Harbor Custom Development Investor Presentation Deck

Condensed

Consolidated

Statements of

Cash Flows

(Unaudited)

HARBOR CUSTOM DEVELOPMENT | INVESTOR DECK

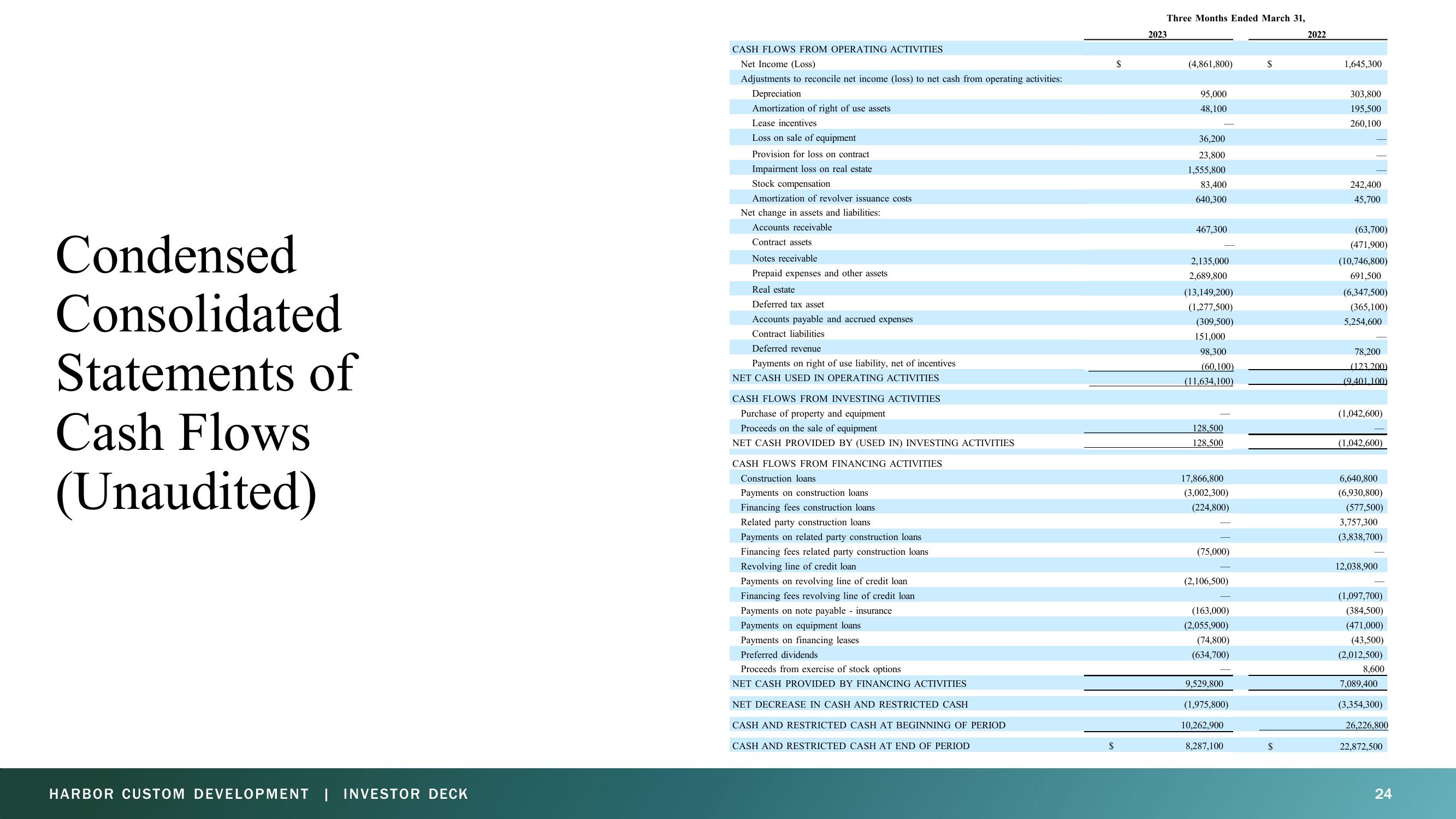

CASH FLOWS FROM OPERATING ACTIVITIES

Net Income (Loss)

Adjustments to reconcile net income (loss) to net cash from operating activities:

Depreciation

Amortization of right of use assets

Lease incentives

Loss on sale of equipment

Provision for loss on contract

Impairment loss on real estate

Stock compensation

Amortization of revolver issuance costs

Net change in assets and liabilities:

Accounts receivable

Contract assets

Notes receivable

Prepaid expenses and other assets

Real estate

Deferred tax asset

Accounts payable and accrued expenses

Contract liabilities

Deferred revenue

Payments on right of use liability, net of incentives

NET CASH USED IN OPERATING ACTIVITIES

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property and equipment

Proceeds on the sale of equipment

NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES

CASH FLOWS FROM FINANCING ACTIVITIES

Construction loans

Payments on construction loans

Financing fees construction loans

Related party construction loans

Payments on related party construction loans

Financing fees related party construction loans

Revolving line of credit loan

Payments on revolving line of credit loan

Financing fees revolving line of credit loan

Payments on note payable insurance

Payments on equipment loans

Payments on financing leases

Preferred dividends

Proceeds from exercise of stock options

NET CASH PROVIDED BY FINANCING ACTIVITIES

NET DECREASE IN CASH AND RESTRICTED CASH

CASH AND RESTRICTED CASH AT BEGINNING OF PERIOD

CASH AND RESTRICTED CASH AT END OF PERIOD

$

$

Three Months Ended March 31,

2023

(4,861,800)

95,000

48,100

36,200

23,800

1,555,800

83,400

640,300

467,300

2,135,000

2,689,800

(13,149,200)

(1,277,500)

(309,500)

151,000

98,300

(60,100)

(11,634,100)

128,500

128,500

17,866,800

(3,002,300)

(224,800)

(75,000)

(2,106,500)

(163,000)

(2,055,900)

(74,800)

(634,700)

9,529,800

(1,975,800)

10,262,900

8,287,100

$

$

2022

1,645,300

303,800

195,500

260,100

242,400

45,700

(63,700)

(471,900)

(10,746,800)

691,500

(6,347,500)

(365,100)

5,254,600

78,200

(123.200)

(9.401.100)

(1,042,600)

(1,042,600)

6,640,800

(6,930,800)

(577,500)

3,757,300

(3,838,700)

12,038,900

(1,097,700)

(384,500)

(471,000)

(43,500)

(2,012,500)

8,600

7,089,400

(3,354,300)

26,226,800

22,872,500

24View entire presentation