LionTree Investment Banking Pitch Book

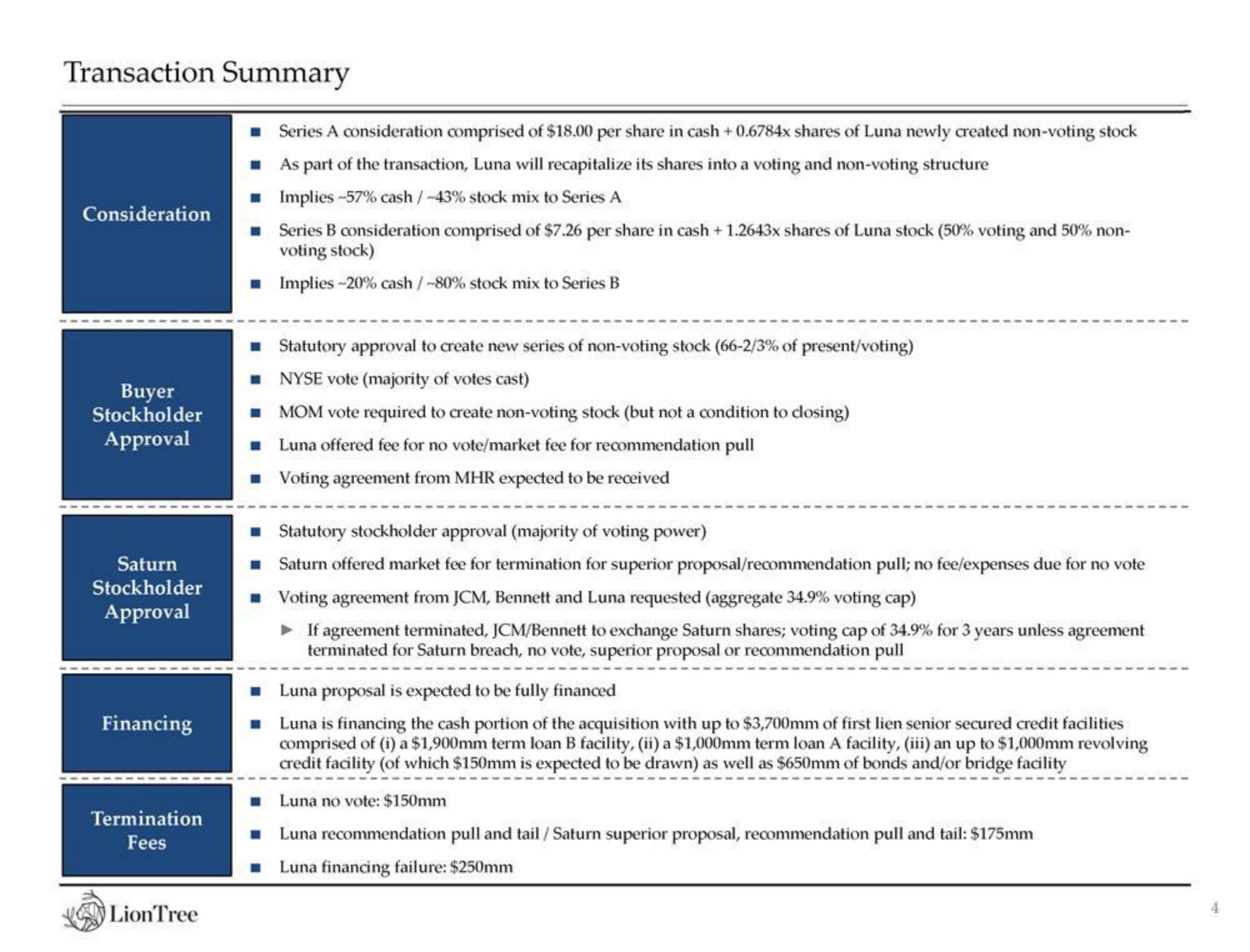

Transaction Summary

Consideration

Buyer

Stockholder

Approval

Saturn

Stockholder

Approval

Financing

Termination

Fees

LionTree

■ Series A consideration comprised of $18.00 per share in cash +0.6784x shares of Luna newly created non-voting stock

As part of the transaction, Luna will recapitalize its shares into a voting and non-voting structure

■ Implies -57% cash / -43% stock mix to Series A

Series B consideration comprised of $7.26 per share in cash + 1.2643x shares of Luna stock (50% voting and 50% non-

voting stock)

■ Implies -20% cash / -80% stock mix to Series B

Statutory approval to create new series of non-voting stock (66-2/3% of present/voting)

■

NYSE vote (majority of votes cast)

■ MOM vote required to create non-voting stock (but not a condition to closing)

Luna offered fee for no vote/market fee for recommendation pull

Voting agreement from MHR expected to be received

Statutory stockholder approval (majority of voting power)

Saturn offered market fee for termination for superior proposal/recommendation pull; no fee/expenses due for no vote

Voting agreement from JCM, Bennett and Luna requested (aggregate 34.9% voting cap)

► If agreement terminated, JCM/Bennett to exchange Saturn shares; voting cap of 34.9% for 3 years unless agreement

terminated for Saturn breach, no vote, superior proposal or recommendation pull

Luna proposal is expected to be fully financed

Luna is financing the cash portion of the acquisition with up to $3,700mm of first lien senior secured credit facilities

comprised of (i) a $1,900mm term loan B facility, (ii) a $1,000mm term loan A facility, (iii) an up to $1,000mm revolving

credit facility (of which $150mm is expected to be drawn) as well as $650mm of bonds and/or bridge facility

Luna no vote: $150mm

■ Luna recommendation pull and tail / Saturn superior proposal, recommendation pull and tail: $175mm

Luna financing failure: $250mmView entire presentation