will replace a certain contingent liability with respect to an operational milestone.

($mm)

$300

330

68

2,250

$2,948

($mm)

$570

68

60

2,250

$2,948

$10.00

295

$2,948

0

(570)

$2,378

1,983

1.2x

Percent

10%

11

2

76

100%

Percent

19%

2

2

76

100%

18View entire presentation