Cannae SPAC Presentation Deck

J

alight

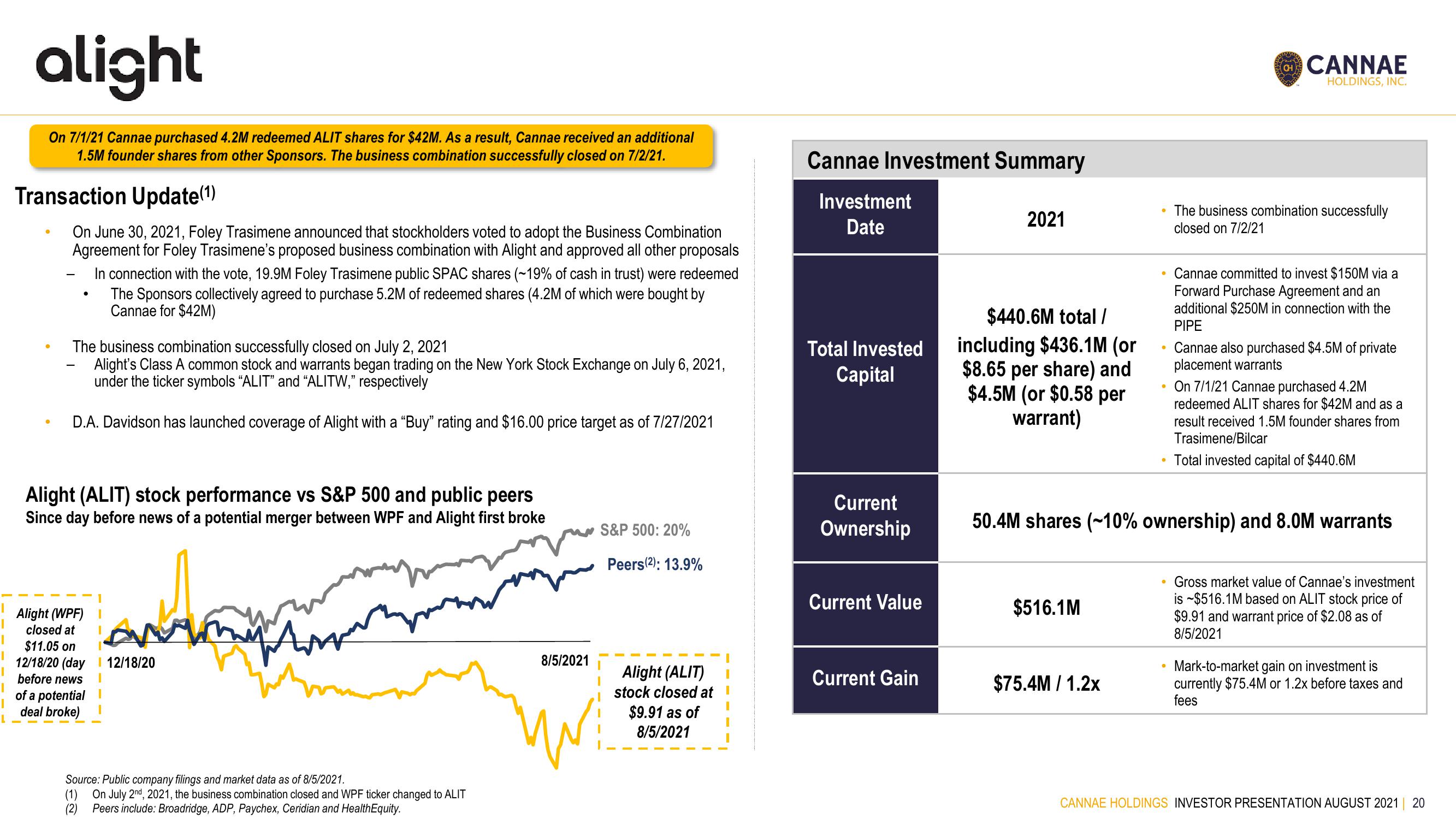

On 7/1/21 Cannae purchased 4.2M redeemed ALIT shares for $42M. As a result, Cannae received an additional

1.5M founder shares from other Sponsors. The business combination successfully closed on 7/2/21.

Transaction Update(¹)

On June 30, 2021, Foley Trasimene announced that stockholders voted to adopt the Business Combination

Agreement for Foley Trasimene's proposed business combination with Alight and approved all other proposals

In connection with the vote, 19.9M Foley Trasimene public SPAC shares (~19% of cash in trust) were redeemed

The Sponsors collectively agreed to purchase 5.2M of redeemed shares (4.2M of which were bought by

Cannae for $42M)

●

The business combination successfully closed on July 2, 2021

Alight's Class A common stock and warrants began trading on the New York Stock Exchange on July 6, 2021,

under the ticker symbols "ALIT" and "ALITW," respectively

D.A. Davidson has launched coverage of Alight with a "Buy" rating and $16.00 price target as of 7/27/2021

Alight (ALIT) stock performance vs S&P 500 and public peers

Since day before news of a potential merger between WPF and Alight first broke

Alight (WPF) I

closed at

I

AN

$11.05 on

12/18/20 (day 12/18/20

before news

of a potential

deal broke)

I

Source: Public company filings and market data as of 8/5/2021.

(1) On July 2nd, 2021, the business combination closed and WPF ticker changed to ALIT

(2) Peers include: Broadridge, ADP, Paychex, Ceridian and HealthEquity.

8/5/2021

S&P 500: 20%

Peers (2): 13.9%

Alight (ALIT)

stock closed at

$9.91 as of

8/5/2021

Cannae Investment Summary

Investment

Date

Total Invested

Capital

Current

Ownership

Current Value

Current Gain

2021

$440.6M total /

including $436.1M (or

$8.65 per share) and

$4.5M (or $0.58 per

warrant)

$516.1M

•

$75.4M / 1.2x

0

CH

CANNAE

HOLDINGS, INC.

The business combination successfully

closed on 7/2/21

Cannae committed to invest $150M via a

Forward Purchase Agreement and an

additional $250M in connection with the

PIPE

Cannae also purchased $4.5M of private

placement warrants

50.4M shares (~10% ownership) and 8.0M warrants

On 7/1/21 Cannae purchased 4.2M

redeemed ALIT shares for $42M and as a

result received 1.5M founder shares from

Trasimene/Bilcar

Total invested capital of $440.6M

Gross market value of Cannae's investment

is $516.1M based on ALIT stock price of

$9.91 and warrant price of $2.08 as of

8/5/2021

Mark-to-market gain on investment is

currently $75.4M or 1.2x before taxes and

fees

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 20View entire presentation