Foxo SPAC Presentation Deck

POLICIES SOLD & SERVICED

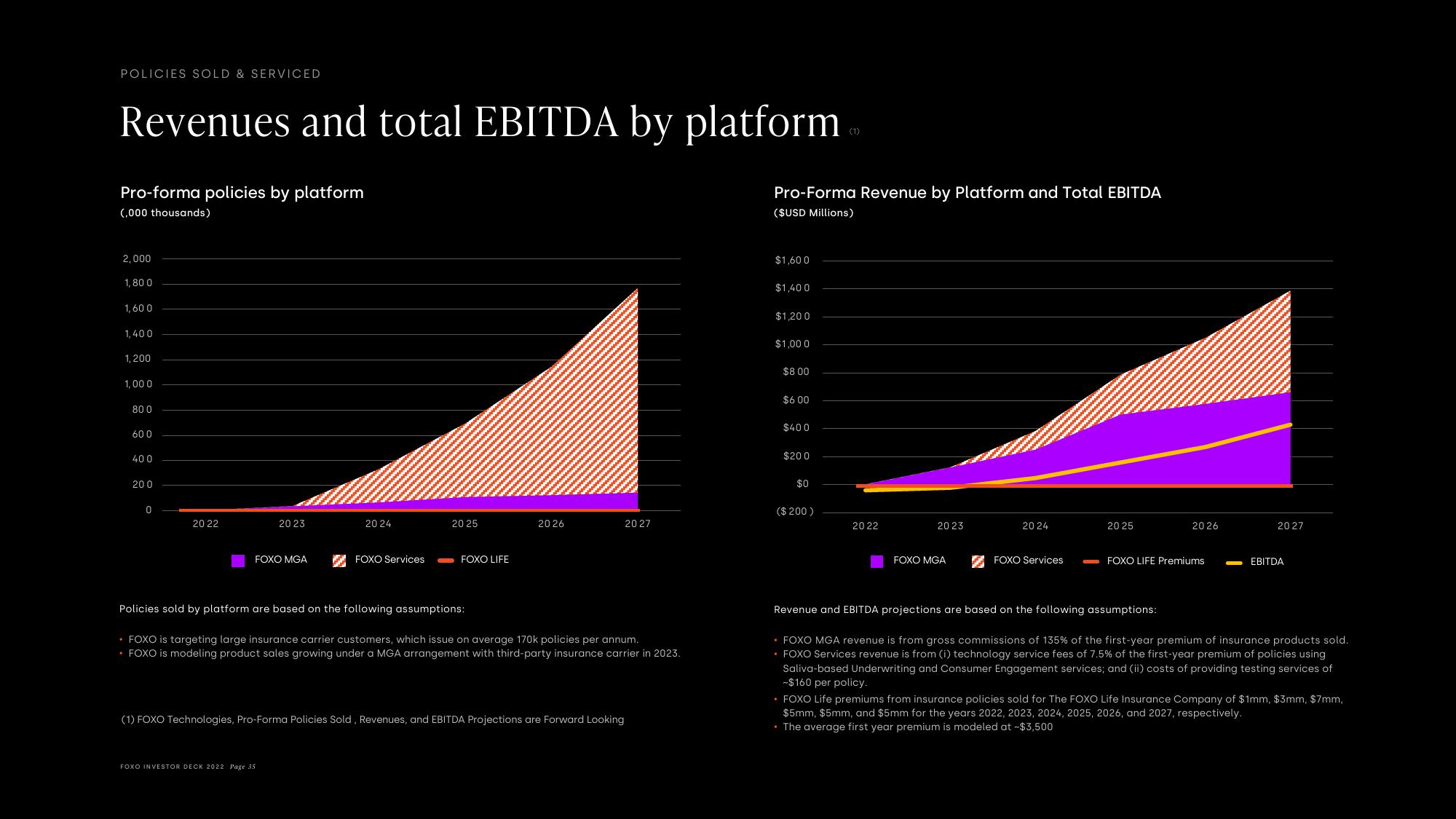

Revenues and total EBITDA by platform

Pro-forma policies by platform

(,000 thousands)

2,000

1,800

1,60 0

1,400

1,200

1,000

80.0

600

400

200

0

20 22

20 23

FOXO MGA

20 24

✔ FOXO Services

FOXO INVESTOR DECK 2022 Page 35

20 25

FOXO LIFE

Policies sold by platform are based on the following assumptions:

20 26

. FOXO is targeting large insurance carrier customers, which issue on average 170k policies per annum.

. FOXO is modeling product sales growing under a MGA arrangement with third-party insurance carrier in 2023.

(1) FOXO Technologies, Pro-Forma Policies Sold, Revenues, and EBITDA Projections are Forward Looking

20 27

Pro-Forma Revenue by Platform and Total EBITDA

($USD Millions)

$1,600

$1,400

$1,200

$1,000

$8.00

$6.00

$400

$200

$0

(1)

($ 200 )

20 22

20 23

FOXO MGA

20 24

FOXO Services

20 25

20 26

FOXO LIFE Premiums

Revenue and EBITDA projections are based on the following assumptions:

2027

EBITDA

• FOXO MGA revenue is from gross commissions of 135% of the first-year premium of insurance products sold.

. FOXO Services revenue is from (i) technology service fees of 7.5% of the first-year premium of policies using

Saliva-based Underwriting and Consumer Engagement services; and (ii) costs of providing testing services of

-$160 per policy.

. FOXO Life premiums from insurance policies sold for The FOXO Life Insurance Company of $1mm, $3mm, $7mm,

$5mm, $5mm, and $5mm for the years 2022, 2023, 2024, 2025, 2026, and 2027, respectively.

• The average first year premium is modeled at -$3,500View entire presentation