UBS Fixed Income Presentation Deck

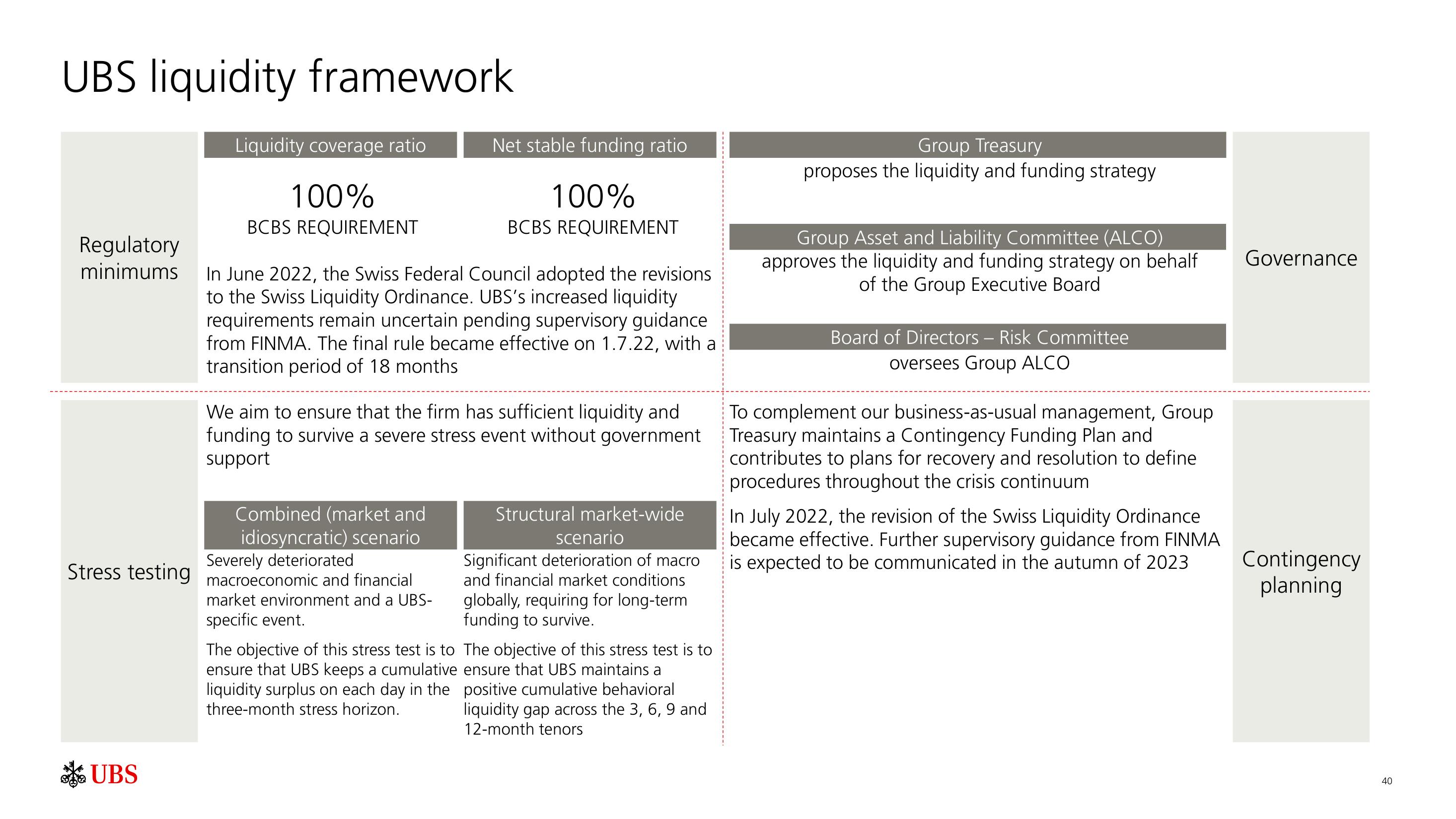

UBS liquidity framework

Regulatory

minimums

Stress testing

UBS

Liquidity coverage ratio

100%

BCBS REQUIREMENT

Net stable funding ratio

In June 2022, the Swiss Federal Council adopted the revisions

to the Swiss Liquidity Ordinance. UBS's increased liquidity

requirements remain uncertain pending supervisory guidance

from FINMA. The final rule became effective on 1.7.22, with a

transition period of 18 months

Combined (market and

idiosyncratic) scenario

Severely deteriorated

macroeconomic and financial

market environment and a UBS-

specific event.

100%

BCBS REQUIREMENT

We aim to ensure that the firm has sufficient liquidity and

funding to survive a severe stress event without government

support

The objective of this stress test is to

ensure that UBS keeps a cumulative

liquidity surplus on each day in the

three-month stress horizon.

Structural market-wide

scenario

Significant deterioration of macro

and financial market conditions

globally, requiring for long-term

funding to survive.

The objective of this stress test is to

ensure that UBS maintains a

positive cumulative behavioral

liquidity gap across the 3, 6, 9 and

12-month tenors

Group Treasury

proposes the liquidity and funding strategy

Group Asset and Liability Committee (ALCO)

approves the liquidity and funding strategy on behalf

of the Group Executive Board

Board of Directors - Risk Committee

oversees Group ALCO

To complement our business-as-usual management, Group

Treasury maintains a Contingency Funding Plan and

contributes to plans for recovery and resolution to define

procedures throughout the crisis continuum

In July 2022, the revision of the Swiss Liquidity Ordinance

became effective. Further supervisory guidance from FINMA

is expected to be communicated in the autumn of 2023

Governance

Contingency

planning

40View entire presentation