Nogin Investor Presentation Deck

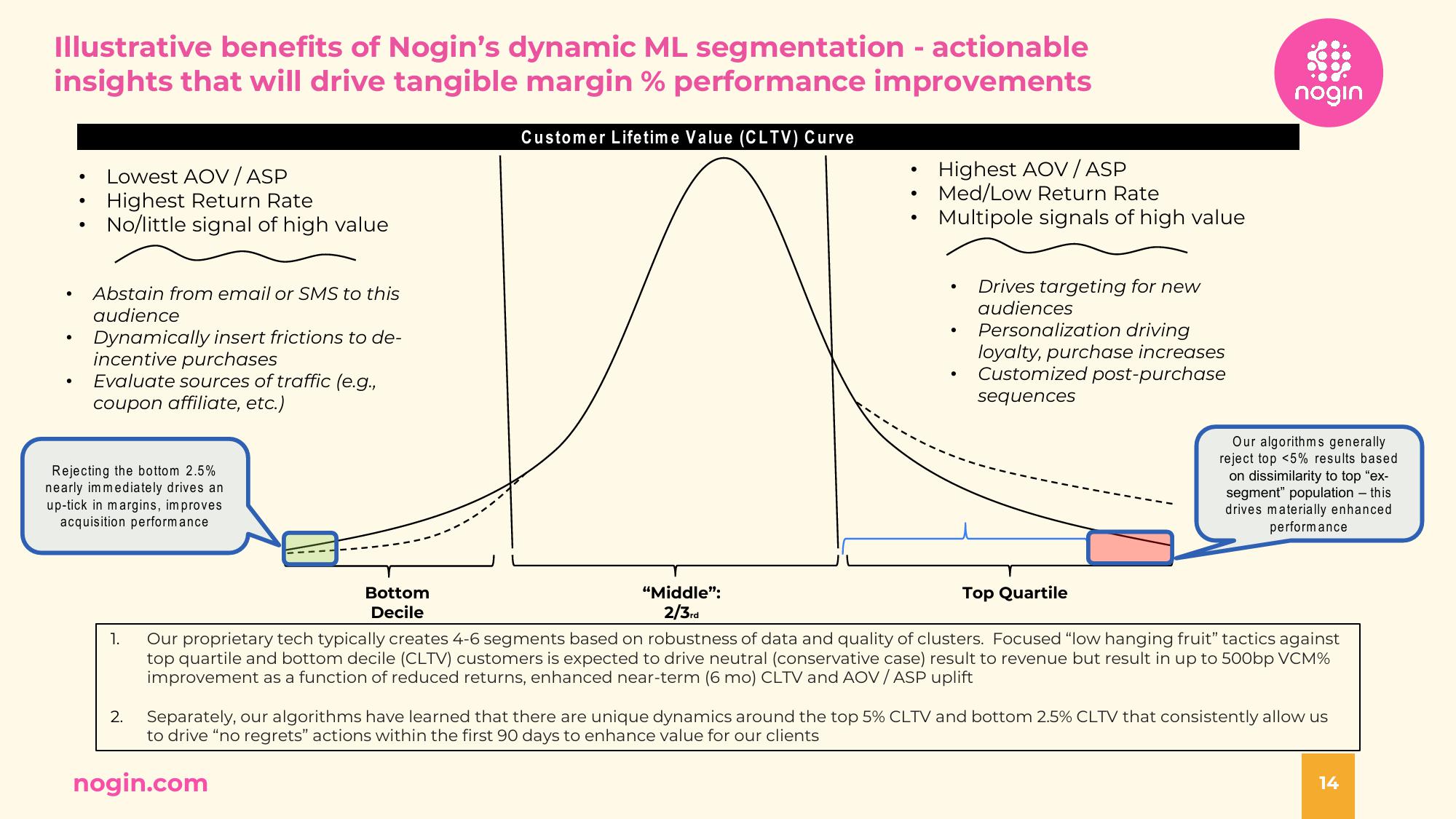

Illustrative benefits of Nogin's dynamic ML segmentation - actionable

insights that will drive tangible margin % performance improvements

Customer Lifetime Value (CLTV) Curve

●

●

●

●

●

Lowest AOV/ASP

Highest Return Rate

No/little signal of high value

Abstain from email or SMS to this

audience

Dynamically insert frictions to de-

incentive purchases

Evaluate sources of traffic (e.g.,

coupon affiliate, etc.)

Rejecting the bottom 2.5%

nearly immediately drives an

up-tick in margins, improves

acquisition performance

1.

Bottom

Decile

2.

"Middle":

2/3rd

Highest AOV/ASP

Med/Low Return Rate

Multipole signals of high value

●

●

●

Drives targeting for new

audiences

Personalization driving

loyalty, purchase increases

Customized post-purchase

sequences

Top Quartile

nogin

Our algorithms generally

reject top <5% results based

on dissimilarity to top "ex-

segment" population - this

drives materially enhanced

performance

Our proprietary tech typically creates 4-6 segments based on robustness of data and quality of clusters. Focused "low hanging fruit" tactics against

top quartile and bottom decile (CLTV) customers is expected to drive neutral (conservative case) result to revenue but result in up to 500bp VCM%

improvement as a function of reduced returns, enhanced near-term (6 mo) CLTV and AOV / ASP uplift

Separately, our algorithms have learned that there are unique dynamics around the top 5% CLTV and bottom 2.5% CLTV that consistently allow us

to drive "no regrets" actions within the first 90 days to enhance value for our clients

nogin.com

14View entire presentation