Fort Capital Investment Banking Pitch Book

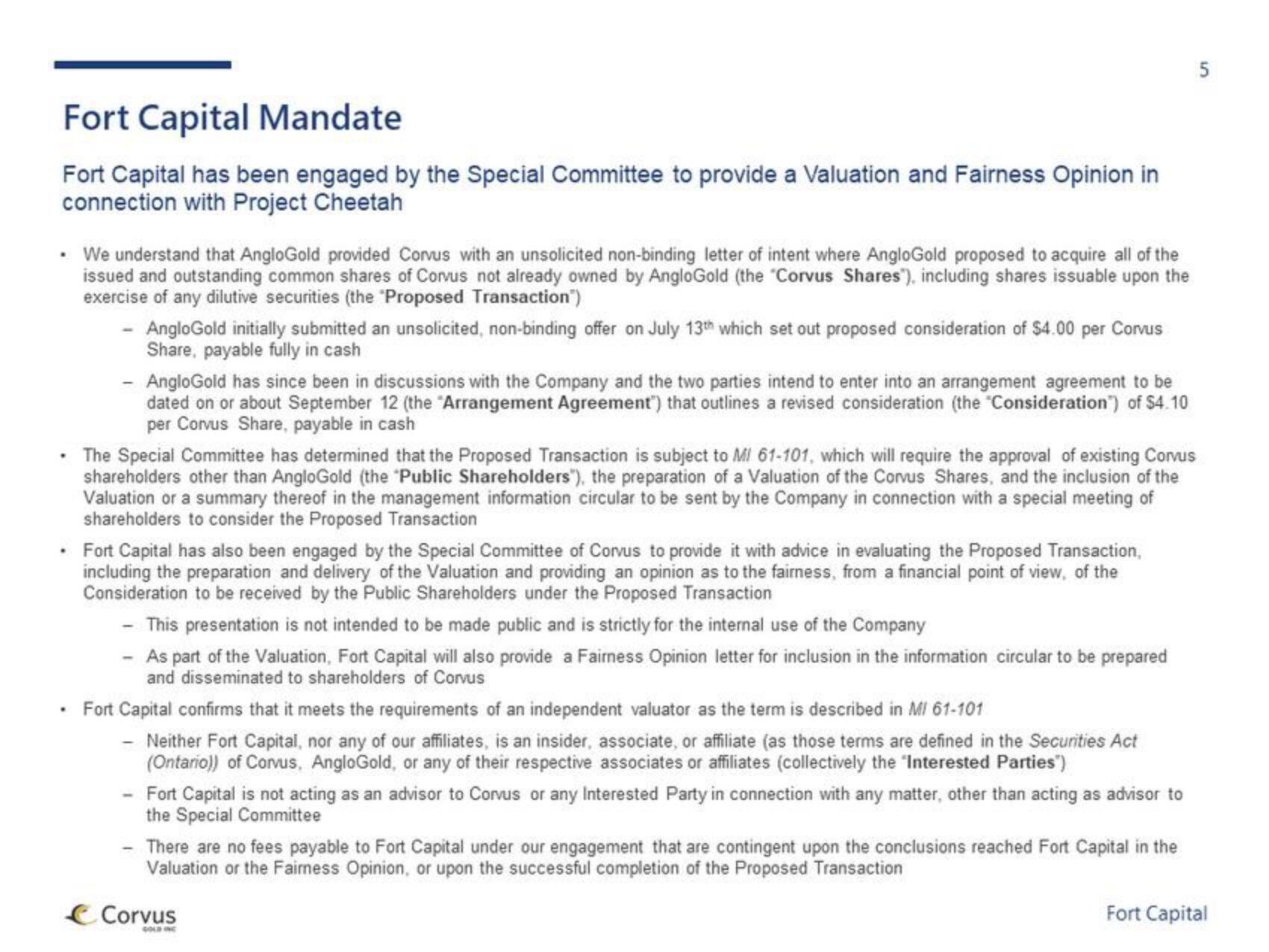

Fort Capital Mandate

Fort Capital has been engaged by the Special Committee to provide a Valuation and Fairness Opinion in

connection with Project Cheetah

We understand that AngloGold provided Corvus with an unsolicited non-binding letter of intent where AngloGold proposed to acquire all of the

issued and outstanding common shares of Corvus not already owned by AngloGold (the "Corvus Shares"), including shares issuable upon the

exercise of any dilutive securities (the "Proposed Transaction")

-

- AngloGold initially submitted an unsolicited, non-binding offer on July 13th which set out proposed consideration of $4.00 per Corvus

Share, payable fully in cash

- Anglo Gold has since been in discussions with the Company and the two parties intend to enter into an arrangement agreement to be

dated on or about September 12 (the "Arrangement Agreement") that outlines a revised consideration (the "Consideration") of $4.10

per Corvus Share, payable in cash

• The Special Committee has determined that the Proposed Transaction is subject to MI 61-101, which will require the approval of existing Corvus

shareholders other than AngloGold (the Public Shareholders"), the preparation of a Valuation of the Corvus Shares, and the inclusion of the

Valuation or a summary thereof in the management information circular to be sent by the Company in connection with a special meeting of

shareholders to consider the Proposed Transaction

• Fort Capital has also been engaged by the Special Committee of Corvus to provide it with advice in evaluating the Proposed Transaction,

including the preparation and delivery of the Valuation and providing an opinion as to the fairness, from a financial point of view, of the

Consideration to be received by the Public Shareholders under the Proposed Transaction

This presentation is not intended to be made public and is strictly for the internal use of the Company

As part of the Valuation, Fort Capital will also provide a Fairness Opinion letter for inclusion in the information circular to be prepared

and disseminated to shareholders of Corvus

Fort Capital confirms that it meets the requirements of an independent valuator as the term is described in M/ 61-101

Neither Fort Capital, nor any of our affiliates, is an insider, associate, or affiliate (as those terms are defined in the Securities Act

(Ontario)) of Corvus, AngloGold, or any of their respective associates or affiliates (collectively the "Interested Parties")

- Fort Capital is not acting as an advisor to Corvus or any Interested Party in connection with any matter, other than acting as advisor to

the Special Committee

- There are no fees payable to Fort Capital under our engagement that are contingent upon the conclusions reached Fort Capital in the

Valuation or the Fairness Opinion, or upon the successful completion of the Proposed Transaction

Corvus

Fort CapitalView entire presentation